178

maturity. Apart from that, Nigeria set up a technical committee to develop a road map for a

national savings strategy in 2016, as delineated in Box 4.20.

Table 4.36: Investors of FGN Bonds Allotted in 2016

Description

Amount

Result

Total amount offered

1,235,000.00

Total subscription

2,125,748.10

Range of bids (%)

8-19

Range of marginal rates (%)

11.3340-16.4348

Range of Coupons (%)

12.4000-15.5400

% of the total allotment

Deposit money banks

325,296.81

24.86

Pension funds

285,437.75

21.82

Government agencies

240,603.33

18.39

Fund managers & NBFIs

408,362.88

31.21

Individuals

3,296.42

0.25

Insurance companies

20,880.39

1.60

Retail/other institutional investors

6,425.75

0.49

Foreign investors

18,000.00

1.38

Total allotment

1,308,303.33

100.00

Source: DMO

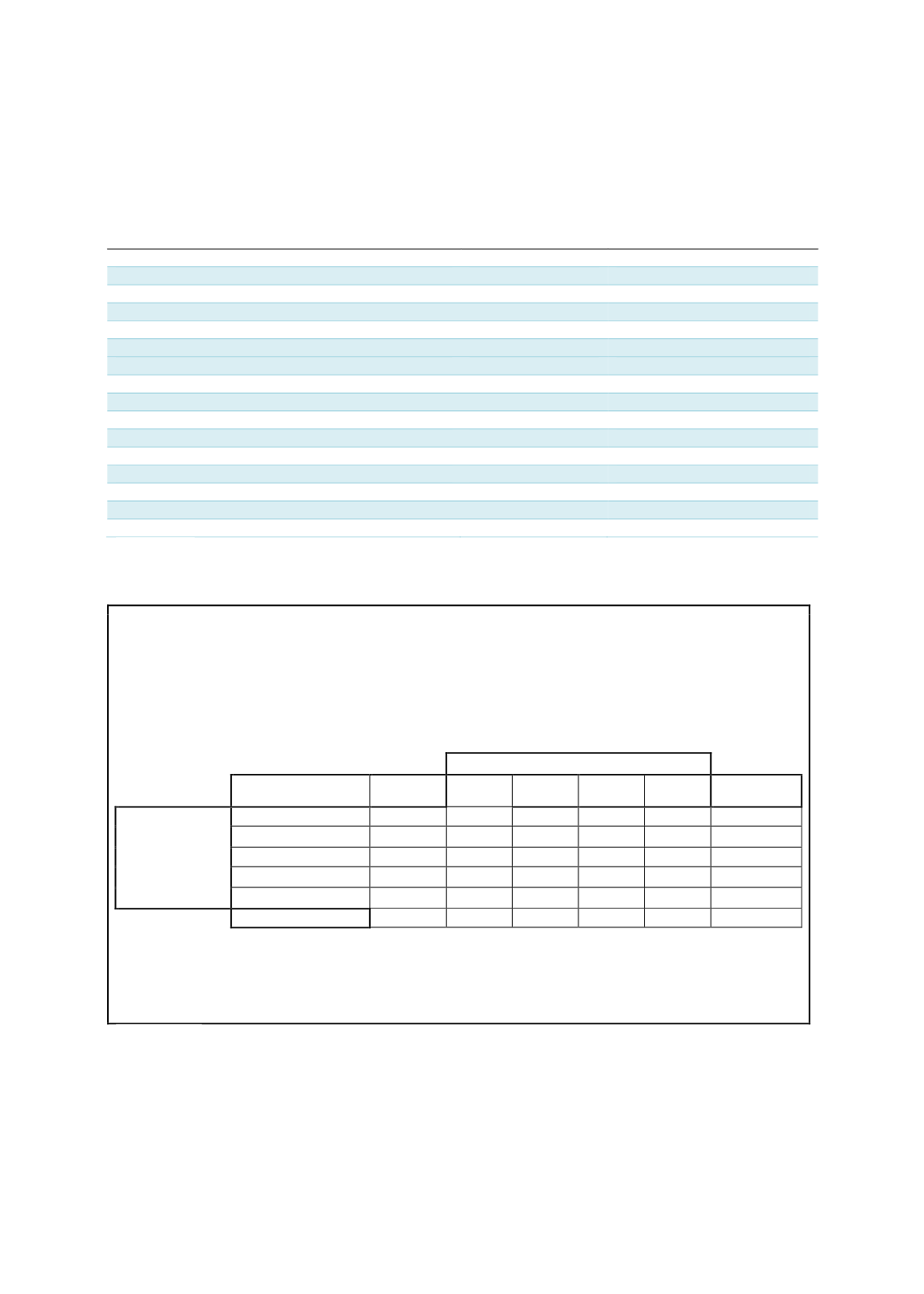

Box 4.20: Nigeria’s National Savings Strategy

The gap in Nigeria’s national savings is massive. At present, savings by the masses are still critically low. The

table below depicts that in 2016, some 36% of the population had access to bank accounts, with 2% having

insurance coverage and 5% enjoying the privilege of a pension scheme. The aggregate savings in the financial

system do not include most of the wealth of the local population that either keep it as cash or invest it in land

and cattle, among other things.

Financial Inclusion in Nigeria for 2010, 2012, 2014 and 2016

Status as at

Focus areas

Target by

2020

2010

2012

2014

2016

Variance to

2020 target

% of total adult

population

Payments

70%

22%

20%

24%

38%

-32%

Savings

60%

24%

25%

32%

36%

-24%

Credit

40%

2%

2%

3%

3%

-37%

Insurance

40%

1%

3%

1%

2%

-38%

Pension

40%

5%

2%

5%

5%

-35%

Financial exclusion

20%

46.3%

39.7%

39.5%

41.6%

-21.6%

That said, the Pension Reform Act was reformed in 2014, making it mandatory for companies with 3 or more

employees to join the pension scheme. Before the statutory amendment, the mandatory participation had

applied to private entities that employed 15 or more workers. Under the current system, employees of state

and local governments are excluded from participation. The total contribution rate will be 18% (i.e. 10% for

employers and 8% for employees).

Source: EFInA

4.7.4

KEY FACTORS UNDERPINNING NIGERIA’S SUKUK MARKET

As a nascent industry, Nigeria requires more efforts to build a conducive sukuk market. Some

of the basic pillars have been put in place, as illustrated in Figure 4.21.