Financial Outlook of the OIC Member Countries 2016

16

in all countries' banking systems, and total regulatory

capital, which includes several specified types of

subordinated debt instruments that need not be repaid if

the funds are required to maintain minimum capital levels

(these comprise tier 2 and tier 3 capital). Total assets

include all nonfinancial and financial assets.

Bank nonperforming loans to

gross loans (%)

GFDD.SI.02 Ratio of defaulting loans (payments of interest and

principal past due by 90 days or more) to total gross loans

(total value of loan portfolio). The loan amount recorded as

nonperforming includes the gross value of the loan as

recorded on the balance sheet, not just the amount that is

overdue.

Source: World Bank (2016b). For more detailed definitions, see CCO (2015, p.61-63).

Rest of the chapter explains the figures in selected measures by financial characterizations.

Measures are aggregated and interpreted on income level groups. Appendix II, Tables 9

through 24 present data on country by year and income groups. For data on specific country,

Appendix II should be referred.

Financial Access

3.1

Financial access, also termed as financial inclusion, is “the degree to which the public can

access financial services” (Cihak et al., 2012:12). Higher financial access characteristic of a

financial system allows economy to utilize more quality projects. This allows financial services

to reach more diverse of firms and individuals. Four measures are covered in financial access

characteristics of financial systems.

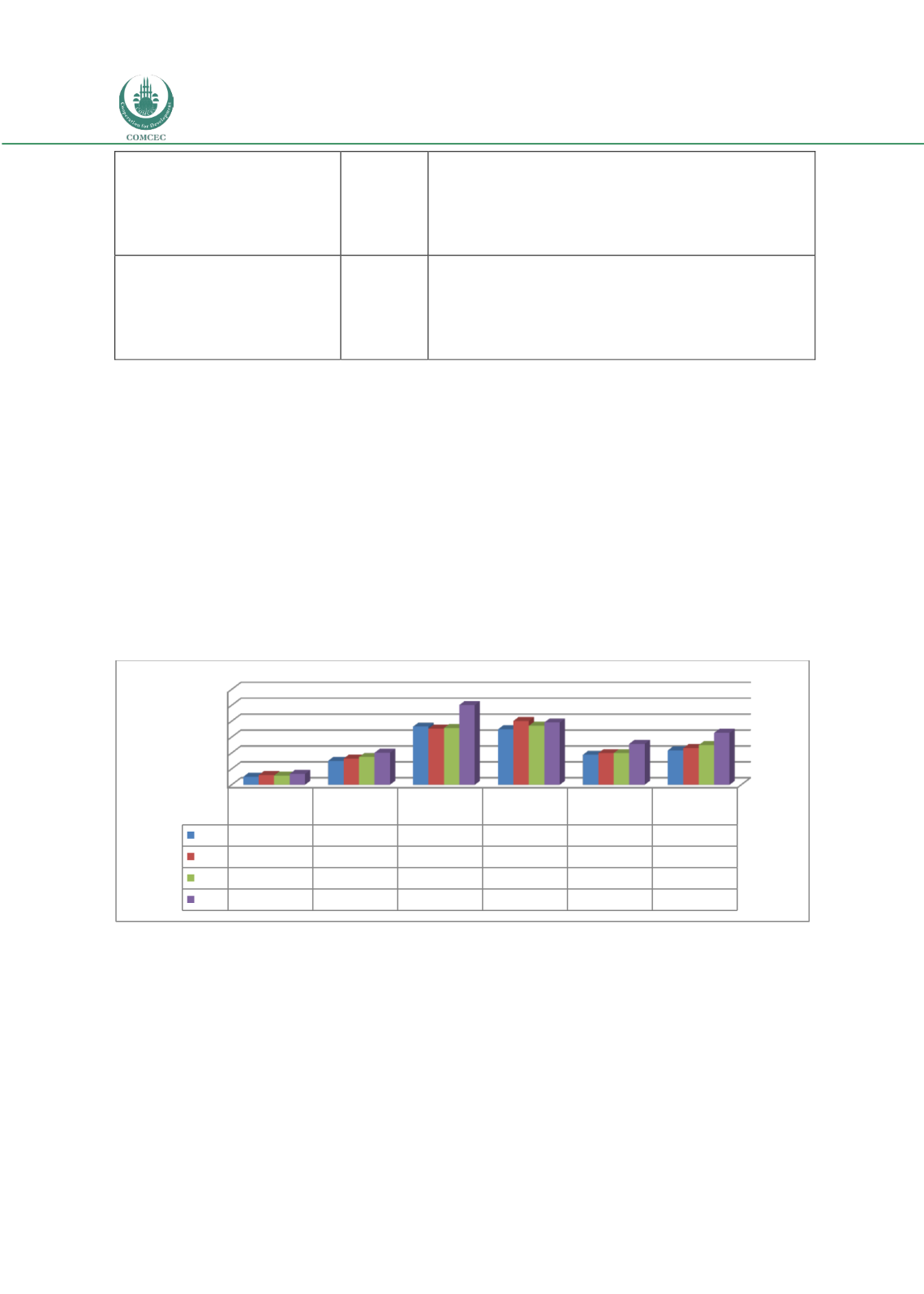

Figure 9: Bank Accounts per 1,000 Adults

Source: COMCEC Coordination Office staff estimations by using Global Financial Development Database, World

Bank (2016b).

Bank accounts per 1,000 adults show how actively individuals use bank services. This measure

identifies access in two respects. One is that individuals are able and willing to use bank

services. The other is that banks are successful to offer bank services to individuals with

affordable prices. Figure 9 shows how this measure evolves over time and among country

groups. From 2011 to 2014, number of bank accounts per 1,000 adults has increased in all OIC

member country groups similar to the world trends. As expected, higher income levels lead

0

200

400

600

800

1000

1200

OIC-LIG

Average

OIC-LMIG

Average

OIC-UMIG

Average

OIC-HIGH

Average

OIC Average

World

2011 100,23

301,56

731,75

697,82

377,58

433,08

2012 122,18

329,27

707,07

803,73

398,80

460,99

2013 117,08

348,51

713,76

742,16

398,98

499,09

2014 136,37

402,58

1003,90

783,74

515,57

653,53