Infrastructure Financing through Islamic

Finance in the Islamic Countries

170

the Ministry of Finance covers different stages of government procurement processes to

enhance transparency and mitigate corrupt practices. The Government Tenders and

Procurement Law was enacted in Saudi Arabia by Royal Decree No.M/58 in 2006 to regulate

procedures of tenders and procurements carried out by the government authorities and

ensure they are not influenced by personal interests in order to protect public funds.

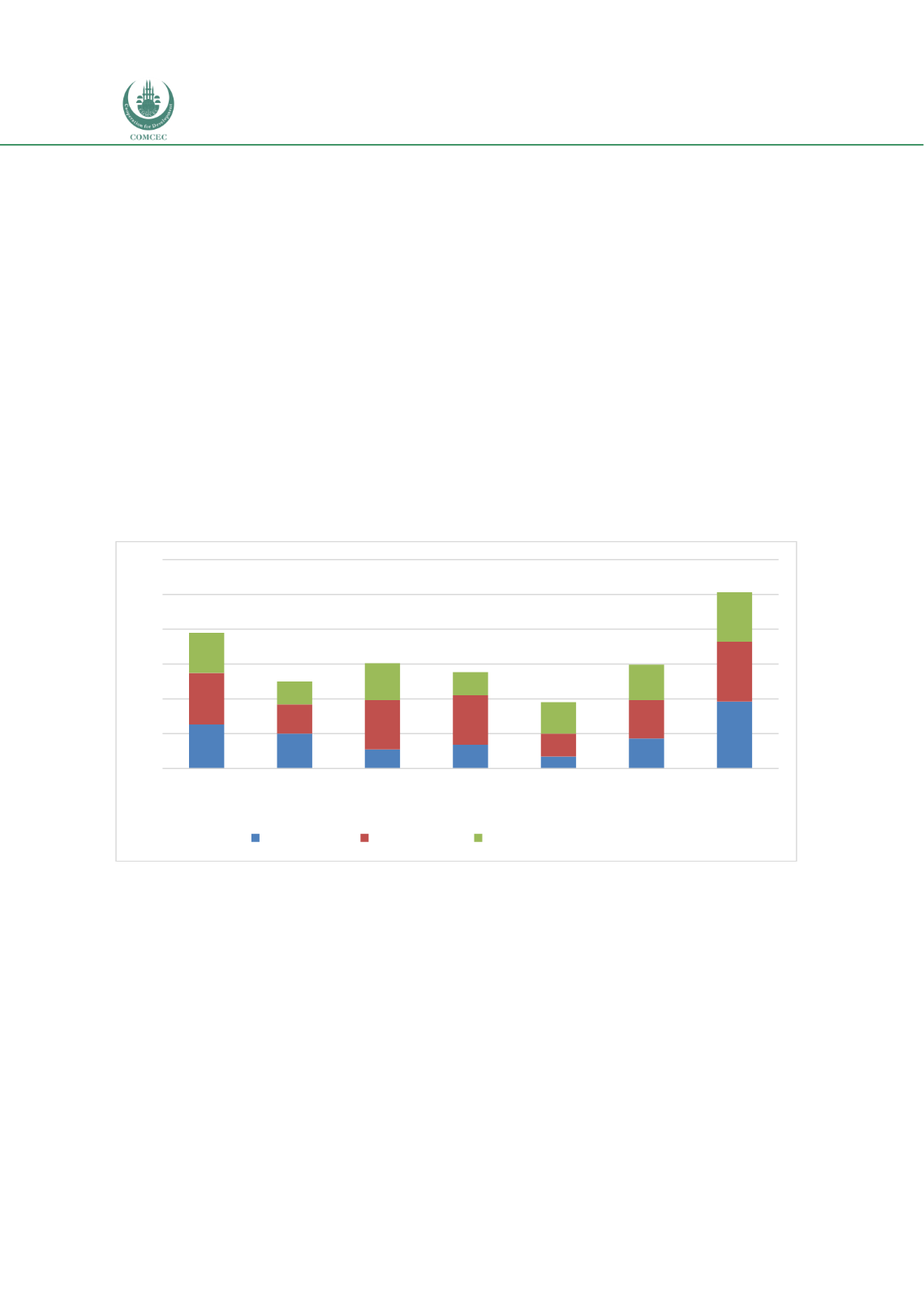

As discussed in Chapter 2, World Bank (2018f) identifies three main stages of the institutional

setup of PPP project cycle as preparation, implementation and management of contract. While

in the preparation stage the potential infrastructure projects that can be procured for

development as PPPs are identified, in the second stage the assessment and execution of

procurement is executed. In the final stage, PPP is managed by monitoring and evaluating the

activities and processes vis-à-vis the contract. The status of the procurement regime in the

countries examined is shown in Chart 5.2. The procurement regime in the UK scores the

highest, followed by Indonesia. The procurement regimes for other OIC countries in the sample

are relatively underdeveloped. While Indonesia has a better procurement regime and Nigeria’s

procurement regime is similar to the OIC average, the remaining countries (Malaysia, Saudi

Arabia and Sudan) have a lower status of procurement compared to the OIC average

Chart 5. 2: Relative Status of PPP Procurement Regimes (0-100 Highest)

Source: World Bank (2018f)

5.2.4.

Legal Environment for Islamic Finance

A supportive legal and regulatory environment for Islamic finance is necessary for its growth

and contribution to the development of the infrastructure sector. In this regard, there is a need

to have supportive Islamic financial laws covering banks, takaful and capital markets. Islamic

finance laws can be issued as stand-alone laws incorporated into existing financial laws. While

Sudan’s whole financial sector is Islamic, in other countries there is a need to enact new laws

or adjust existing financial laws to accommodate Islamic financial practices.

The Malaysian government has enacted various laws that are supportive of Islamic finance.

While IFSA 2013 provides a robust, legal framework for the Islamic banking and takaful

sectors, the Capital Markets and Services Act 2007 has provisions for Islamic securities such as

63

50

27

34

17

43

96

74

42

71

71

33

55

86

58

33

53

33

45

51

71

0

50

100

150

200

250

300

Indonesia Malaysia

Nigeria Saudi Arabia Sudan OIC Members

(40)

United

Kingdom

Preparation

Procurement

Contract management of PPPs