Financial Outlook of the OIC Member Countries 2016

11

2

CAPITAL MARKETS

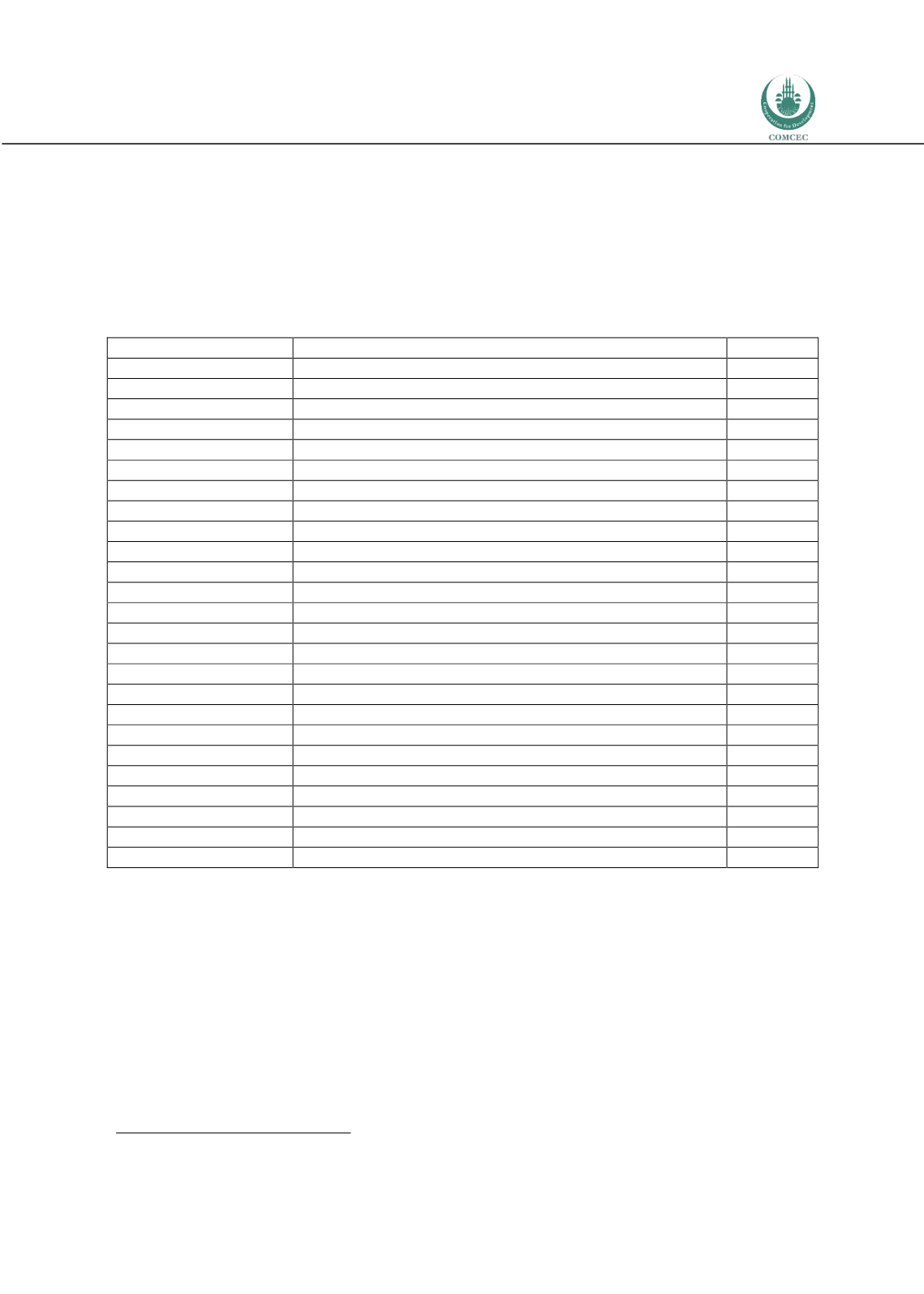

This section is drawn from OIC Member States’ Stock Exchanges Forum Integrated Statistics

Report 2014 (OIC Exchanges, 2015). The forum publishes a statistics report by applying a

survey and using data from World Bank, World Federation of Exchanges and Federation of

European and Asian Stock Exchanges. The report covers 25 stock exchanges from 21 OIC

member countries listed in Table 3.

Table 3: Stock Exchanges

Country

Stock Exchange

Acronym

United Arab Emirates

Abu Dhabi Securities Exchange

ADX

Jordan

Amman Stock Exchange

ASE

Bahrain

Bahrain Stock Exchange

BHB

Turkey

Borsa İstanbul

BIST

Malaysia

Bursa Malaysia Berhad

BM

2

Mozambique

Bolsa de Valores de Moçambique

BVM

Tunisia

Bourse des Valeurs Mobilières de Tunis

BVMT

Bangladesh

Chittagong Stock Exchange

CSE(B)

Morocco

Casablanca Stock Exchange

CSE(M)

United Arab Emirates

Dubai Financial Market

DFM

Bangladesh

Dhaka Stock Exchange Limited

DSE

Egypt

The Egyptian Exchange

EGX

Indonesia

Indonesia Stock Exchange

IDX

Iran

Iran Fara Bourse Company

IFB

Kazakhstan

Kazakhstan Stock Exchange

KASE

Pakistan

Karachi Stock Exchange Limited

KSEL

Pakistan

Lahore Stock Exchange

LSE

Maldives

Maldives Stock Exchange Pvt Ltd

MSE

Nigeria

Nigerian Stock Exchange

NSE

Oman

Muscat Securities Market

MSM

Palestine

Palestine Securities Exchange

PEX

Qatar

Qatar Stock Exchange

QSE

Algeria

Société de Gestion de la Bourse des Valeurs Mobilières Spa

SGBV

Saudi Arabia

Saudi Stock Exchange

Tadawul

Iran

Tehran Stock Exchange

TSE

The number of listed domestic companies is 4,949, and the number of foreign companies is 41

as of 2014. The shares of Bursa Malaysia (18 per cent), Karachi Stock Exchange (11 per cent),

Indonesia Stock Exchange (10 per cent), and Lahore Stock Exchange (9 per cent) make up 48

per cent of the number of companies (OIC Exchanges, 2015). Figure 6 shows the number of

companies listed in the covered stock exchanges.

2

Unofficial acronym representing Bursa Malaysia