Infrastructure Financing through Islamic

Finance in the Islamic Countries

183

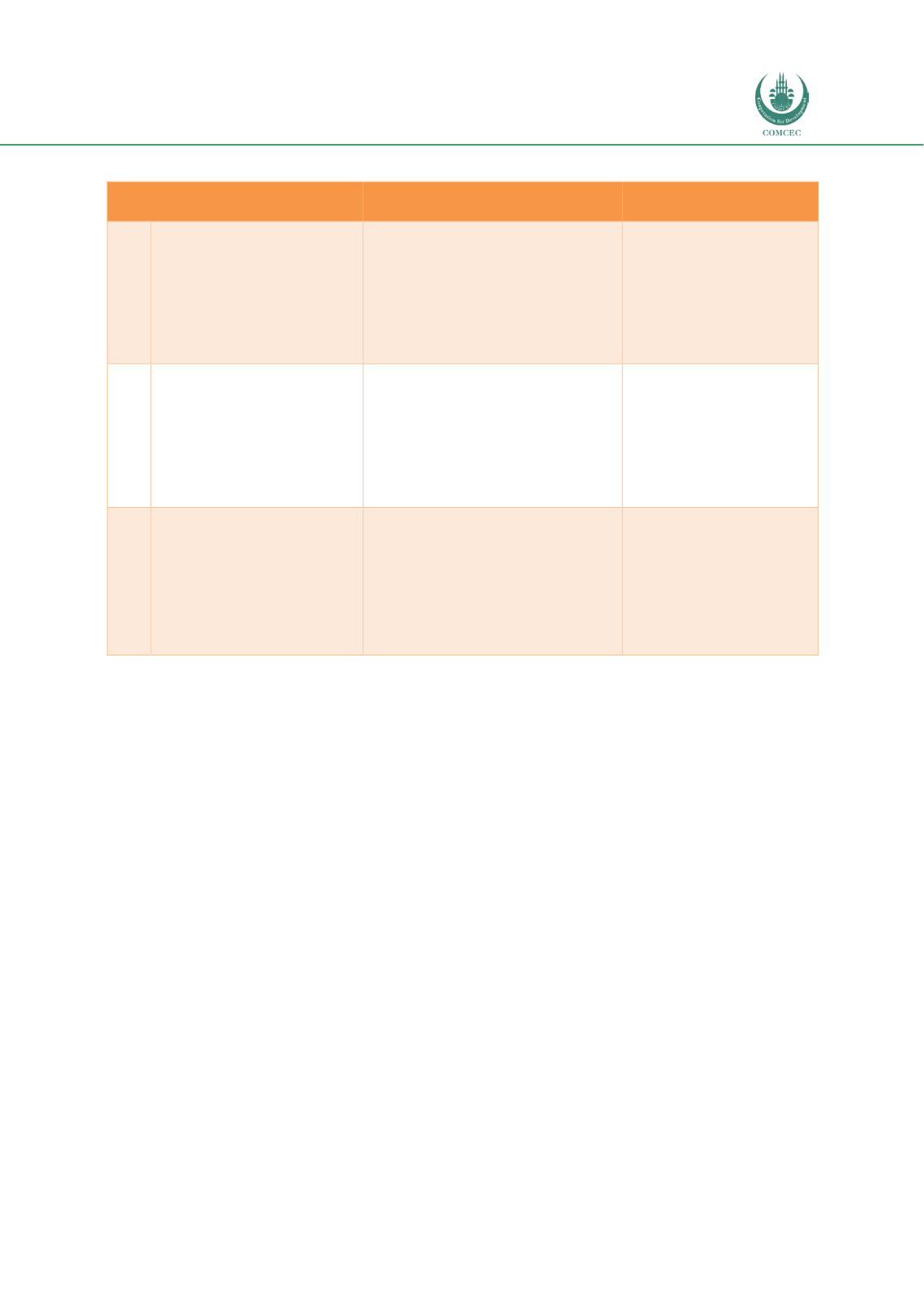

Table 5. 10: Policy Recommendations for Reducing Knowledge Gap

No. Recommendations

Specific Steps

Implemented by

9.1 Fill the knowledge gap

Increase awareness among

stakeholders to increase the

use of Islamic finance for

infrastructure projects

Develop an Islamic

infrastructure finance

Database

Relevant

government

ministries

Multilateral

development bank

(IDB) or proposed

IIIB

9.2 Develop Standardized

Shariah-Compliant

Products for

Infrastructure Financing

Develop

templates for

Shariah structures for PPP

and financing infrastructure

projects

National Shariah

board

Multilateral

development bank

(IDB) or proposed

IIIB

AAOIFI

9.3

Build capacity and

human capital for

implementing Islamic

project financing

Develop executive training

programs for Islamic PPP

and infrastructure financing

Technical assistance from

multilateral development

organizations

Multilateral

development bank

(IDB) or proposed

IIIB

COMCEC

A related issue to developing the knowledge base is to build capacity to implement Islamic

financing for infrastructure projects. This will be relevant in countries where Islamic finance is

relatively new and underdeveloped such as Nigeria. To implement the capacity building would

require identifying professionals with knowledge and skills related to infrastructure financing

and then using them to provide specialized training to the executives of Islamic financial

institutions in different countries/regions. The capacity building can be done by developing

executive training programs and using technical assistance from multilateral development

banks (MDBs) or the proposed International Islamic Infrastructure Bank.

5.10.

Sectoral Significances in Islamic Infrastructure Finance

While the recommendations on the increase of the contributions of individual sectors have

been outlined, in this section the role of the overall Islamic financial industry is examined. The

case studies show that the contribution of Islamic finance in infrastructure development will

depend on the characteristics and size of the sectors. For example, the smaller size of the

Islamic banks and financial institutions impose limits on investments in large infrastructure

projects. In countries where the Islamic banking sector is still small, using Islamic capital

markets to raise funds for infrastructure appears to be a better option. The case studies show

that in countries such as Indonesia, Nigeria and the UK where the Islamic banking sector is still

a small component of the overall banking sector, the governments have been able to issue

sukuk that were oversubscribed.