175

Nigeria’s 2 sovereign sukuk issues and potential future issuance will help the FGN meet its

funding deficits and broaden the array of capital market instruments.

4.7.3

ANALYSIS OF SUKUK STRUCTURES, ISSUANCE AND INVESTMENT

Analysis of Sukuk Structures

The

Rules on Sukuk

provide a list of sukuk structures that are based on Shariah contracts,

including

ijarah, istisna’, musharakah

and

murabahah

. Despite the facilitating legal provisions,

the 2 Nigerian sovereign sukuk structures are based on

ijarah

.

Analysis of Sukuk Issuances – Supply (Sell Side)

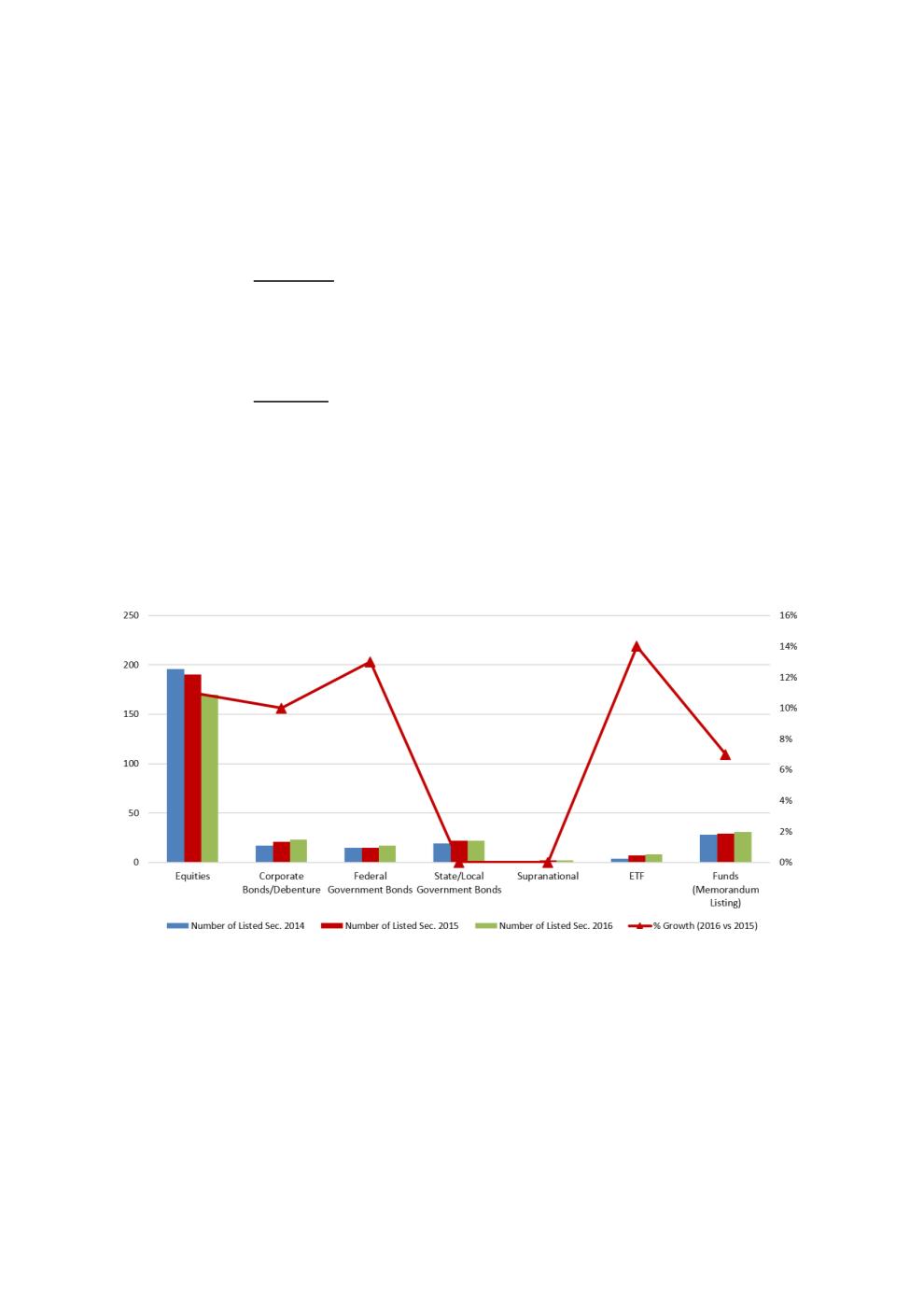

The size and liquidity of a debt market are important indicators of its vibrancy. A snapshot of

the size of the Nigerian domestic bond market shows that it is still small compared to the

equity market. The issuance of the FGN Sukuk and the Osun State Sukuk has slightly deepened

the nascent Nigerian capital markets, by increasing the variety of instruments available to

issuers and investors. Chart 4.58 depicts the size of the domestic bond market from 2014 to

2016. As at end-2016, the bond market was equivalent to 20% of the entire domestic bond

market while the equity market dominated with a 70% share.

Chart 4.58: Size of Capital Markets in Nigeria (2014-2016)

Source: NSE

Table 4.35 shows that within the domestic bond market, sovereign bond issues (FGN and state

government bonds) outnumber corporate bonds. This highlights that debt securities have been

a reliable and cost-effective source of financing for the government. Sovereign bonds are

touted as safe, low-risk investments as they are direct obligations of the government, which is

fully responsible for the payment of the coupon/rental income and the repayment of the

principal at maturity. They are also backed by the full faith and credit of the federal

government. However, the dominance of sovereign bonds in the debt market will crowd out or

deter corporate issuers from entering the market.