Infrastructure Financing through Islamic

Finance in the Islamic Countries

174

5.3.4.

Providing Support Services

Since the private sector will typically invest in projects for a return, its role in the

infrastructure sector is limited to those projects that are profitable. The role of the private

sector in infrastructure development can be enhanced if the viability of some projects can be

enhanced. This can be done by either providing subsidies or revenue support. The Availability

Payment scheme in Indonesia instituted by the Ministry of Finance supports projects that are

not commercially viable and have high demand risks through budgetary allocations to enable

private participation.

There are other institutions that provide support services such as guarantees to promote

investments in infrastructure projects. For example, Danajamin Nasional Berhad in Malaysia

established by the Ministry of Finance and Credit Guarantee Corporation in Malaysia provides

financial guarantees and insurance for bonds and sukuk issuances to Malaysian companies

that can help investments in the infrastructure sector. Being a GLC, the guarantees provided by

Danajamin are rated AAA by RAM Rating Services and the Malaysian Rating Corporation

(MARC). Similarly, the UK Guarantee Scheme was established to provide guarantees to

encourage investments from the private sector for infrastructure projects of national

importance.

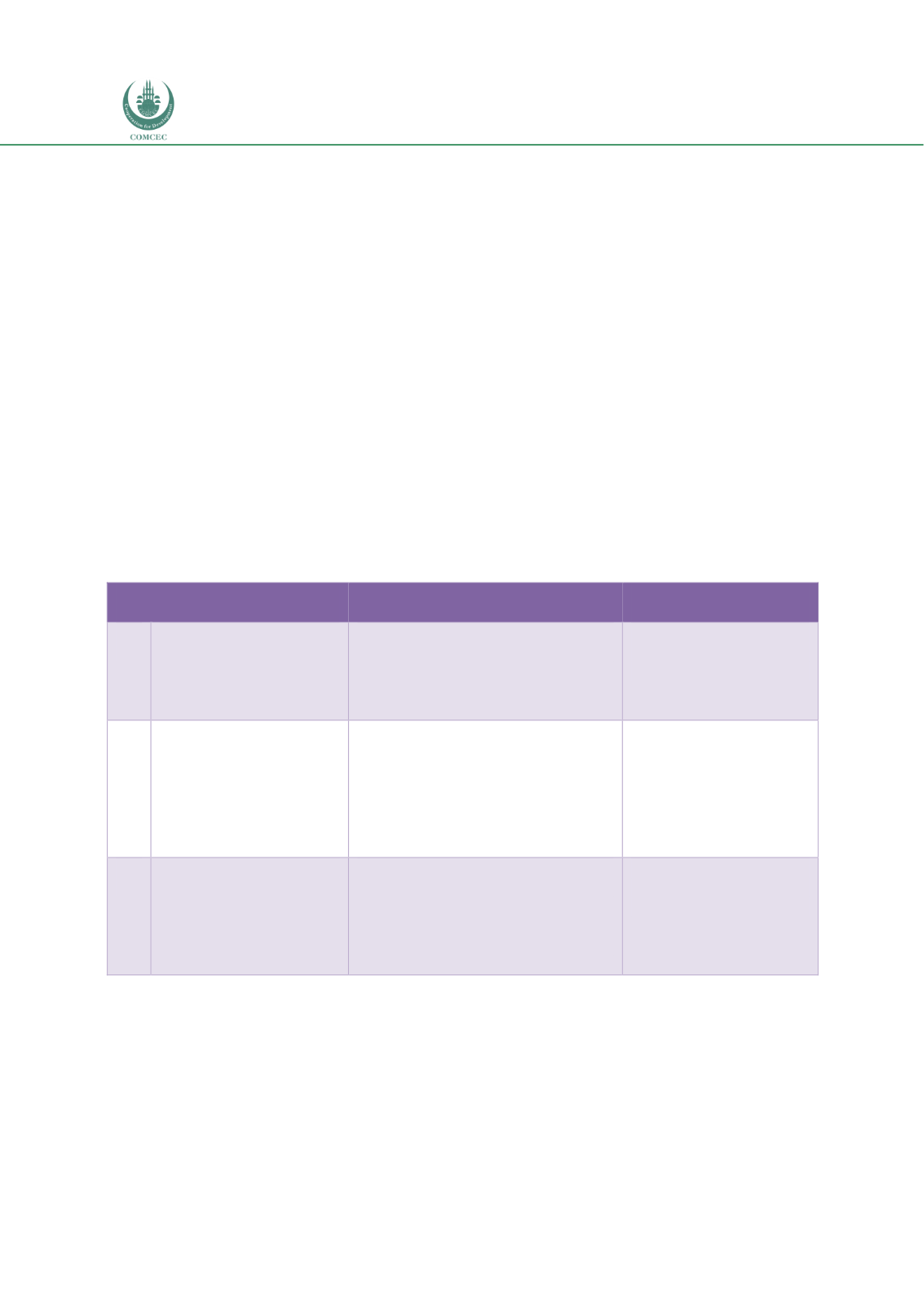

Table 5. 3: Policy Recommendations for Government and Public Bodies

No.

Recommendations

Specific Steps

Implemented by

3.1 Establish Infrastructure

related (GLCs)

Establish infrastructure-related

GLCs to develop and manage

infrastructure assets

GLCs issue sukuk to fund

infrastructure projects

Government

(Ministry of Finance)

GLCs

3.2 Establish National

Islamic Infrastructure

Investment Bank

Establish Shariah-compliant

infrastructure investment bank

as GLIC

Government and GLCs can

provide initial capital

Issue sukuk to fund

infrastructure projects

Relevant

government

ministries

GLICs

3.3 Providing Supportive

Services

Provide public financial support

to improve the viability of

infrastructure projects

Establish institutions that can

provide guarantees for

infrastructure projects

Relevant

government

ministries

5.4.

Islamic Banks

As indicated in Chapter 3, the total global banking assets are worth USD 1.598 trillion and

constitute 72.6% of the overall Islamic financial industry. Though large, the size of the Islamic

banking sector is different in various countries. The relative size of Islamic banking in the

countries examined in Chapter 4 along with investments in the infrastructure sectors and