172

Nigeria has successfully issued 2 sovereign sukuk since 2013. The introduction of the Rules on

Sukuk by the SEC had paved the way for its first sukuk―the State Government of Osun ₦11.4

billion

ijarah

sukuk (Osun State Sukuk). The Osun State Sukuk is part of the Osun State N60

billion Debt Issuance Programme, to fund the development of 20 high schools, 2 middle

schools and 2 elementary schools in the state. The tax incentives under this sukuk are key to

its oversubscription. The sukuk was taken up by local banks, fund managers, insurance

companies and high-net-worth individuals. The tax incentives entitle the sukuk holders to

payments that are free from withholding, state and federal income and capital gains taxes, with

no deductions at source. In addition, proceeds from the disposal of the Sukuk and stamp duty

on its sale or transfer are exempted from taxation. This tax benefit is due to the 10-year tax

waiver approved by the federal government in March 2010, which exempts all categories of

bonds (including sukuk) issued by all tiers of the government (sub-national and supra-

national) and corporate bonds from company income tax, personal income tax, value-added

tax, capital gains tax and stamp duties.

The successful issuance of the Osun State Sukuk had paved the way for the issuance of

Nigeria’s second sukuk. The Federal Government of Nigeria (FGN) ₦100.0 billion

ijarah

sukuk

(FGN Sukuk) was issued in 2017. The proceeds will be used to construct and rehabilitate 25

roads in Nigeria’s 6 geopolitical zones selected by the Ministry of Power, Works and Housing

due to their strategic economic importance. Similar tax incentives have been accorded to the

FGN Sukuk, which had led to its over sub subscription by investors across a broad

spectrum―pension funds, banks, fund managers, institutional and retail players. Further

details on the Osun State Sukuk and the FGN Sukuk are described in Table 4.33. There is

reportedly another sovereign sukuk in the pipeline; the Nigerian Mortgage Refinance Company

(NMRC) plans to issue its first sukuk. The purpose is to source cheaper funding for mortgage

refinancing and lighten the interest-rate burden of the ultimate mortgage beneficiaries.

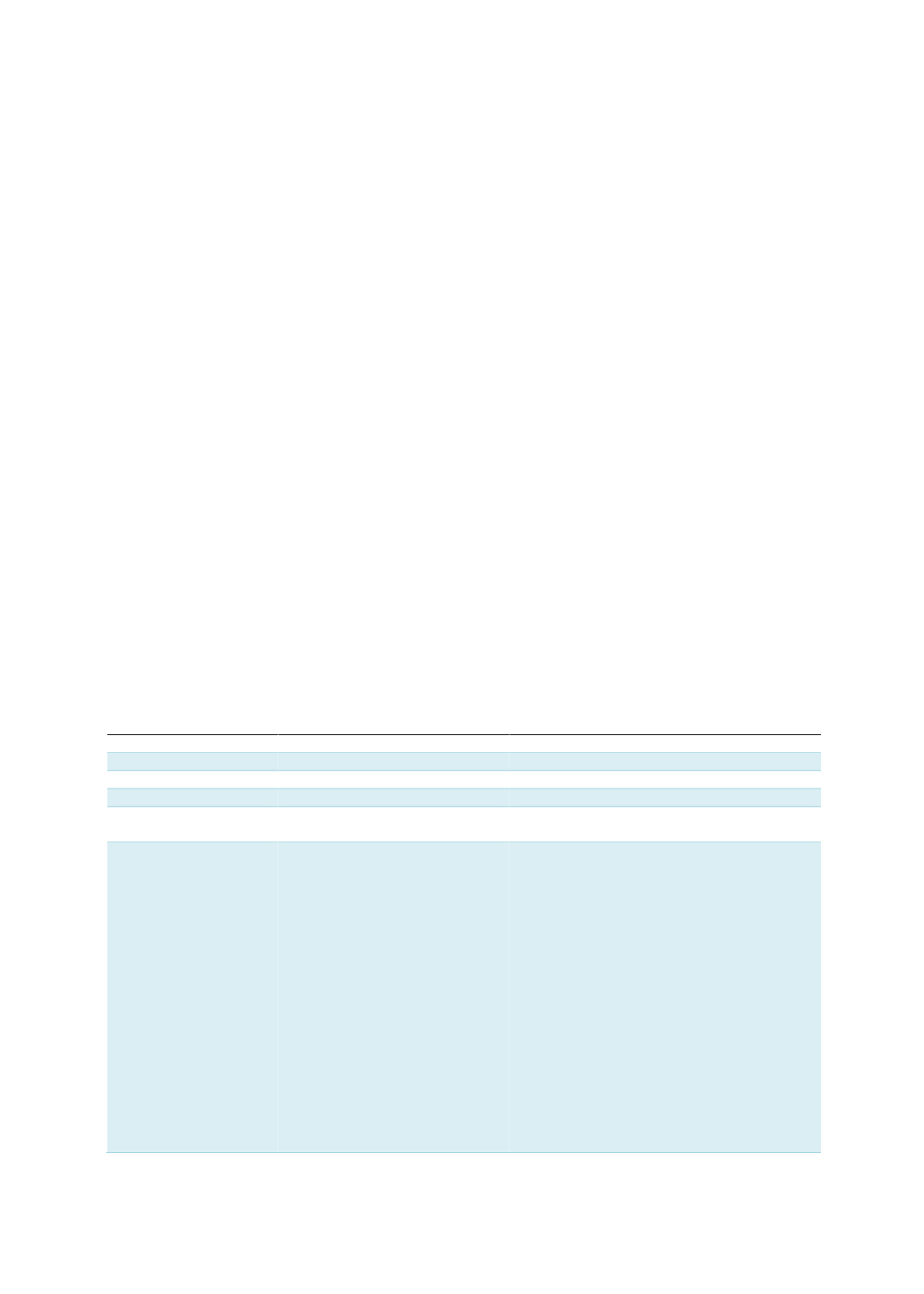

Table 4.33: Overview of Nigeria’s Government Sukuk Issuances

SPV issuer

Osun Sukuk Company Plc

FGN Roads Sukuk Company 1 Plc

Obligor

State Government of Osun

Federal Government of Nigeria

Currency/format

Nigerian Naira

Nigerian Naira

Structure

Ijarah

Ijarah

Sukuk/obligor ratings

Bbb+ (Agusto & Co)

A (Agusto & Co)

B- (Fitch)

Use of proceeds

The net proceeds of Naira10.97

billion after deduction of the cost

of the offer of Naira 0.43 billion

(i.e. 3.77% of the amount) will be

utilised for the following:

(i)

Construction of 23 high

schools (total cost of Naira

10.35 billion – 94.35% of

sukuk value)

(ii)

Construction of 2 middle

schools (total cost of Naira

0.30 billion – 2.73% of

sukuk value)

(iii)

Construction of 2

elementary schools (total

cost of Naira 0.32 billion –

2.92% of sukuk value)

To fund the construction and rehabilitation of

roads across the country:

(i)

North Central:

5 projects costing

Naira16.67 billion: construction of Loko

Oweta bridge, dualization of the Abuja-

Lokoja road (sections 1 and 4),

dualization of the Suleja-Minna road

(Phase 2), dualization of the Lokoja-

Benin road (Section 1)

(ii)

North East:

5 projects costing Naira

16.67 billion: dualization of the Kano-

Maiduguri road (Sections 2-5)

(iii)

North West:

4 projects costing Naira

16.67 billion: dualization of the Kano-

Maiduguri road (Section 1), dualization

of the Kano-Katsina road (Phase 1),

construction of Kano western bypass

and the Kaduna eastern bypass