Financial Outlook of the OIC Member Countries 2016

21

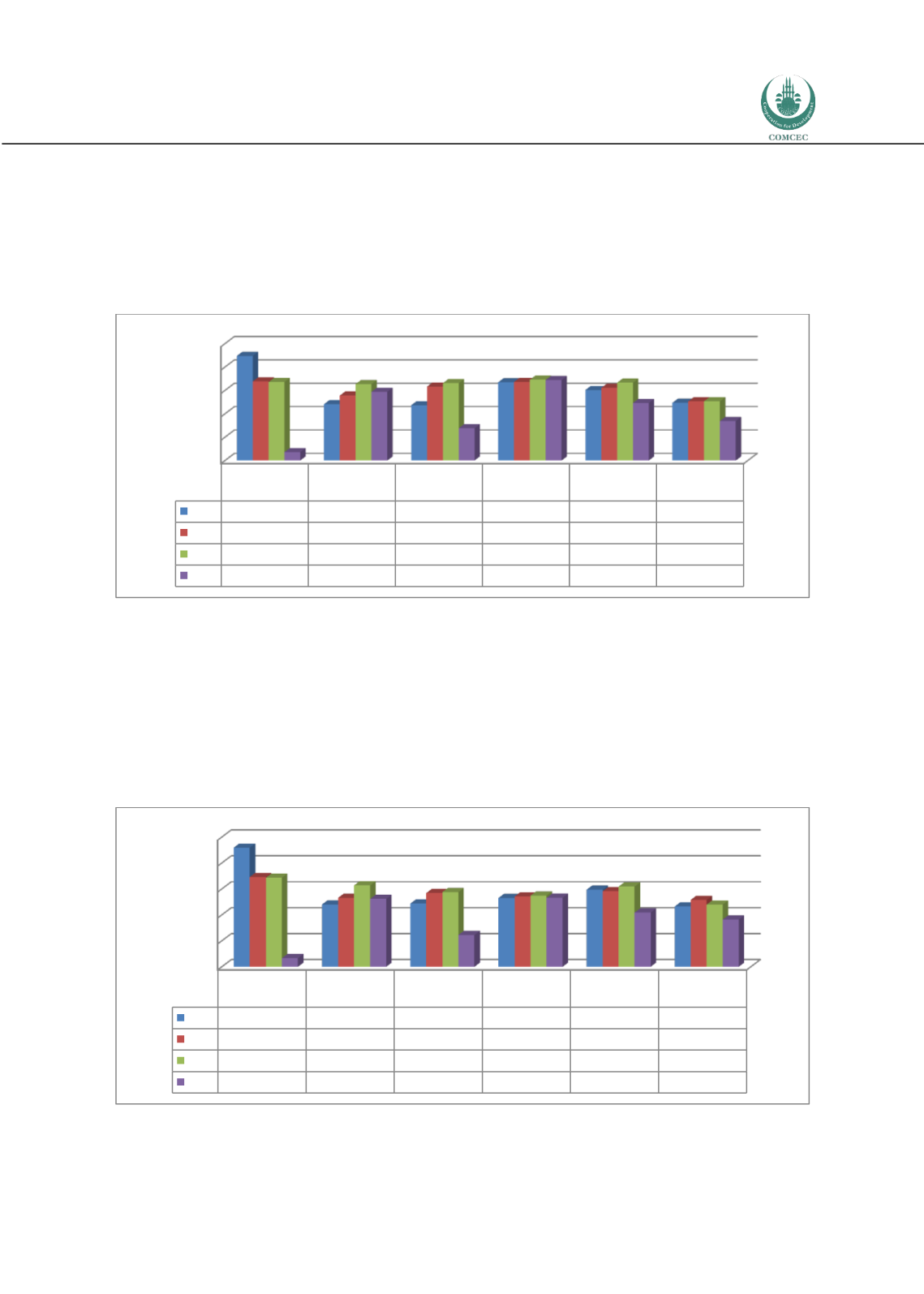

Bank Return on Asset (ROA) (%, after tax) shows the profitability of banks over their average

assets during that year. Hence, over all bank activities that appear in the balance sheet, this

measure shows how high the revenue, stemming from any bank activity regardless of

appearance in the balance sheet, is generated in per cent of assets. ROA drops in 2014 for all

OIC country groups. This profitability ratio has kept its level for OIC-HIGH in 2011-2014

whereas it fluctuated significantly for other OIC country groups (Figure 17).

Figure 17: Bank Return on Asset (ROA) (%, after tax)

Source: COMCEC Coordination Office staff estimations by using Global Financial Development Database, World

Bank (2016b).

Bank Return on Equity (ROE) (%, after tax) shows the bank profitability in terms of the money

invested in this bank. Hence, this measure shows the profitability of bank investors. The world

average in 2011-2014 stayed at around 12 per cent in general and dropped to 9.1 per cent in

2014. This measure for OIC-LIG dropped from 23 per cent in 2011 to 1.7 per cent in 2014. The

averages in 2011-2014 for OIC-LMIG, OIC-UMIG and OIC-HIGH are 13.5, 11.7 and 13.5 per cent

respectively (Figure 18).

Figure 18: Bank Return on Equity (ROE) (%, after tax)

Source: COMCEC Coordination Office staff estimations by using Global Financial Development Database, World

Bank (2016b).

0,00

0,50

1,00

1,50

2,00

2,50

OIC-LIG

Average

OIC-LMIG

Average

OIC-UMIG

Average

OIC-HIGH

Average

OIC Average

World

2011

2,24

1,21

1,18

1,67

1,51

1,24

2012

1,69

1,39

1,58

1,68

1,55

1,27

2013

1,68

1,64

1,65

1,73

1,66

1,27

2014

0,18

1,47

0,69

1,72

1,23

0,85

0

5

10

15

20

25

OIC-LIG

Average

OIC-LMIG

Average

OIC-UMIG

Average

OIC-HIGH

Average

OIC Average

World

2011

22,97

12,02

12,18

13,28

14,86

11,62

2012

17,32

13,28

14,22

13,55

14,55

12,89

2013

17,17

15,70

14,40

13,73

15,47

12,00

2014

1,66

13,09

6,15

13,30

10,46

9,11