Financial Outlook of the OIC Member Countries 2016

22

Financial Stability

3.4

Financial stability is complementary to the previous characteristics of access, depth and

efficiency in the sense that it shows how durable or reliable are those characteristics in the

presence of a shock. Hence, financial stability shows the strength of financial systems to

economic or financial shock, such as recession and depreciation in exchange rates. Selected

two measures regarding bank capital shows how much buffer banks have to match a shock and

the selected third measure shows how much banks have already exposed to cost.

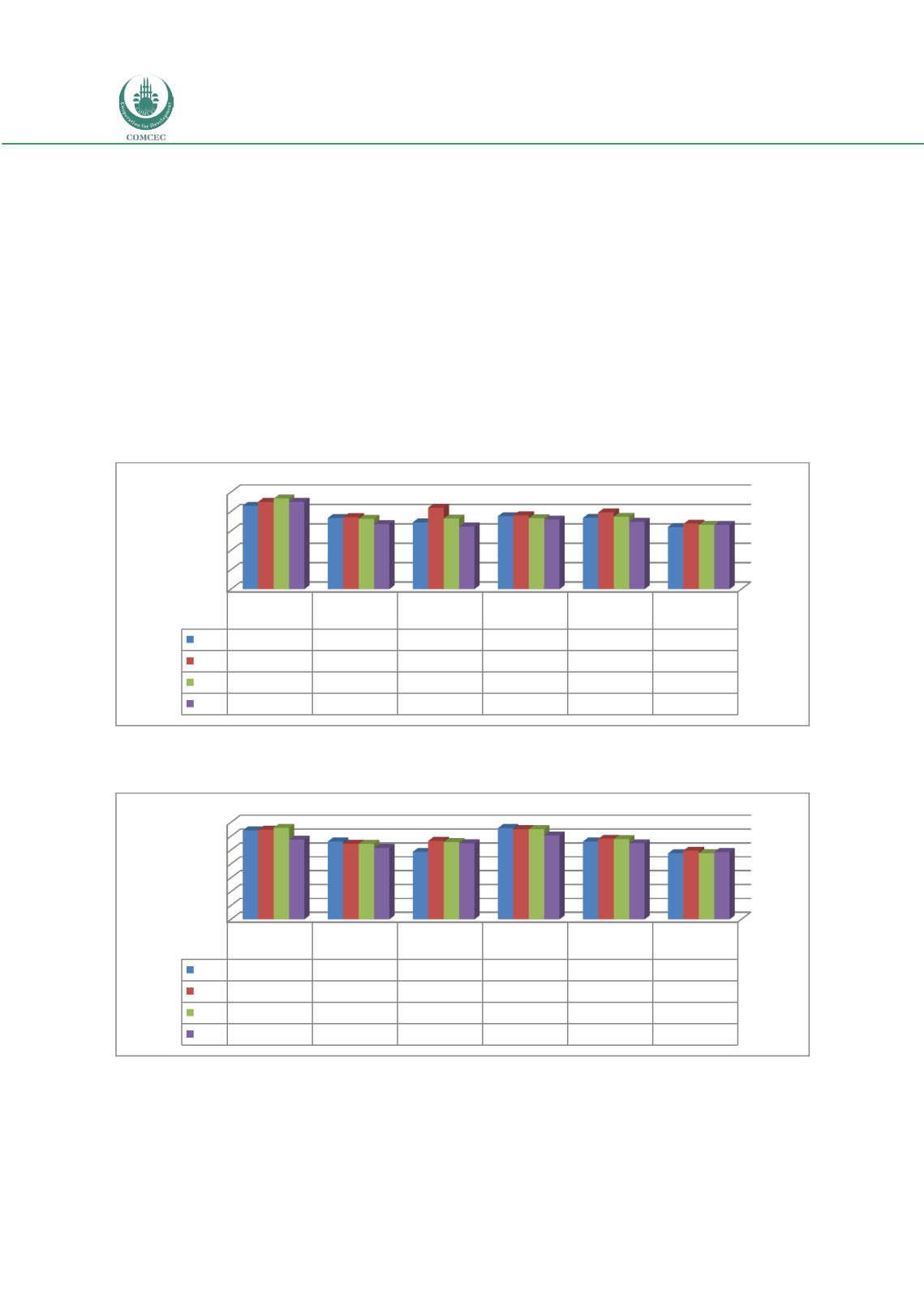

Bank regulatory capital to risk-weighted assets (%) shows the percentage of capital to the

level of assets adjusted to their risks. Hence, some risky assets are regarded more than their

accounting levels. The world average is about 16.5 per cent in 2011-2014. In the same period,

all OIC country groups (except OIC-UMIG in 2014) have higher ratios than the world averages

(Figure 19).

Figure 19: Bank Regulatory Capital to Risk-Weighted Assets (%)

Source: COMCEC Coordination Office staff estimations by using Global Financial Development Database, World

Bank (2016b).

Figure 20: Bank Capital to Total Assets (%)

Source: COMCEC Coordination Office staff estimations by using Global Financial Development Database, World

Bank (2016b).

Bank capital to total assets (%) shows how much capital is used to finance bank activities

including credits, bank’s own buildings etc. Capital includes all capital paid by equity owners,

0

5

10

15

20

25

OIC-LIG

Average

OIC-LMIG

Average

OIC-UMIG

Average

OIC-HIGH

Average

OIC Average

World

2011 21,47

18,30

17,20

18,76

18,32

16,00

2012 22,50

18,52

20,98

18,97

19,76

16,80

2013 23,30

18,11

18,15

18,27

18,60

16,50

2014 22,50

16,76

16,07

17,86

17,34

16,50

0

2

4

6

8

10

12

14

OIC-LIG

Average

OIC-LMIG

Average

OIC-UMIG

Average

OIC-HIGH

Average

OIC Average

World

2011 12,80

11,22

9,73

13,15

11,22

9,50

2012 12,90

10,90

11,32

13,00

11,60

9,90

2013 13,20

10,85

11,15

12,98

11,57

9,55

2014 11,47

10,27

10,94

12,10

10,93

9,70