Financial Outlook of the OIC Member Countries 2016

12

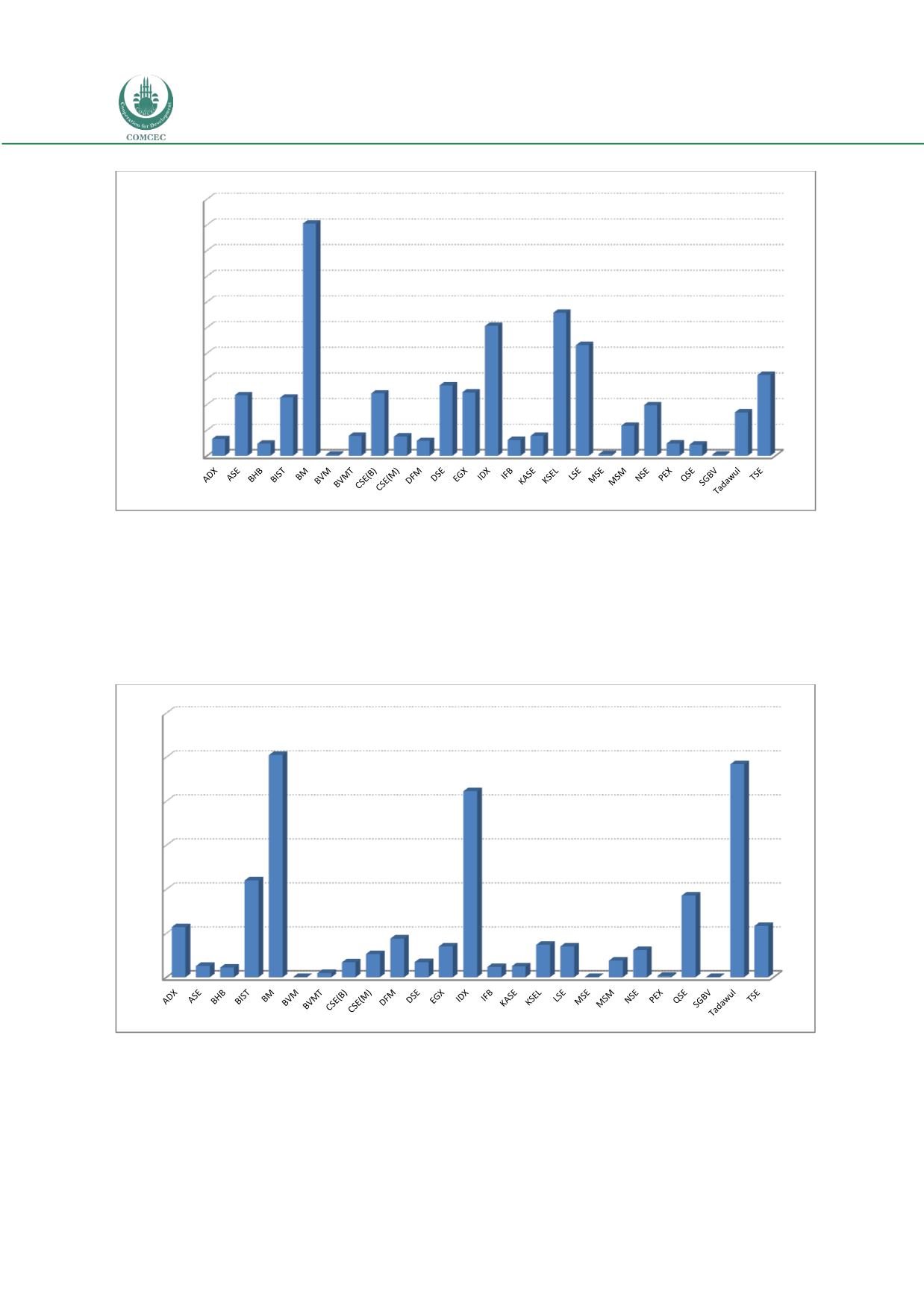

Figure 6: Number of Listed Companies as of 2014

Source: OIC Exchanges (2015)

OIC Exchanges’ market capitalization is 2.7 trillion USD as of 2014. The share of the market

capitalization of the OIC Exchanges to the WFE Exchanges is 4 per cent in 2014 (OIC

Exchanges, 2015). The ratios for the top three (BM, IDX and Tadawul) and top 10 exchanges

(top three plus ADX, BIST, DFM, EGX, KSEL, QSE, and TSE) among OIC Exchanges were 53 per

cent and 85 per cent respectively (Figure 7).

Figure 7: Market Capitalization as of 2014 (billions USD)

Source: OIC Exchanges (2015)

The average ratio of the market capitalizations of the OIC Exchanges to the GDP values of their

respective countries is 37 per cent as of 2014 (Figure 8). The median ratio is 27 per cent (for

BIST). Malaysia has the highest ratio with 154 per cent, followed by Qatar (88 per cent) and

Jordan (71 per cent).

0

100

200

300

400

500

600

700

800

900

1.000

65

236

47

227

905

4

77

243

75 58

274

247

506

62 77

557

431

6

117

197

48 43

4

169

315

Eksen Başlığı

0

100

200

300

400

500

600

114

26 22

220

504

0,5 9,3

33

53

88

34

70

422

24 25

74 70

0,4

38

62

3,2

185

0,2

483

117