Infrastructure Financing through Islamic

Finance in the Islamic Countries

181

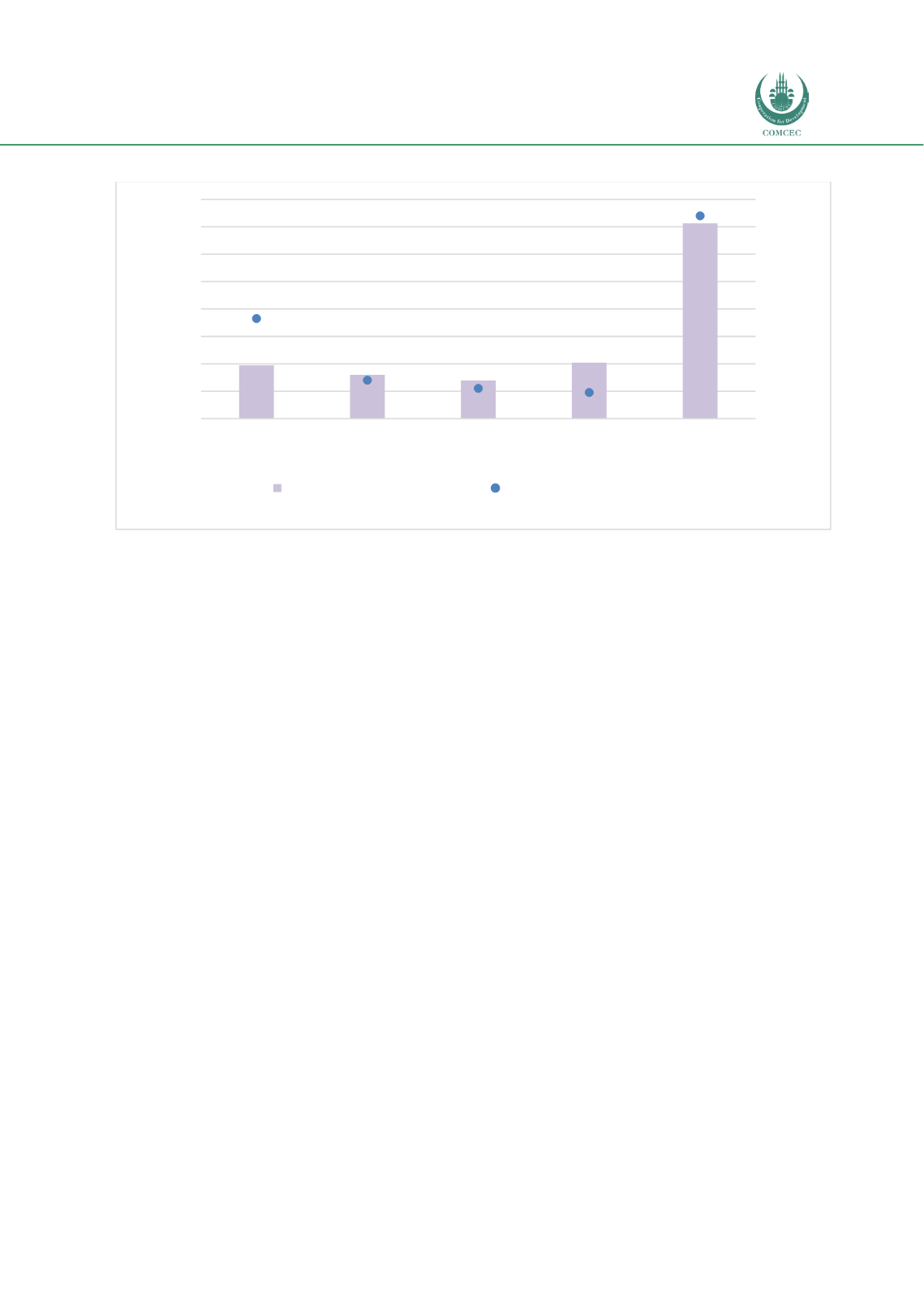

Chart 5. 4: Total IDB Project Financing 2016+ (USD million)

Source:

https://isdbdata.github.io/monograph2017.htmlWhile the huge infrastructure financing gap in many OIC/IDB member countries presents a

great opportunity for IDB, the relatively small sources of funds available to IDB relative to the

needs of its 57 members may limit the scale and scope of the funding provided to each member

country. One way in which the resource constraints can be mitigated is to create Islamic

infrastructure funds in which institutional investors can invest. Furthermore, funds can be

created with other multilateral developmental banks. IDB has taken initiatives in the past and

has launched a number of infrastructure funds and also established Islamic infrastructure

funds in collaboration with Asian Development Bank. Similar initiatives can be taken with

other development banks such as African Development Bank and World Bank.

Due to some factors that limit the scope of IDB to provide adequate infrastructure financing, it

is recommended that an International Islamic Infrastructure Bank (IIIB) be established. In

particular, IDB has various mandates related to achieving SDGs and infrastructure project

financing is one aspect of its operations. Given the huge needs and gaps in infrastructure

financing in OIC member countries, there is a need to have additional sources of funding for

investing in the development of the infrastructure sector to meet the SDGs. Furthermore, since

infrastructure projects are large and complex, OIC member countries would require advisory

services in addition to financing. Establishing IIIB would not only raise funds from the market

by issuing sukuk and initiating funds, it can also provide other capacity-building services to

strengthen the legal and regulatory environment, provide standardized contracts and

structures for Islamic syndicate financing and sukuk, and advise on structuring contracts for

enhancing PPP arrangements using Islamic finance.

1,944.3

1,604.0

1,389.6

2,042.5

7,123.4

73

28

22

19

148

0

20

40

60

80

100

120

140

160

0

1,000

2,000

3,000

4,000

5,000

6,000

7,000

8,000

Sub-Saharan

Africa-22

Middle East and

North Africa-18

Asia and Latin

America-9

Europe and

Central Asia-8

OIC Total

No. of Projects

USD Million

Total Project Financing 2016+

US mill.

Total Project Financing 2016+

No.