Financial Outlook of the OIC Member Countries 2016

15

this report are based on availability of data for OIC member countries. Furthermore, these

measures are among the basic ones mentioned in Cihak et al. (2012). Table 5 also gives Global

Financial Development Database (GFDD) codes to allow researchers to make their own

compilation of data and their own analysis.

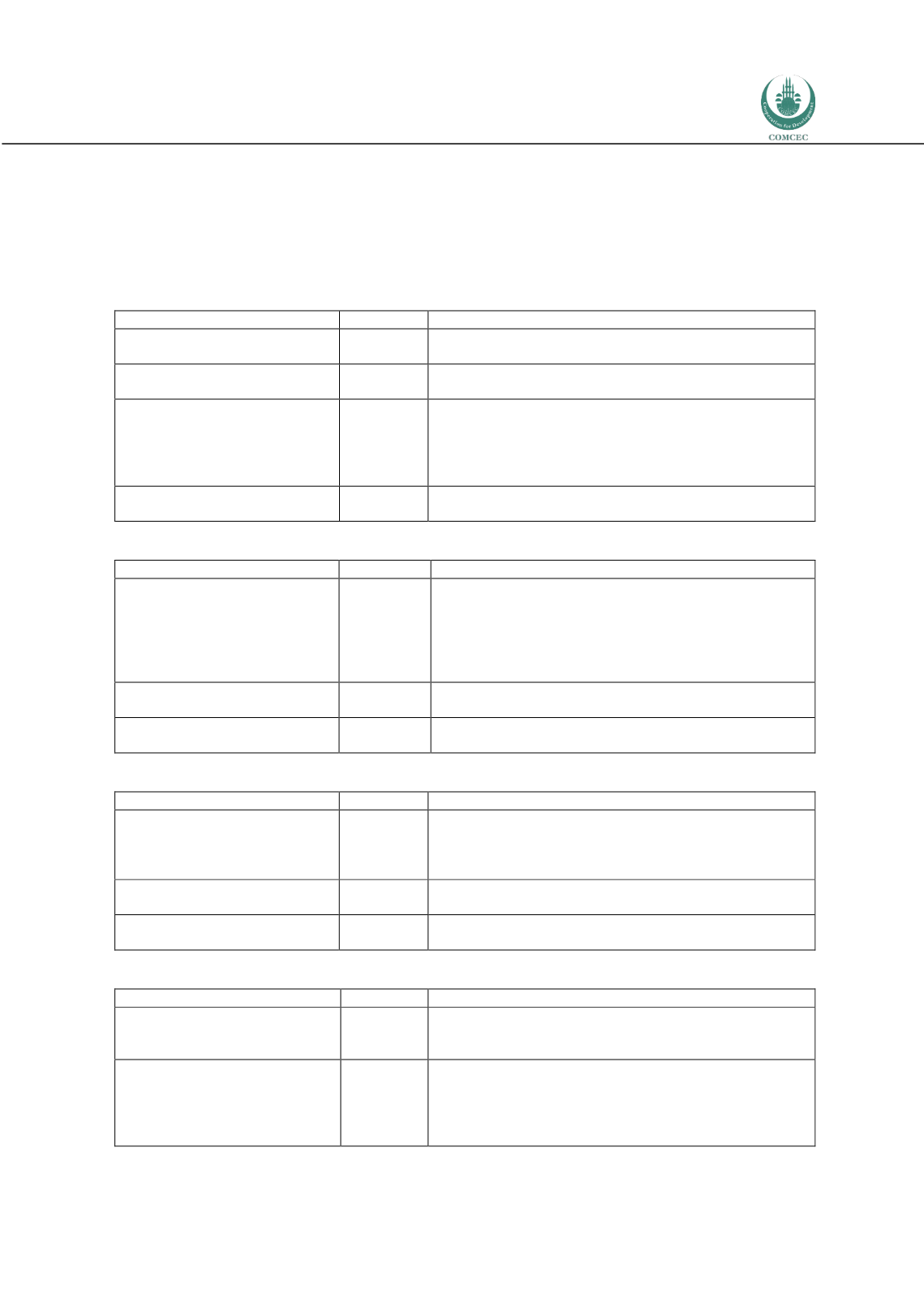

Table 5: Selected Measures on OIC Member States

Panel A. Financial Access

Measure

GFDD Code Definition

Bank Accounts per 1.000 Adults

GFDD.AI.01 Number of depositors with commercial banks per 1,000

adults.

Bank Branches per 100,000

Adults

GFDD.AI.02 Number of commercial bank branches per 100,000 adults.

Account at a formal financial

institution (% age 15+)

GFDD.AI.05 The percentage of respondents with an account (self or

together with someone else) at a bank, credit union,

another financial institution (e.g., cooperative, microfinance

institution), or the post office (if applicable) including

respondents who reported having a debit card (% age 15+).

Saved any money in the past year

(% age 15+)

GFDD.AI.12 The percentage of respondents who report saving or setting

aside any money in the past 12 months (% age 15+).

Panel B. Financial Depth

Measure

GFDD Code Definition

Domestic credit to private sector

(% of GDP)

GFDD.DI.14 Domestic credit to private sector refers to financial

resources provided to the private sector, such as through

loans, purchases of nonequity securities, and trade credits

and other accounts receivable, that establish a claim for

repayment. For some countries these claims include credit

to public enterprises.

Stock market capitalization to

GDP (%)

GFDD.DM.01 Total value of all listed shares in a stock market as a

percentage of GDP.

Stock market total value traded to

GDP (%)

GFDD.DM.02 Total value of all traded shares in a stock market exchange

as a percentage of GDP.

Panel C. Financial Efficiency

Measure

GFDD Code Definition

Bank Lending-Deposit Spread

(%)

GFDD.EI.02 Difference between lending rate and deposit rate. Lending

rate is the rate charged by banks on loans to the private

sector and deposit interest rate is the rate offered by

commercial banks on three-month deposits.

Bank Return on Asset (ROA) (%,

after tax)

GFDD.EI.05 Commercial banks’ after-tax net income to yearly averaged

total assets.

Bank Return on Equity (ROE) (%,

after tax)

GFDD.EI.06 Commercial banks’ after-tax net income to yearly averaged

equity.

Panel D. Financial Stability

Measure

GFDD Code Definition

Bank regulatory capital to risk-

weighted assets (%)

GFDD.SI.05 The capital adequacy of deposit takers. It is a ratio of total

regulatory capital to its assets held, weighted according to

risk of those assets.

Bank capital to total assets (%)

GFDD.SI.03 Ratio of bank capital and reserves to total assets. Capital

and reserves include funds contributed by owners, retained

earnings, general and special reserves, provisions, and

valuation adjustments. Capital includes tier 1 capital (paid-

up shares and common stock), which is a common feature