166

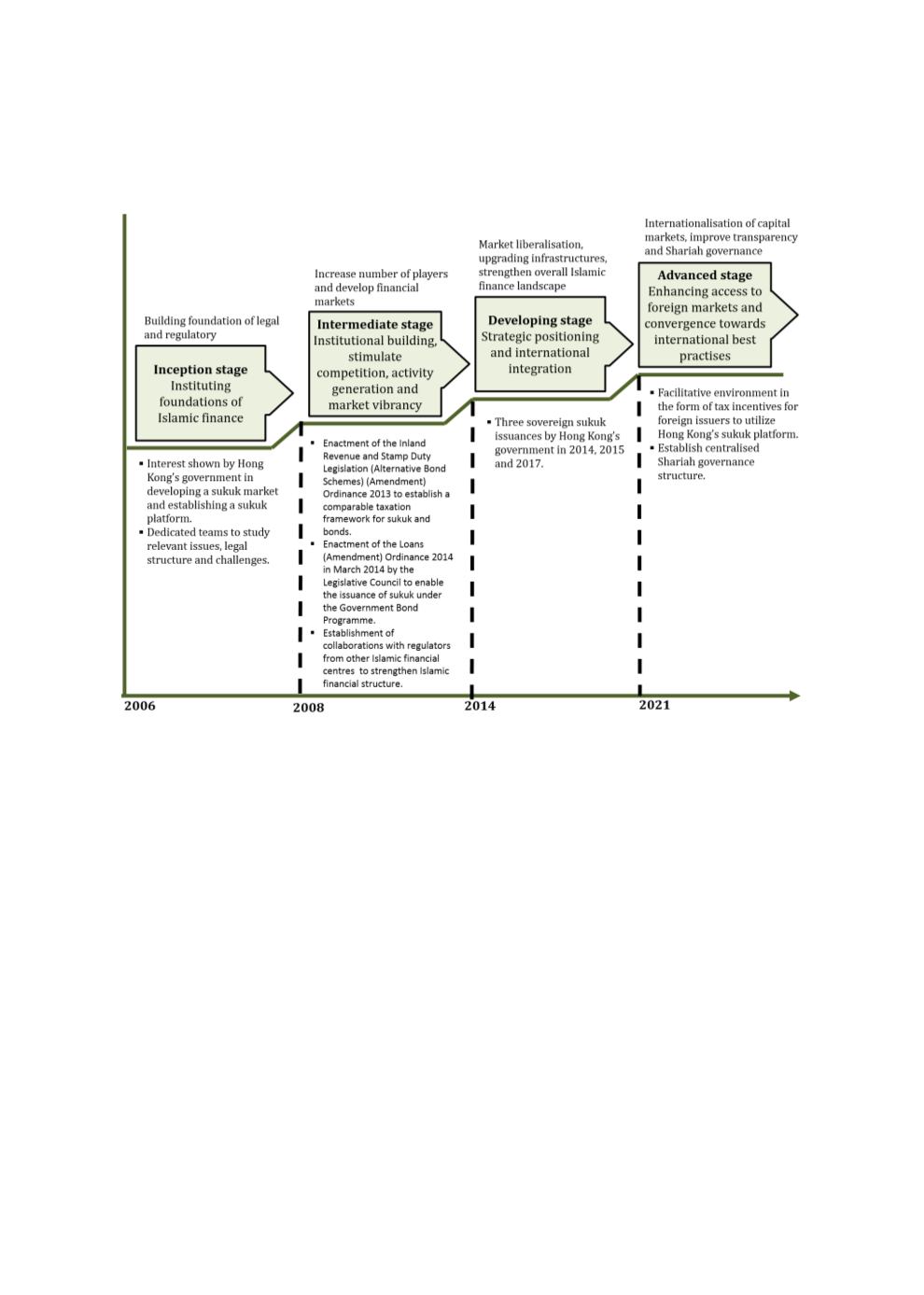

Figure 4.20: Phases of Islamic Finance’s Inclusion in Hong Kong’s Financial Landscape

Sources: RAM, ISRA

4.6.5

COUNTRY-SPECIFIC RECOMMENDATIONS

Some key factors, as depicted in Chart 4.54, have contributed to the development of Hong

Kong’s sukuk market. The Hong Kong government scores particularly highly in setting a

benchmark yield curve, its existing infrastructure for bond/sukuk issuance, its strong

regulatory framework, and its tax-neutrality policy for bonds and sukuk, over and above its

favourable tax regime.