171

Box 4.19: Nigeria’s NICMP Master Plan 2015 – 4 Key Strategies

1.

To build a strong regulatory foundation

for the NICM

2.

To encourage the development of NICM market

stakeholders

Strategic Initiatives

Strengthen the institutional capacity of the

SEC.

Strengthen

coordination

among

the

regulatory authorities within the financial

sector.

Continuous review/creation of new rules

on NICMPs.

Strategic Initiatives

Regulatory authorities to continuously engage

stakeholders on issues relating to the NICM.

Conduct robust public awareness and education

programmes on NICMPs.

Build the capacity of stakeholders through tailored

courses/programmes/seminars/workshops.

Ensure easy entry of market participants into the

NICM.

3.

To encourage the development of

NICMPs

4.

To create a regional NICM hub

Strategic Initiatives

Ensure availability of NICMPs that meet the

regulatory requirements of banks,

takaful

companies, PFAs, assets managers and

other fund/portfolio managers.

Ensure availability of NICMPs that attract

retail investors, to achieve financial

inclusion.

Regulatory

authorities

to

engage

stakeholders in addressing tax issues

related to new products.

Strategic Initiatives

Promote and enhance cross-listing of NICMPs.

Promote and enhance multi-currency listing.

Rationalise cost of listing/issuance process of

NICMP.

Ensure active promotion of the NICM in the sub-

Saharan region.

Enhance the liquidity of NICMPs in the secondary

market.

Source: SEC (2015b)

4.7.2

DEVELOPMENT OF THE SUKUK MARKET IN NIGERIA

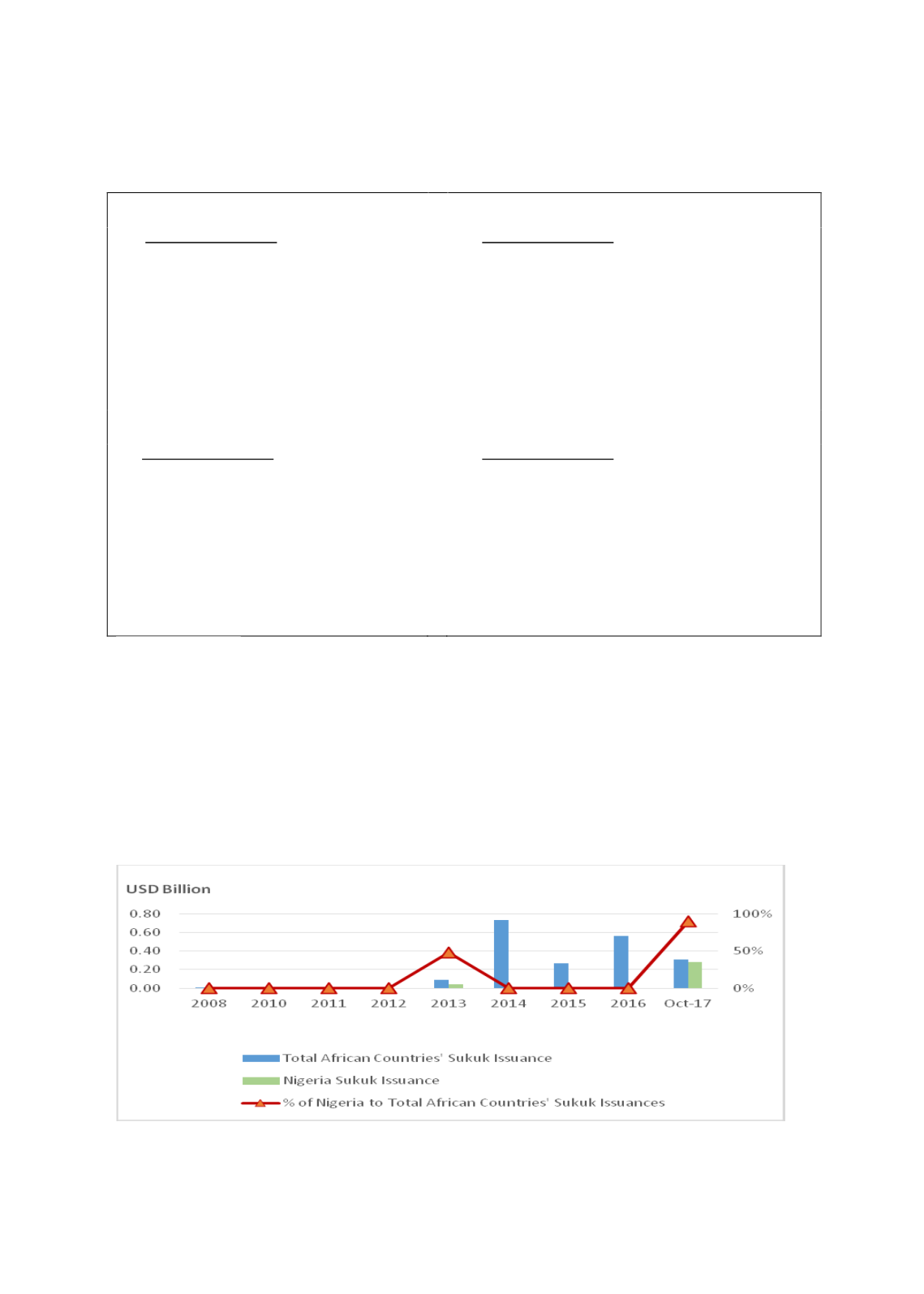

The Nigerian sukuk market is still at a nascent stage. Africa only accounted for 0.46% of the

global sukuk market, with only 619 sukuk issues valued at USD3.33 billion. Out of the 55

countries in the sub-Saharan region, only 7 countries had issued sukuk as at end-October

2017. Nigeria stands out as the third largest sukuk issuer in this region, behind South Africa

and Ivory Coast, as shown in Chart 4.56.

Chart 4.56: Nigeria’s Sukuk Issuance vs Africa’s (2008-October 2017)

Source: Bloomberg