176

Table 4.35: Size and Composition of Nigeria’s Domestic Bond Market (2015-2016)

2015

2016

Issuer

Amount outstanding

(Naira billion)

% of total

Amount outstanding

(Naira billion)

% of total

FGN

5,808.14

89.14

6,663.36

93.33

State governments

457.38

7.00

324.20

4.54

Corporates

226.15

3.47

127.31

1.78

Supra-nationals

24.95

0.38

24.95

0.35

Total

6,515.62

100.0

7,139.82

100.00

Sources: SEC, DMO

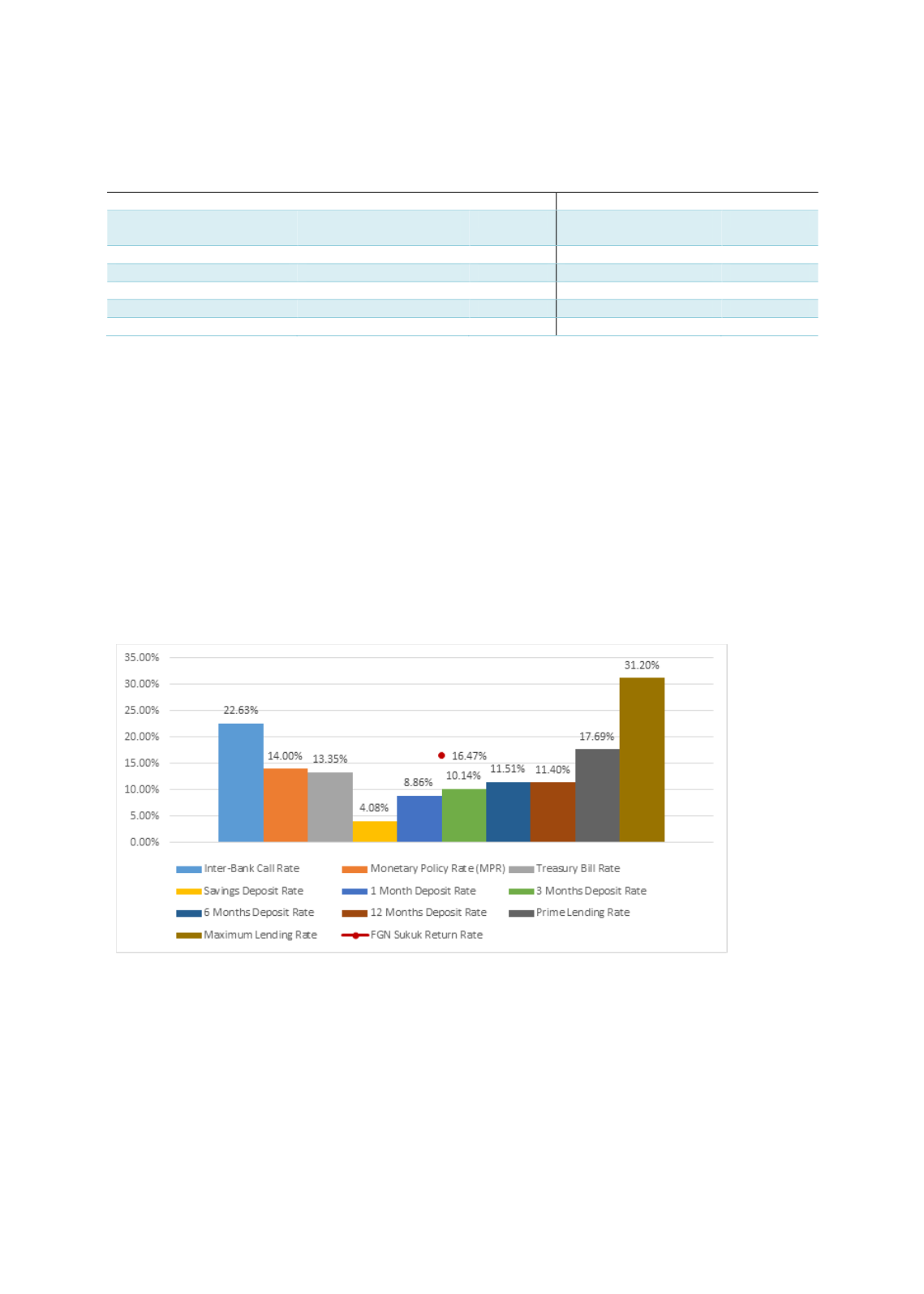

The sovereign benchmark yield curve is key to developing an efficient and active debt market.

The Osun State and FGN sukuk set the benchmark for the pricing of future sukuk with 7-year

tenures that may be issued by other tiers of government, corporates and multilaterals. For

investors, the 16.47% annual return offered by the FGN Sukuk is above Nigeria’s inflation rate

of 15.98% (as of September 2017). The FGN Sukuk’s return is also favourable to investors as it

is higher than the country’s official monetary policy rate (14%), Treasury Bill yield (13.35%),

savings deposit rate (4.08%), and 1-, 3-, 6- and 12-month fixed deposit rates (8.86%, 10.14%,

11.51%, 11.40%). Chart 4.60 depicts the money-market rates published by the CBN in August

2017. For private issuers, however, high interest rates affect coupon rates and thus discourage

private issuance. The Nigerian prime lending rate stands at 17.69%, as noted in Chart 4.59, and

shows a wide spread of 6%-13%.

Chart 4.59: Nigeria’s Money-Market Indicators in August 2017

Source: CBN

Although there is no FGN bond with a 7-year tenure to compare with the FGN Sukuk, the range

of coupon rates from the FGN benchmark bond issued in 2016 may be taken as a guidance. The

FGN introduced a new 5-year benchmark bond and a 20-year benchmark bond in 2016, with

the issuance of the 14.5% FGN JUL 2021 and 12.40% FGN MAR 2036 (refer to Chart 4.60 on

Nigerian 10-year sovereign bond yield). The introduction of longer-tenure FGN benchmark

bonds was due to the implementation of the nation’s second Debt-Management Strategy, 2016-

2019. The strategy seeks to rebalance the country’s debt portfolio in favour of less expensive

long-term external financing, to reduce the cost of debt and lengthen the maturity profile. It