Infrastructure Financing through Islamic

Finance in the Islamic Countries

172

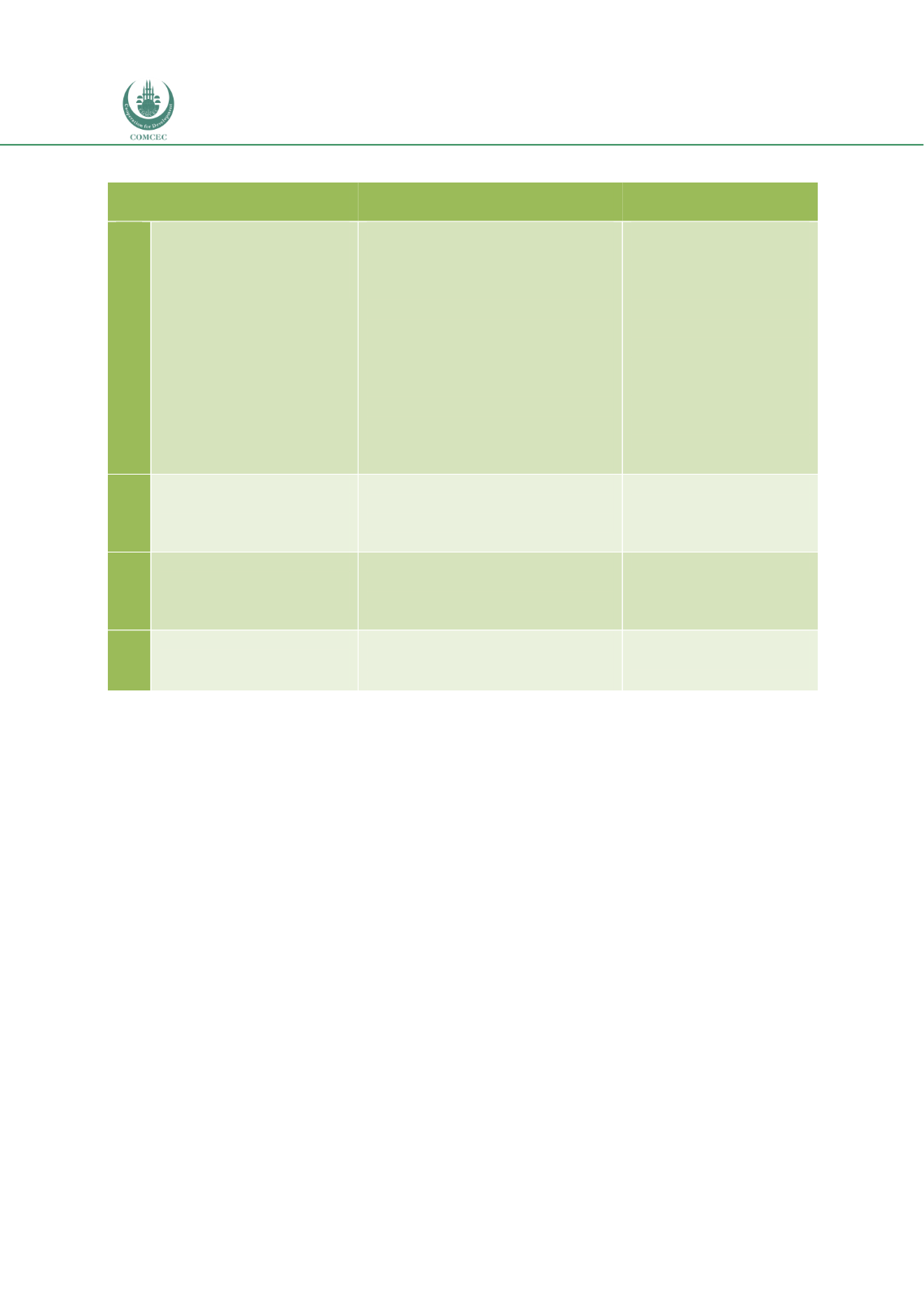

Table 5. 2: Policy Recommendations for Legal and Regulatory Regimes

No.

Recommendations

Specific Steps

Implemented by

2.1

Introduce Appropriate

Laws/Regulations

governing Infrastructure

Laws/regulations related to

private sector participation

(PPP)

Laws/regulations related to

specific infrastructure sectors

Provide a sound legal and

regulatory framework for

encouraging investments in

infrastructure projects

Develop a standardized

Shariah-compliant contract

format that can be used in

different PPP projects

Government and

relevant ministries

Government and

relevant ministries

Governments in

collaboration with

IDB

2.2

Enhance the Public

Procurement

Framework

Enact laws/regulations that

provide clarity with regards to

procurement in PPP

Government and

relevant ministries

2.3

Provide Supportive Tax

Regimes

Adapt/change tax laws to

create a level playing field

between Islamic finance and

conventional finance

Ministry of Finance

2.4

Enact Islamic Financial

Laws

Islamic banking law

Takaful law

Islamic capital markets law

Government

(Ministry of Law/

Legal Affairs)

5.3.

Government and Government Linked Companies

Although the government develops infrastructure projects though procurement, in many

countries government-linked companies (GLCs) or state-owned enterprises (SOEs) are

established to deliver various infrastructure services. Since many of these companies also have

private share-holders, the key objectives of creating GLCs is to improve efficiency and

productivity and encourage innovation. The country case studies show that there are three

types of GLCs when it comes to the infrastructure sector. First, GLCs that provide the

infrastructure services such as utility or telecommunications. Second, government-linked

investment companies (GLICs) that invest in infrastructure projects. Finally, GLCs that provide

support services such as guarantees to promote investments in infrastructure projects. The

role of Islamic finance in supporting infrastructure projects initiated by the government and

GLCs is discussed below.

5.3.1.

Government Budget Support

The country case studies show that governments are still the key players in the provision of

infrastructure in most countries. Many governments have issued sukuk to raise funds for

financing either their budgets in general or infrastructure projects in particular. For example,

in Saudi Arabia, the government raised USD 19.2 billion domestically and USD 12.5 billion from

international investors in 2017 by issuing bonds and sukuk to cover budgetary deficits. Since

the allocations of budgets are also used for infrastructure projects, part of the funds raised has