177

also seeks to lengthen the maturity profile of the domestic debt portfolio by reducing the

issuance of short-dated debt instruments, in addition to the introduction of new debt

instruments into the domestic debt market. The implementation of the debt strategy should

help the FGN restructure its public debt, reduce its overall cost of debt, finance critical

infrastructure at minimum cost, and help create room for private borrowing in the domestic

debt market (DMO Annual Report 2016).

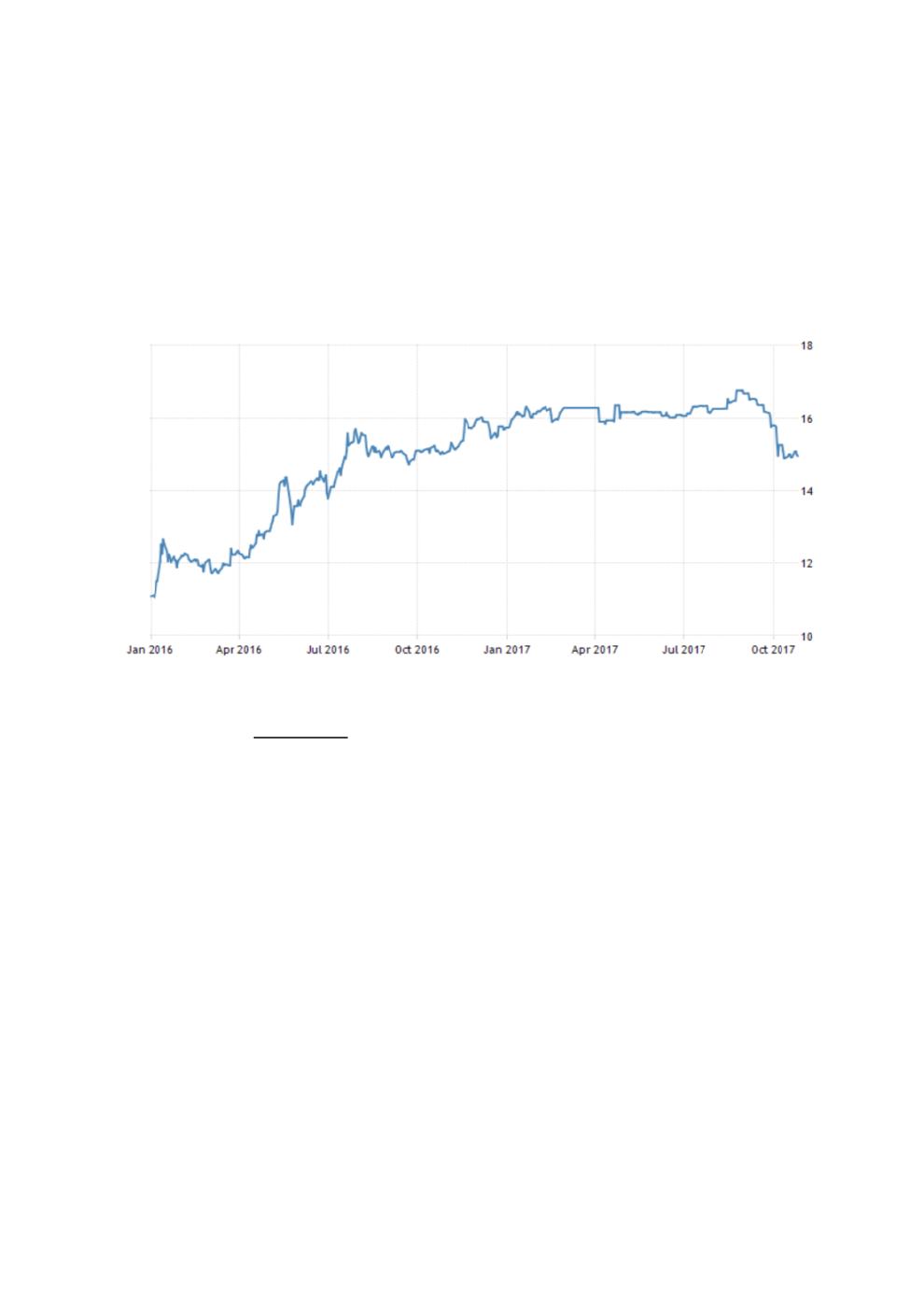

Chart 4.60: Nigerian 10-Year Sovereign Bond Yield

Sources: CBN, Trading Economics

Analysis of Sukuk Investments – Demand (Buy Side)

The FGN bond market delivered an impressive performance in 2016, as underlined by the high

level of subscriptions during the year. This indicates a diverse and expanding investor base

driven by the growth of the pension sub-sector of the financial market, and increased

awareness on bonds as an alternative investment vehicle. In spite of the economic recession,

activities in the secondary market for FGN bonds picked up significantly during the year, as

investors increasingly embraced fixed-income instruments to take advantage of their higher

yields (DMO 2016 Annual Report). The total allotment, subscription and divergence of the type

of investors for FGN bonds are shown in Table 4.36.

The widening of the investor base was also due to the recent regulatory revisions. In 2017,

PENCOM revised its regulations on the investment of pension assets. As a result, the Pension

Funds Administrators (PFAs) are allowed to invest in sukuk; prior to this legal amendment,

PFAs had only been allowed to invest in bonds. The CBN’s guidelines on the liquidity status of

NICMPs confer “liquid asset” status, i.e. the low risk of the FGN Sukuk and its “liquid asset”

status make it relatively easy for investors to use these sukuk holdings as collateral. This is to

promote the investment culture and mobilise savings. In addition, the liquidity of the FGN

Sukuk in the secondary market is further enhanced as it is listed on the Nigerian Stock

Exchange (NSE) and the FMDQ OTC Securities Exchange. Such listing provides alternative

avenues for investors that may wish to sell part or all of their investment in the sukuk before