Infrastructure Financing through Islamic

Finance in the Islamic Countries

175

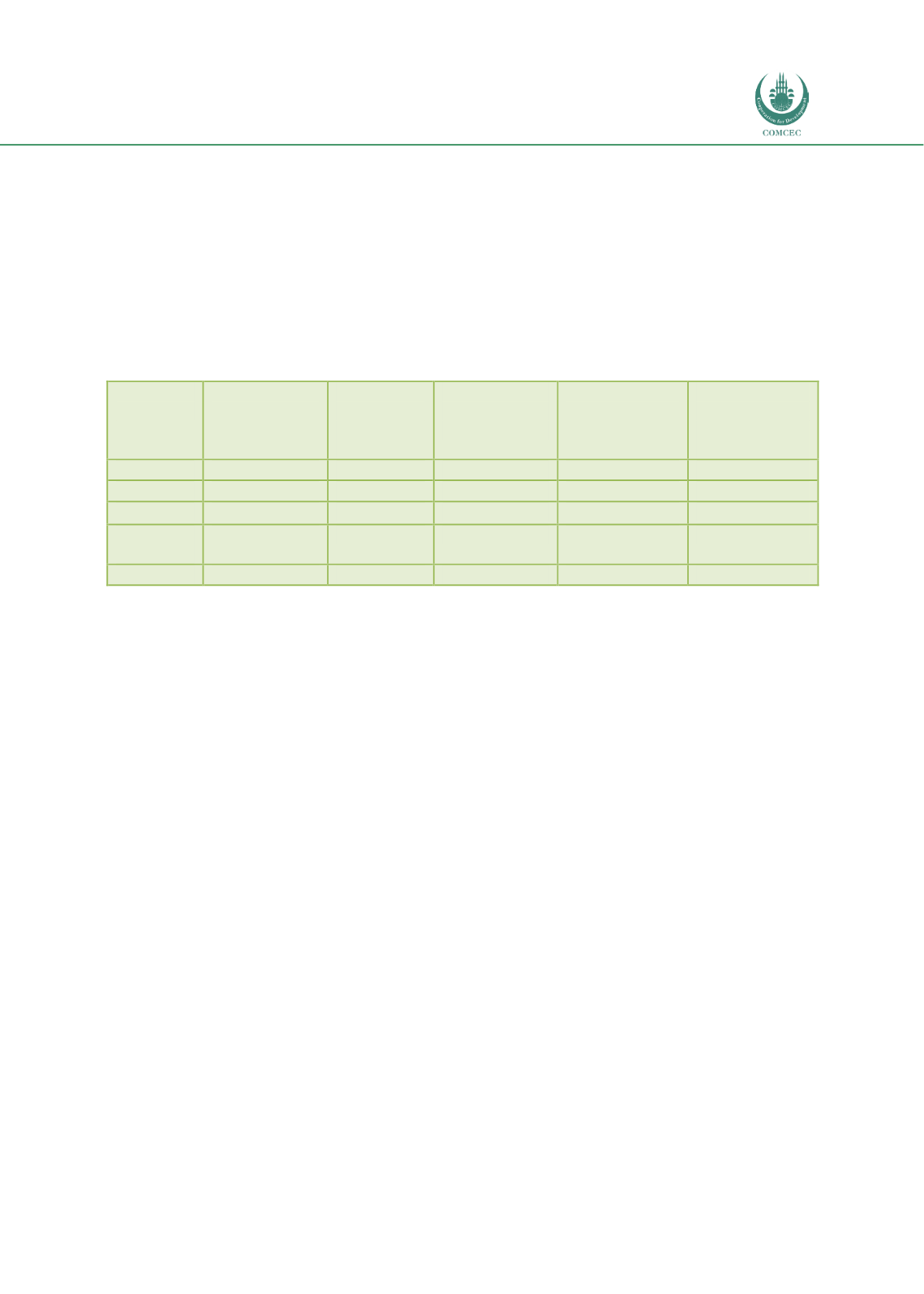

sukuk are shown in Table 5.4. Indonesian banking assets during Q1 2018 were valued at

USD21.37 billion, of which USD 1.79 billion or 8.4% was used to finance the infrastructure

sector. The total assets of Islamic banks in Malaysia in Q1 2018 were valued at USD 172.265

billion, of which only RM 29.112 billion (USD 7.538 billion) or 4.38% of the total assets went to

finance the infrastructure sectors. Of the total assets of USD 159.131 billion of the Islamic

banks in Saudi Arabia, only USD 5.955 billion equivalent to 3.74% of the total assets was used

in the infrastructure sectors. The total Islamic banking assets of Sudan were valued at USD

10.440 billion out of which only USD 374 million or 3.59% was spent on infrastructure.

Table 5. 4: Islamic Banks Assets and Financing of Infrastructure Sector (Q1 2018)

(USD million)

Countries

Islamic

banking

assets

(USD million)

Percentage

of total

banking

assets

Percentage of

investments

in Sukuk

Infrastructure

financing (USD

Million)

Percentage of

investments in

Infrastructure

Sectors

Indonesia

21,374.84

5.6

9.0

1,791.51

8.4

Malaysia

172,265.39

30

13.1

7,538.21

4.38

Nigeria

327.20

0.28

6.8

-

-

Saudi

Arabia

159,131.82

51.1

8.6

5,955.90

3.74

Sudan

10,440.64

100

7.0

374.88

3.59

Source: IFSB Prudential and Structural Islamic Financial Indicators (PSIFIs)

The figures in Table 5.4 show the relatively low levels of direct investments in the

infrastructure sector with an average of 4.3% of the total Islamic banking assets for the five

countries investing in sukuk. While a part of the investments in sukuk is related to the

infrastructure sector, the exact information is not available.

As discussed in Chapter 2, given the nature of the balance sheet, banks face certain problems in

financing infrastructure projects. Since most of the liabilities of banks in the form of deposits

are short-term and liquid, it becomes difficult to finance infrastructure projects that are long-

term and illiquid. Furthermore, the capital adequacy regulatory requirements impose higher

capital charges on long-term unsecured investments.

The liquidity concerns can be partly mitigated with a developed Islamic money market where

Islamic banks can tap into these funds in case they need to. While Malaysia and Indonesia have

developed Shariah-compliant instruments to manage liquidity risk, in other countries these

are lacking. In countries where the Islamic money-market is not developed, such as in Nigeria,

Islamic banks do not have access to liquid funds. The lack of tools to manage liquidity risk

further inhibits Islamic banks from investing in infrastructure projects.

Given the above, the experiences show that a few steps can be undertaken to enhance the role

of Islamic banks in long-term infrastructure investments. First, the liability side of the Islamic

banks can introduce a form of restricted investment account where clients put funds for long

term investment purposes. This has been done in Malaysia where IFSA 2013 distinguishes

between deposit and investment accounts. If investment accounts are structured for longer-

term investments, then a part of the funds can be used for infrastructure projects.