Financial Outlook of the OIC Member Countries 2016

14

3

CHARACTERIZATION AND FUNCTIONING OF FINANCIAL SYSTEMS

Previous two chapters cover banking and capital markets individually among OIC member

countries with available data. The effort shows that the data is difficult to obtain and inference

on them should be cautious. It also shows that the size of bank and capital markets is greatly in

parallel to the size of the economy and economic development.

This chapter makes use of World Bank Global Financial Development Database. Cihak,

Demirgüç-Kunt, Feyen and Levine (2012) introduce this database and explain that the

database measures and benchmarks financial systems, allows cross-country and regional

comparison, and time series trends.

The database has varying coverage of data among countries. With this limitation and the fact

that economic development could be used to aggregate and represent income-level group

countries, this Financial Outlook categorizes OIC Member States in four major groups

according to the World Bank Income Grouping Methodology (according to their GDP per capita

levels), which is globally used in current financial and economic researches. According to this

categorization, 15 countries are in OIC-Low Income Group (OIC-LIG); 19 are in OIC Lower

Middle Income Group (OIC-LMIG); 16 are in OIC-Upper Middle Income Group (OIC-UMIG), and

7 are in OIC-High Income Group (OIC-HIGH) as shown in Table 4.

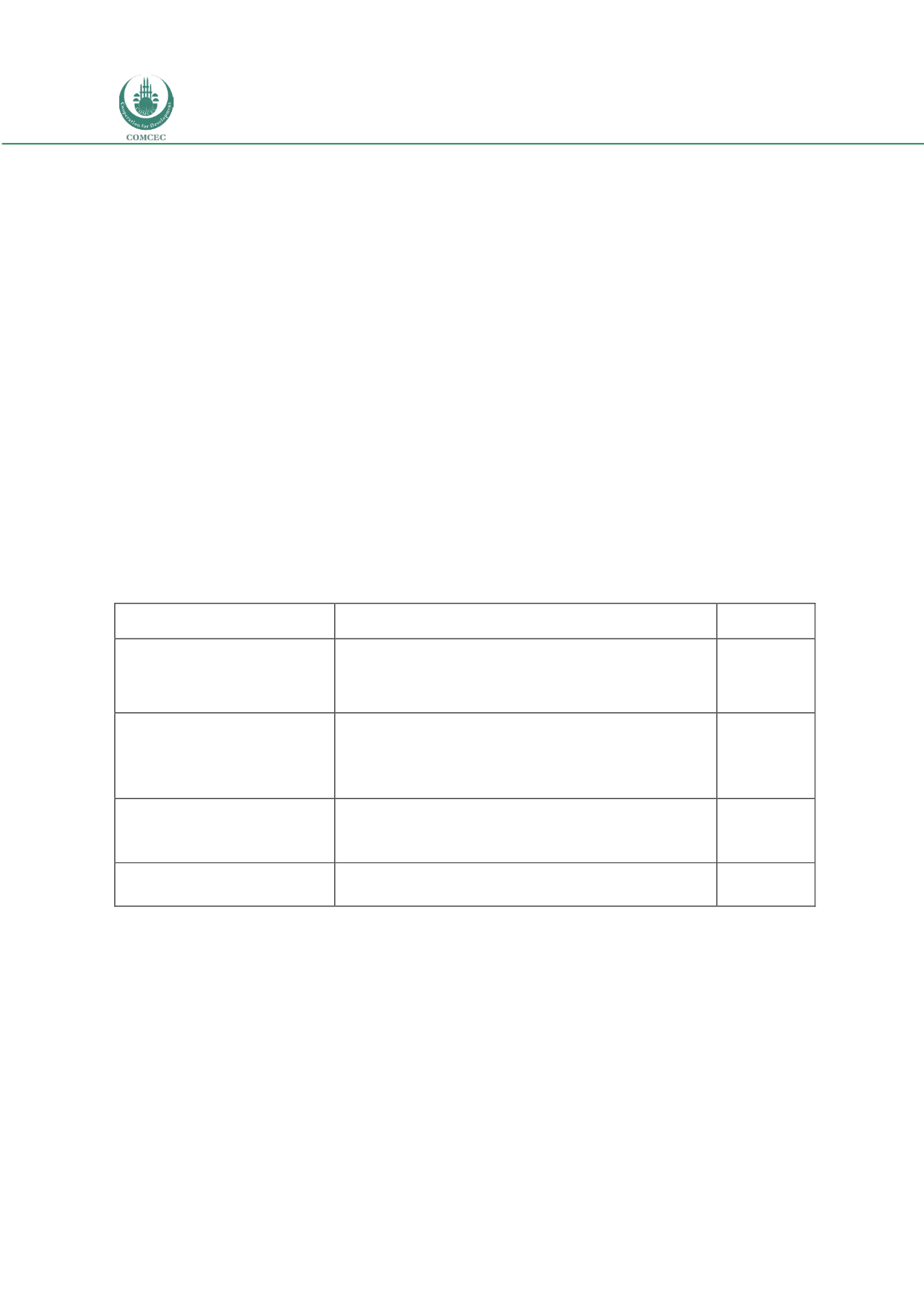

Table 4: Categorization of OIC Member States as of Calendar Year 2014

Categories

Countries

Number of

Countries

OIC-Low income group

1,045 USD or less

Afghanistan, Benin, Burkina Faso, Chad, Comoros, Guinea,

Guinea-Bissau, Mali, Mozambique, Niger, Sierra Leone,

Somalia, Gambia The, Togo, Uganda

15

OIC-Lower middle income group

1,046 USD to 4,125 USD

Bangladesh, Cameroon, Cote d'Ivoire, Djibouti, Egypt, Arab

Rep., Guyana, Indonesia, Kyrgyz Republic, Mauritania,

Morocco, Nigeria, Pakistan, Palestine, Senegal, Sudan,

Syrian Arab Republic, Tajikistan, Uzbekistan, Yemen

19

OIC-Upper middle income

4,126 USD to 12,735 USD

Albania, Algeria, Azerbaijan, Gabon, Iran, Iraq, Jordan,

Kazakhstan, Lebanon, Libya, Malaysia, Maldives, Suriname,

Tunisia, Turkey, Turkmenistan

16

OIC-High income group 12,736

USD or more

Bahrain, Brunei Darussalam, Kuwait, Oman, Qatar, Saudi

Arabia, United Arab Emirates

7

Note: World Bank (2016a) names West Bank and Gaza rather than Palestine.

Source: World Bank (2016a)

Cihak et al. (2012:3) collect measures of financial systems in four broad characteristics: “(a)

the size of financial institutions and markets (financial depth), (b) the degree to which

individuals can and do use financial institutions and markets (access), (c) the efficiency of

financial institutions and markets in providing financial services (efficiency), and (d) the

stability of financial institutions and markets (stability).”

Table 5 shows the selected financial measures within these four characteristics to study how

well financial institutions and markets of OIC Member States perform. Among four

characteristics there are many measures given in World Bank (2016b). Selected measures in