Infrastructure Financing through Islamic

Finance in the Islamic Countries

178

5.6.

Capital Markets

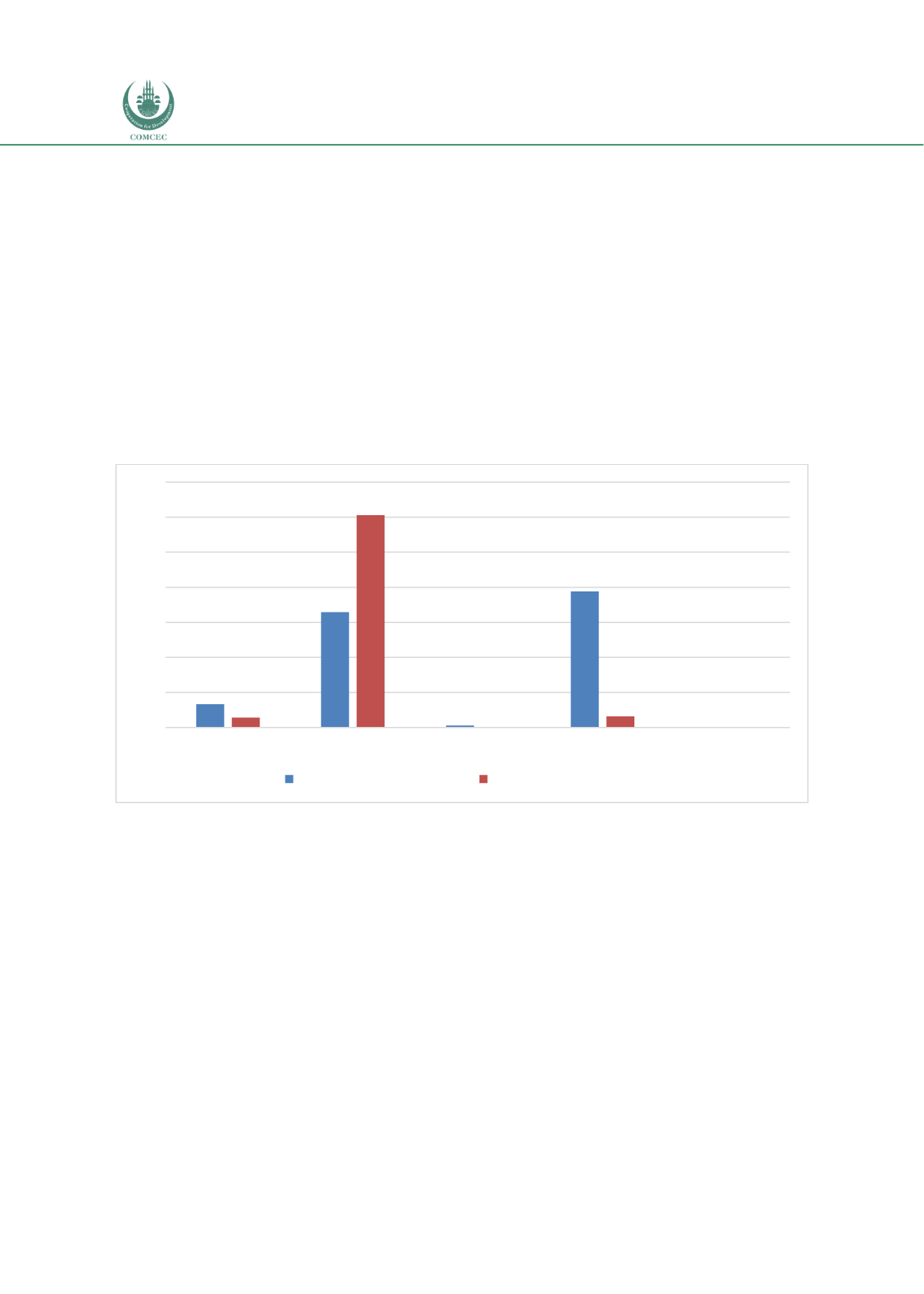

Chapter 3 (Chart 3.7) shows that, compared to financial institutions, the capital markets are

relatively less-developed in OIC member countries (with a score of 0.33 and 0.13 respectively).

The relative size of the capital markets in general and the sukuk market, in particular, indicates

that there is potential for the use of the Islamic capital market to raise funds for infrastructure

financing. The development of the sukuk market among the countries included in this study

are varied. As Chart 5.3 shows, the sukuk market is the largest in Malaysia, followed by Saudi

Arabia, where the sovereign sukuk market dominates. While the Indonesian sukuk market is

relatively moderate, only two sukuk for infrastructure projects have been issued in Nigeria to

date. The experiences from different countries show that there is a huge demand for sukuk as

seen by their oversubscription in Nigeria and the UK. This implies that there is a great

potential to use sukuk to raise funds for infrastructure projects.

Chart 5. 3: Percentage of Global Sukuk Issuances (2017) (%)

Source: IFSB (2018)

While a developed sukuk market can be tapped into to raise funds for infrastructure projects,

Chapter 3 (Chart 3.14) shows that sukuk issuances by different infrastructure sectors (physical

infrastructure, power and utilities, transportation and telecommunications) were relatively

small (8.54% of the total) in 2017. To increase the potential of raising funds from the sukuk

market would require not only a sound legal and regulatory framework but also the institution

of supporting infrastructure and institutions. COMCEC (2018) identifies the key components of

a comprehensive framework for the development of sukuk markets as being a legal and

regulatory framework, market and infrastructure development, and diversified market players

on supply and demand sides. The recommendations on strengthening the legal and regulatory

framework are partly covered in recommendation 1.3 above.

While the recommendations for strengthening the sukuk market provided by COMCEC (2018)

applies for promoting the role of Islamic capital markets for infrastructure financing, there are

some additional steps that can be taken to enhance potential use. On the supply side, the costs

of issuance can be a hindrance to issue sukuk since sukuk structures are complex and involve

6.7%

32.9%

0.6%

38.8%

2.8%

60.6%

3.2%

0%

10%

20%

30%

40%

50%

60%

70%

Indonesia

Malaysia

Nigeria

Saudi Arabia

Sudan

Sovereign Sukuk Issuance

Corporate Sukuk Issuance