169

4.7

NIGERIA

4.7.1

OVERVIEW OF NIGERIA’S CAPITAL MARKETS

The Nigerian capital market has grown significantly since its inception, with a CAGR of 28.4%

in 2015. Growth, however, weakened the following year amid policy uncertainties, a shortage

of foreign currencies precipitated by the plunge in crude oil receipts, low power generation

and weak investor confidence. The expansion of the sub-Saharan African economies also

slowed down, from 3.4% in 2015 to 1.6% in 2016, following slow adjustments amid the impact

from soft commodity prices, rising inflation and a less supportive global environment (DMO

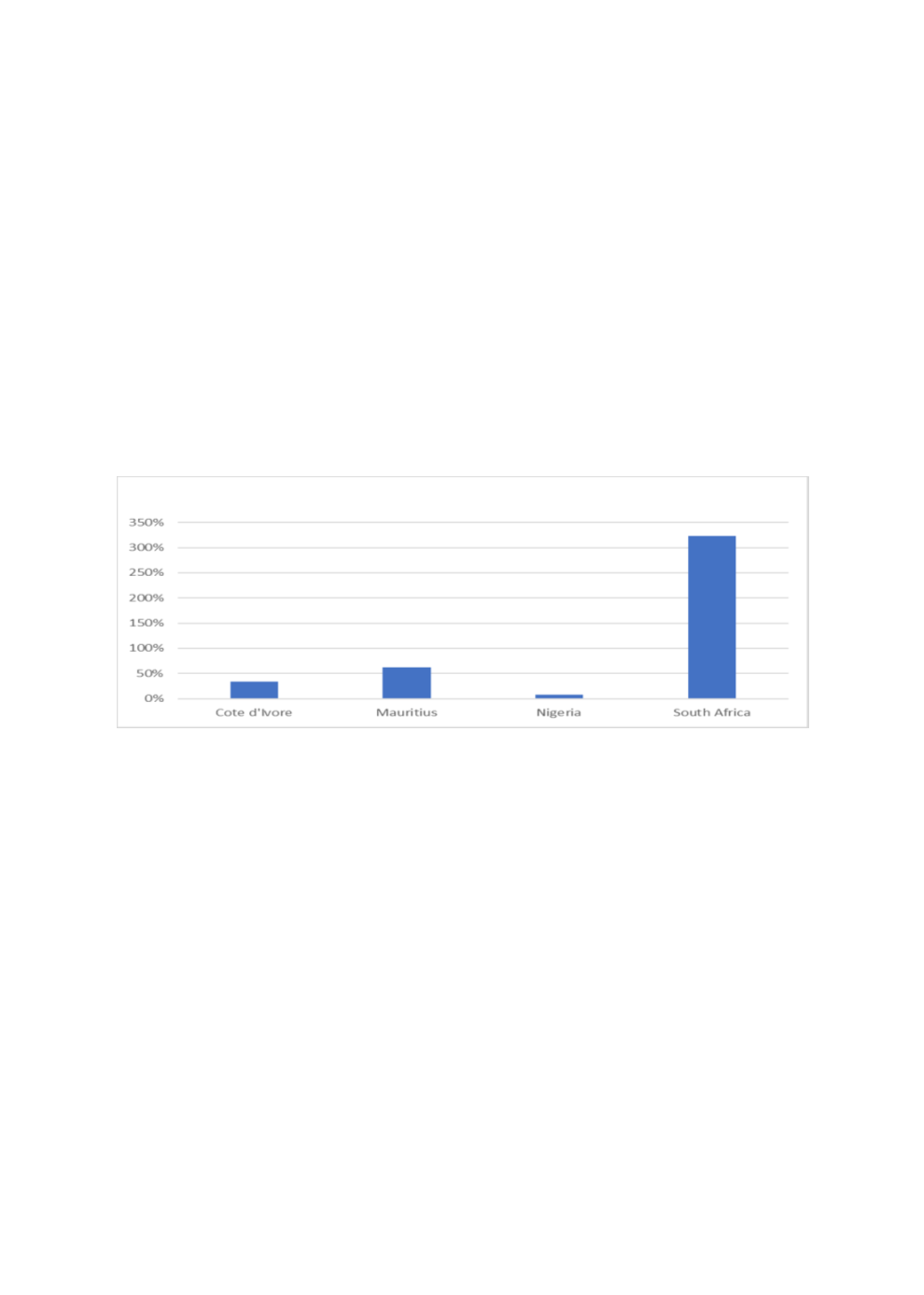

2016 Annual Report). In 2016, Nigeria’s market capitalization as a percentage of GDP came up

to 7% compared to the other developing sub-Saharan capital markets, i.e. 34% for Cote

d’Ivoire, 62% for Mauritius, and 322% for South Africa, as noted in Chart 4.55.

Chart 4.55: Market Capitalization as a Percentage of GDP

Source: World Bank

The data in Chart 4.55 indicates that Nigeria’s capital markets are extremely small compared

to its regional peers’. Nigeria aspires to become one of the world’s top 20 economies by 2020,

through its Vision 20:2020 National Plan. It is a long-term plan that aims to stimulate Nigeria’s

economic growth and launch the country onto a path of sustained and rapid socio-economic

development. This requires robust capital markets that would effect intermediation and

facilitate the meeting of the nation’s capital needs, including mobilising and channeling

medium-to-long-term investment funds. To do so, Nigeria’s capital markets must be well

positioned and structured. In 2013, a Capital Market Master Plan Committee was formed by

Nigeria’s Securities and Exchange Commission (SEC), with the mandate of reviewing the state

of its capital markets. The Committee had identified and classified issues under 4

transformation themes―contribution to the national economy, market structure,

competitiveness and regulation and oversight―which have in turn led to the launch of

Nigeria’s Capital Market Master Plan 2015-2025.

The Capital Market Master Plan unveiled in 2015 by the SEC lays out strategic transformation

themes, initiatives and recommendations for the growth of the niche market in amid the

challenging economic environment (refer to Box 4.18).