174

Domestic Market – Public Sector Issuance

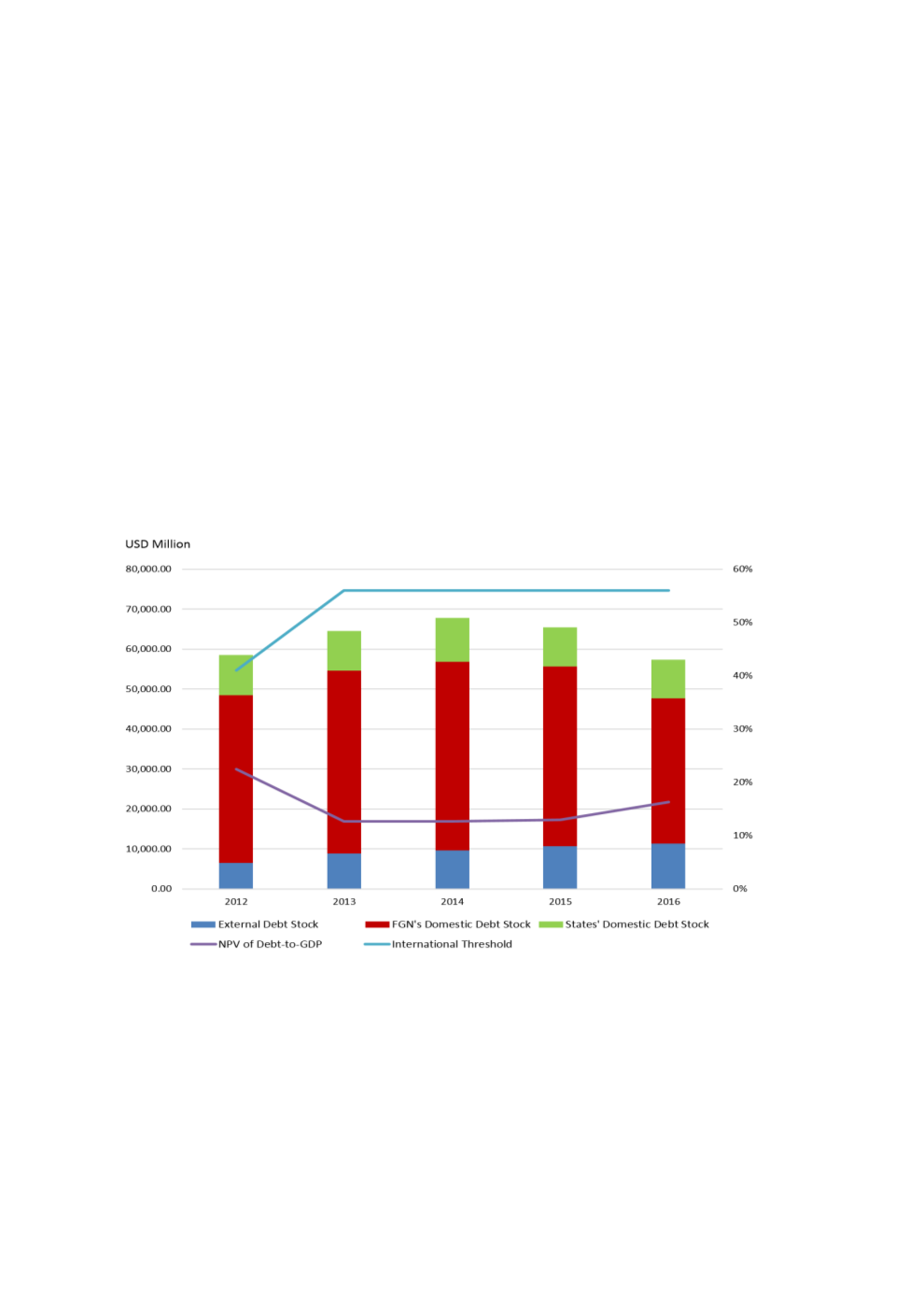

Nigeria fell into an economic recession in 2016, with 2 consecutive quarters of negative GDP

growth rate (-0.36% in 1Q 2016 and -2.06% in 2Q 2016). This was triggered by stagflation,

shocks in crude oil production, and heightened vandalism of oil and gas pipelines, which had

significantly affected output and earnings. The inflation rate shot up to 11.38% in February

2016 (end-2015: 9.55%), before escalating further to 18.55% in December. The rampant

inflation is attributable to a shortage of foreign exchange and spiralling energy prices amid a

weak power supply. Nigeria’s outstanding public debt stood at ₦17,360,009.57 million as at

end-December 2016 (USD57,391.53 million), compared to ₦12,603,705.28 million

(USD65,428.53 million) a year earlier, translating into an increase of ₦4,756,304.30 million or

37.74% (refer to Chart 4.57). The surge in public debt was due to additional issuances to fund

the 2016 budget deficit, which had widened to 2.14% of GDP compared to 1.09% in 2015, and

refinancing/redeeming matured securities, exacerbated by the depreciation of the naira

against the USD following the liberalization of the exchange-rate regime (DMO 2016 Annual

Report).

Chart 4.57: Nigeria’s Outstanding Public Debt (2012-2016)

Source: DMO

Based on available data, the country’s budget deficits have been funded by domestic

borrowing, through monthly issues of FGN securities in the local debt market. This is in line

with the objectives of Nigeria’s National Debt-Management Framework (NDMF), 2013-2017

and the DMO’s Strategic Plan (2013-2017), i.e. to efficiently meet government financing needs

at minimum cost and risk; supporting the development of the domestic debt market; and

sustaining capacity-building initiatives at the sub-national level for overall debt sustainability

and the macroeconomic stability of the country. Undoubtedly, the successful launch of