173

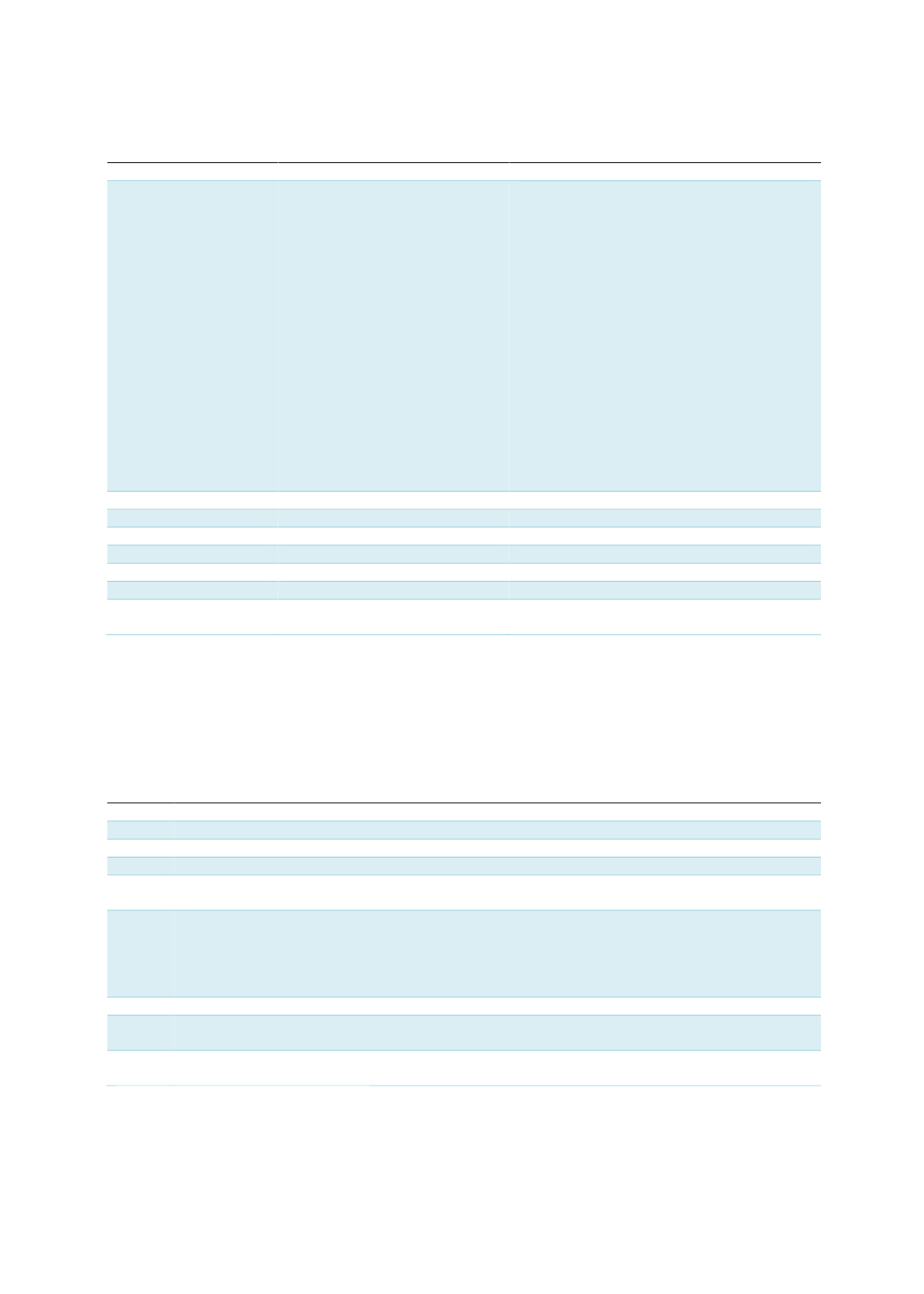

SPV issuer

Osun Sukuk Company Plc

FGN Roads Sukuk Company 1 Plc

(iv)

South East:

4 projects costing Naira

16.67 billion: rehabilitation of the

Onitsha-Enugu expressway and the

Enugu-Port Harcourt road (Sections 1-

3)

(v)

South South:

5 projects costing Naira

16.67 billion: rehabilitation of the

Enugu-Port Harcourt road (Section 4),

dualization of the Yenegwe road

junction-Kolo-Otuoke Bayelsa Palm, and

dualization of the Lokoja-Benin road

(Sections 2-4).

(vi)

South West:

3 projects costing Naira

16.67 billion: reconstruction of the

Benin-Ofosu-Ore-Ajebandele-Shagamu

dual carriageway (Phases 3 and 4), and

dualization of the Ibadan-Ilorin road

(Section 2)

Facility tenure

7 years

7 years

Issuance date

10 October 2013

22 September 2017

Maturity date

10 October 2020

22 September 2024

Amount

Naira11.4 billion

Naira100.0 billion

Profit rate

14.75%

16.47%

Order book

Fully subscribed

Oversubscribed more than 5.8%

Listing

NSE

FMDQ

NSE

FMDQ

Sources: Prospectus of Osun Sukuk Company Plc, Prospectus of FGN Roads Sukuk Company 1 Plc

The positive outcomes of these sukuk issues are underpinned by the reforms and

infrastructure that have been incorporated into Nigeria’s regulatory framework and capital

markets. Table 4.34 provides a brief description of the initiatives undertaken by the FGN in

developing its ICM, particularly sukuk.

Table 4.34: Timeline of the Development of Nigeria’s ICM/Sukuk Market

Year

Timeline description

2008

The first

halal

investment established by Lotus Capital Ltd.

2010

The SEC issued

Rules on Islamic Fund Management

2011

The CBN issued

Guidelines for the Regulation ad Supervision of NBFIs

2012

The Lotus Islamic Index was set up in the NSE to track selected Shariah-compliant equities

The SEC issued

Rules on Sukuk

2013

The FIRS issued

Guidelines on Tax Implications of Non-Interest Banking in Nigeria

The CBN inaugurated the Financial Regulation Advisory Council of Experts (FRACE) to provide

advice on Shariah compliant matters

The issuance of Nigeria’s first sukuk: the State Government of Osun Naira 11.4 billion

ijarah

sukuk

2015

The SEC launched the NICMP Master Plan

2016

The CBN issued

Guidelines for Granting Liquid Asset Status to Sukuk Instruments Issued by State

Governments

2017

PENCOM issued guidelines on investment by the Pension Fund Administrator

The issuance of Nigeria’s second sukuk, the FGN ₦100.0 billion

ijarah

sukuk

Sources: SEC (2015b), CBN, SEC, PENCOM