Financial Outlook of the OIC Member Countries 2016

18

includes any financial institution rather than just a bank as it is the case for the measure, bank

accounts per 1,000 adults. The measure takes the population of age 15 and more of which

some considered adolescent rather than adults. Hence, the measure account at formal

institution (% age 15+) also increases the base of population. There are only 2 years of

available data, 2011 and 2014 for this measure. The world average increased in 2014 to 50.5

per cent which is well above the average for all OIC member countries, 30.1 per cent. Between

2011 and 2014, this measure increased for all OIC country groups except OIC-LIG (Figure 11).

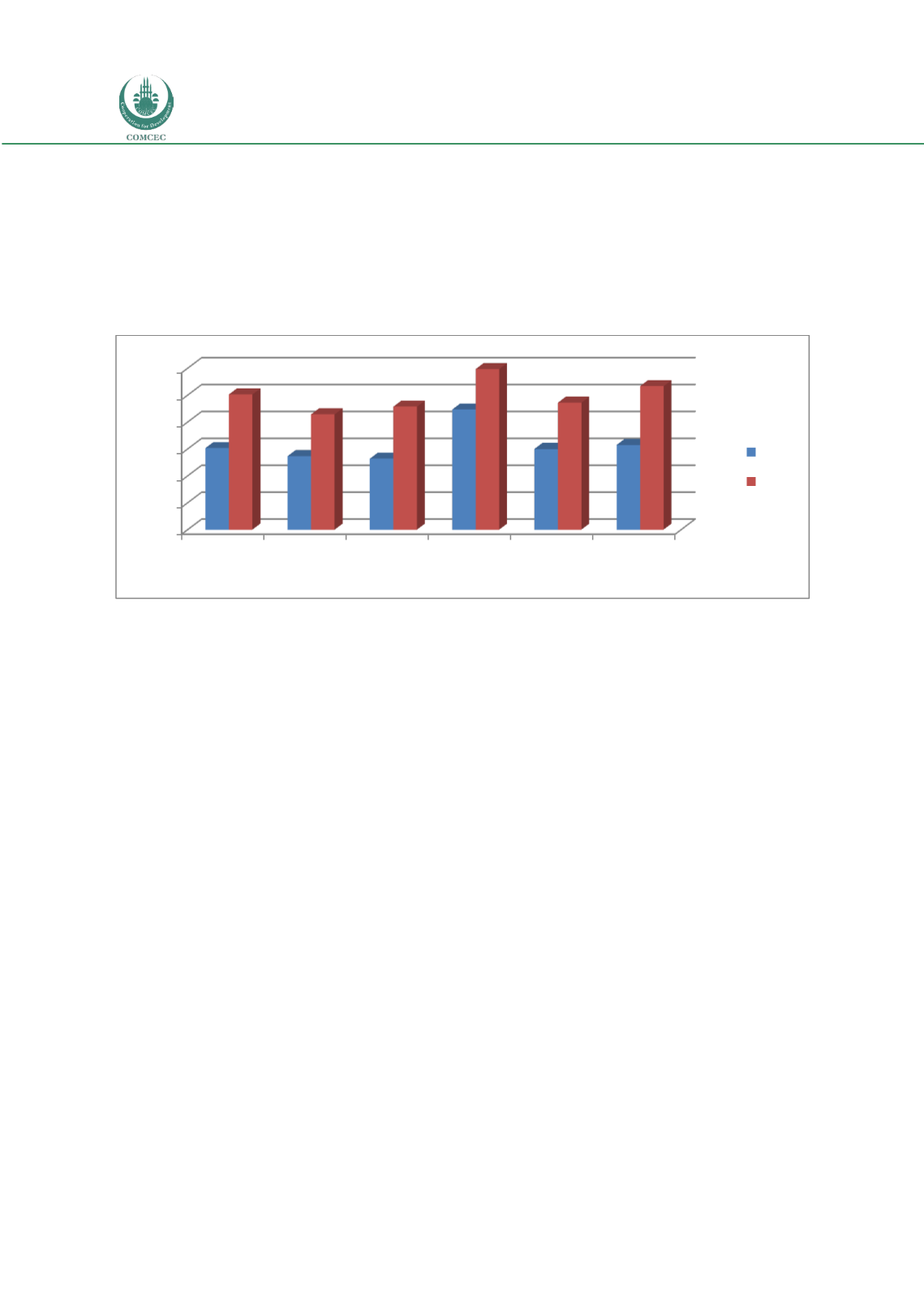

Figure 12: Saved any money in the past year (% age 15+)

Source: COMCEC Coordination Office staff estimations by using Global Financial Development Database, World

Bank (2016b).

Saved any money in the past year (% age 15+) shows the percentage of people who saved

money regardless of whether they deposited in a financial institution or not. Hence, this

measure is about demand or funding side of financial services. If there is a saving, then these

excess funds could be channeled into the economy to fund a project or a need of an individual.

The data for this measure is available for 2011 and 2014 only. Percentage of population who

saved the previous year increased more than 15 percentage points for all OIC country groups.

However, only OIC-HIGH has reached a level, 59.7 per cent, above the world average of 53.3

per cent in 2014. Interestingly, percentage of people saved is higher in OIC-LIG than in OIC-

LMIG and OIC-UMIG in 2014 (Figure 12).

Financial Depth

3.2

Financial depth, also termed as size of the financial services, shows in what extent financial

services are in place within the economy. Hence, measures regarding this characteristic are

given compared to the size of the economy, usually Gross Domestic Product (GDP). There are

three measures selected to cover financial depth.

Domestic credit to private sector (% of GDP) shows financial resources provided to private

sector by local financial institutions, relative to the local size of the economy. From 2011 to

2014, there is generally an increasing trend in this measure among OIC country groups. Levels

of this measure in 2011-2014 are higher in all years for OIC-UMIG and OIC-HIGH and lower in

all years for OIC-LIG and OIC-LMIG compared to the world averages (Figure 13).

0

10

20

30

40

50

60

OIC-LIG

Average

OIC-LMIG

Average

OIC-UMIG

Average

OIC-HIGH

Average

OIC

Average

World

30,3

27,3

26,4

44,6

30,0

31,5

50,2

42,9

45,7

59,7

47,2

53,3

2011

2014