167

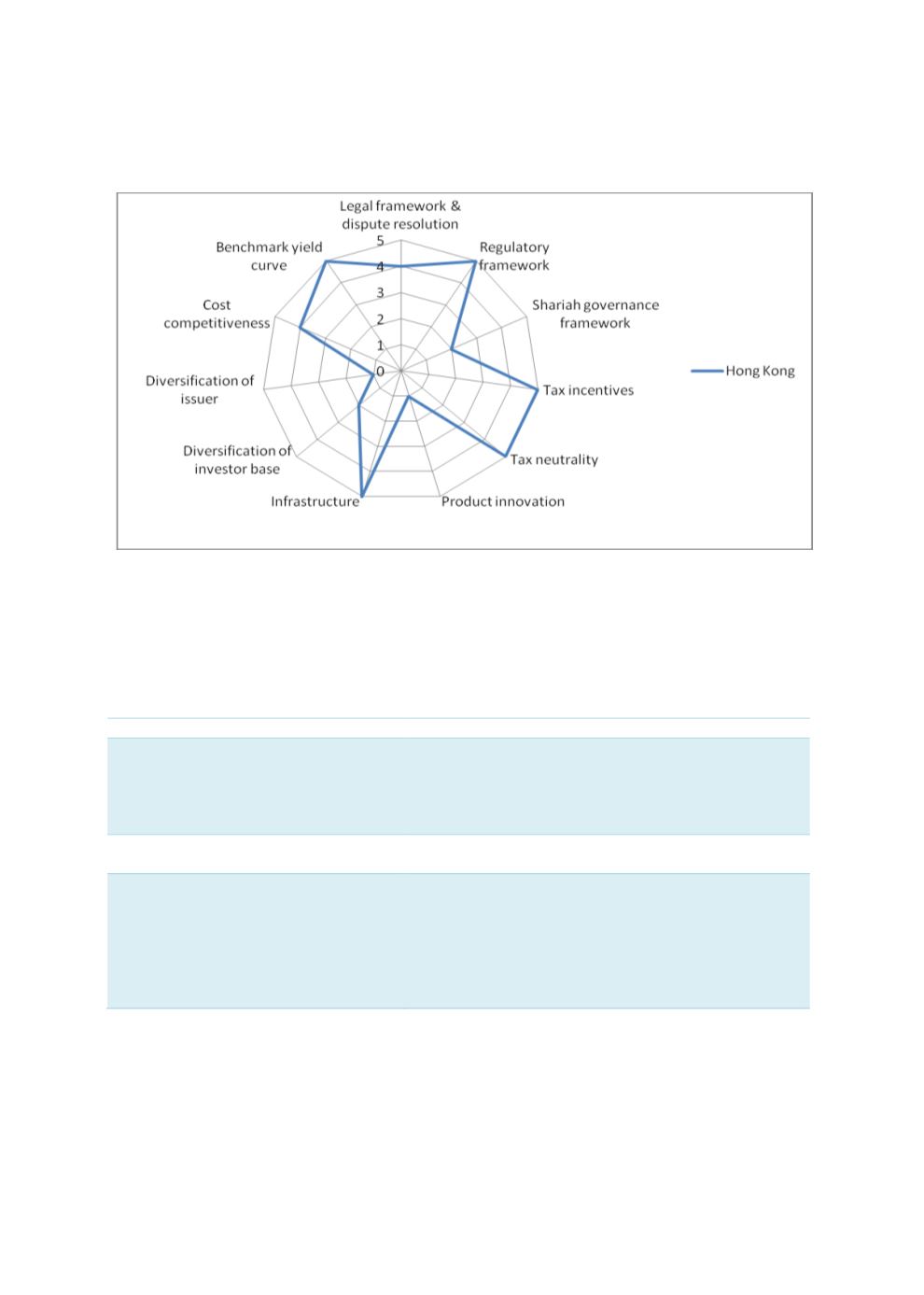

Chart 4.54: Factors Influencing the Development of Hong Kong’s Sukuk Market

Sources: RAM, ISRA

While Hong Kong’s sovereign issuances have been highly successful, underlining investors’

confidence in its credentials, there are a number of challenges that it still faces in further

developing its sukuk market. Based on these challenges, the policy recommendations from the

supply and demand sides are briefly outlined in Tables 4.31 and 4.32.

Table 4.31: Recommendations to Improve Demand (Buy Side) – Medium-Term Solutions

Issues and challenges

Demand (buy side) opportunities

Market awareness

More promotional activities on Islamic finance and

sukuk among stakeholders.

Establish collaborative platforms between the

regulators and industry players, to settle arising issues

and increase awareness on sukuk.

Limited domestic Muslim population

Incentives provided through tax rebates for individuals

to invest in retail sukuk.

Investor base

As a leading global offshore RMB business hub, Hong

Kong has the advantage in developing RMB-

denominated sukuk products. Previous RMB-

denominated sukuk issued in Malaysia had attracted a

diverse group of investors, reflecting the strong

demand for RMB-denominated sukuk. Hong Kong could

take similar initiatives.

Sources: RAM, ISRA