Financial Outlook of the OIC Member Countries 2016

20

Figure 15: Stock market total value traded to GDP (%)

Source: COMCEC Coordination Office staff estimations by using Global Financial Development Database, World

Bank (2016b).

Financial Efficiency

3.3

Financial efficiency is about how efficient the financial intermediaries operate. Therefore, the

basic measures of this characteristic are related to the cost of financial services. Closely related

to the cost measures are profitability measures since the lower costs usually accompany with

higher profitability. However, note that profitability may be high for inefficient financial

systems during financial turmoil. Therefore, selected one cost and two profitability measures

should be used in combination rather than in isolation.

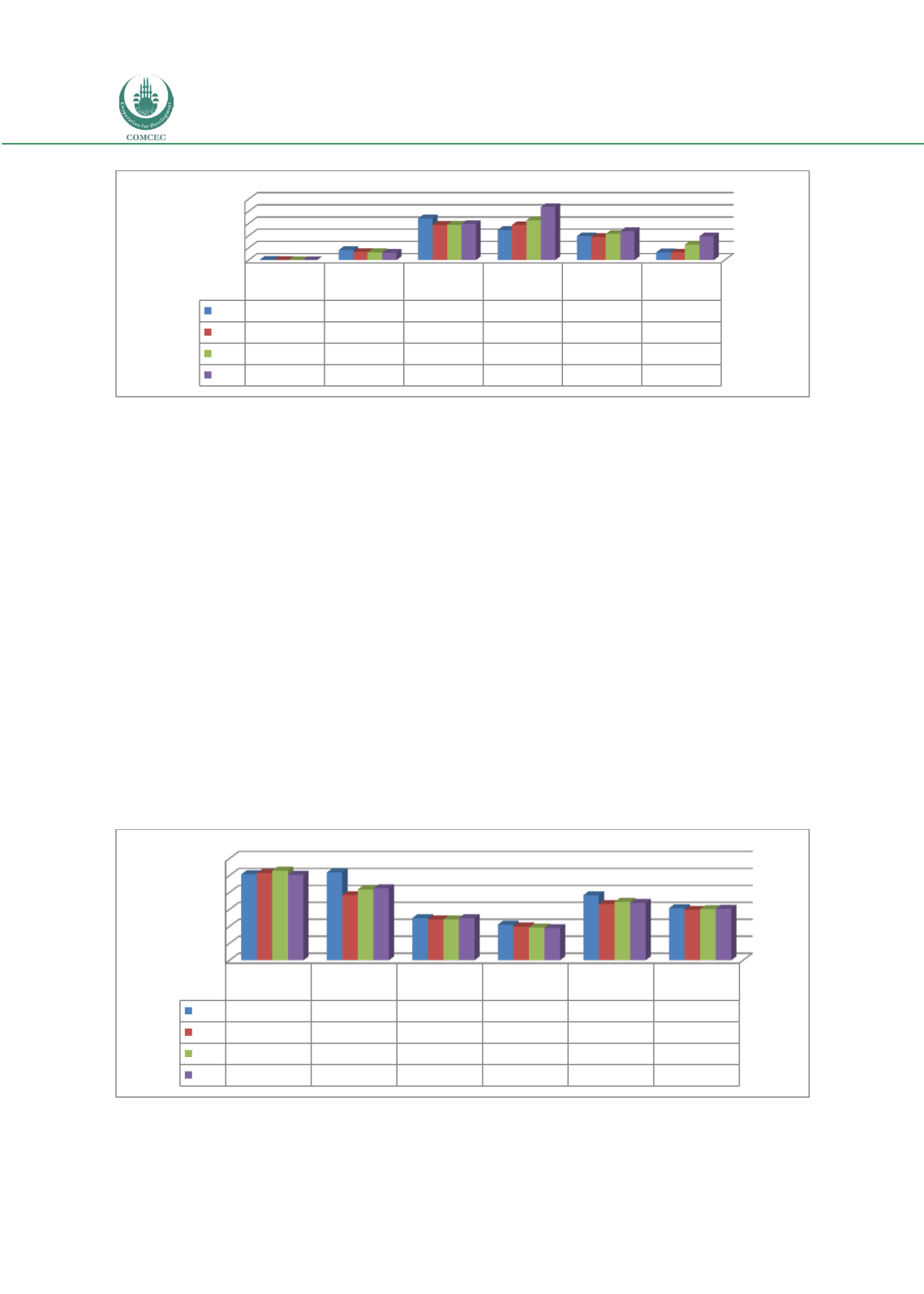

Bank Lending-Deposit Spread (%) shows the spread between obtaining and crediting the fund.

This spread is the rate that a bank covers its operating and overhead costs and makes profits.

The less the spread associates with the high the efficiency of the banking system since banks

are very efficient to cover their costs with little amount of money obtained from firms and

individuals for using bank credits. Bank costs associated with credit activity also include non-

paid credits. Hence, for high risk economies, the spread tends to be high. This is also evident in

Figure 16. Bank lending minus deposit rate is about 6 per cent in the world for 2011 to 2014,

whereas the rate is 10 per cent for OIC-LIG and 8 per cent for OIC-LMIG.

Figure 16: Bank Lending-Deposit Spread (%)

Source: COMCEC Coordination Office staff estimations by using Global Financial Development Database, World

Bank (2016b).

0

5

10

15

20

25

OIC-LIG

Average

OIC-LMIG

Average

OIC-UMIG

Average

OIC-HIGH

Average

OIC Average World

2011 0,06

4,13

17,09

12,35

9,80

3,19

2012 0,06

3,33

14,47

14,39

9,46

3,07

2013 0,00

3,22

14,47

16,36

10,72

6,37

2014 0,00

3,01

14,83

21,79

11,84

9,74

0

2

4

6

8

10

12

OIC-LIG

Average

OIC-LMIG

Average

OIC-UMIG

Average

OIC-HIGH

Average

OIC Average

World

2011 10,12

10,34

4,98

4,21

7,67

6,14

2012 10,26

7,68

4,81

3,98

6,64

5,95

2013 10,58

8,37

4,81

3,87

6,87

6,02

2014 10,10

8,46

4,97

3,80

6,74

6,06