Improving Public Debt Management

In the OIC Member Countries

58

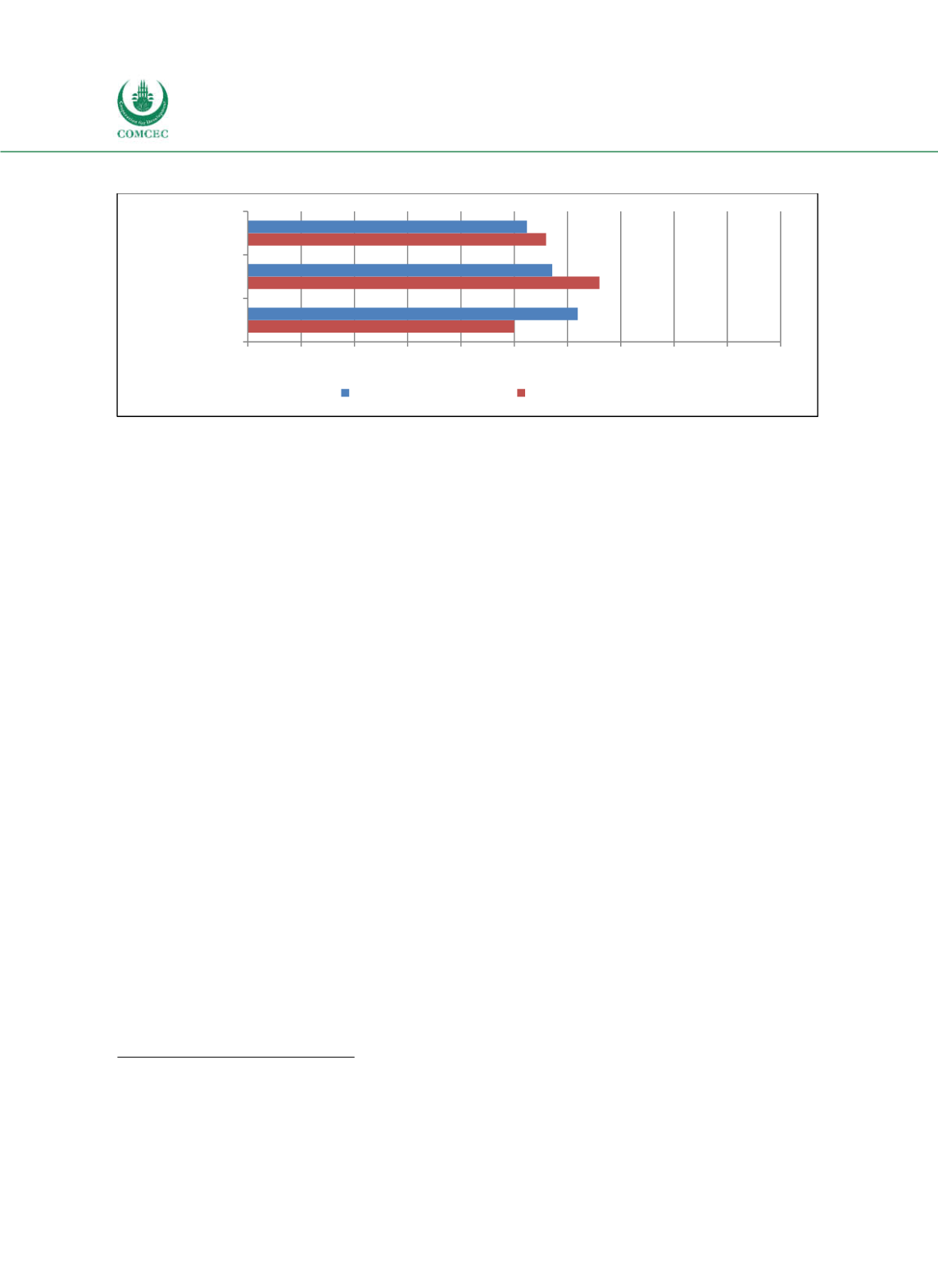

Figure 3-14: Use of Strategic Targets by Type of Risk

Note: 21 observations. Sources: Ifo Public Debt Management Survey (2016), public debt management strategies,

Cabral (2015).

3.3

Islamic Finance in Public Debt Management

3.3.1

Islamic Finance

Islamic finance has become an important part of the financial system in several OIC countries.

Broadly speaking, Islamic finance is based on sharia rules (see also Table G02 in the

Glossary). An important difference between Islamic finance and conventional finance is the

avoidance of interest based finance instruments. The Islamic finance system relies on

partnership and risk sharing, which means that the purchaser of an Islamic bond participates

in the profits or losses of the underlying asset (principle of profitandlosssharing). Profits

and losses are connected to real economic activities and economic risks (Lewis and Alagoud

2001). As returns on investment should be derived from proprietary risk taking, not from

purely financial risks, Islamic finance promotes real economic activity (Song and Oosthuizen

2014).

11

Between 2000 and 2015, the amount of global assets of Islamic finance increased by more than

the twentyfold (see Figure 315). The global financial crisis starting in 2007 only slightly

moderated the growth of Islamic finance assets. The majority of Islamic finance institutions

remained relatively immune to the negative effects of the financial crisis (Baele et al. 2014, OIC

2012, Song and Oosthuizen 2014). Islamic banks did not own significant amounts of subprime

and other toxic assets (COMCEC 2016a, World Bank 2012).

In 2015, global assets of Islamic finance are estimated to total $1.88 trillion (compared to

about $1.81 trillion in 2014). The breakdown of Islamic finance assets in 2015 is as follows:

$1,497 billion for banking assets, $291 billion for outstanding

sukuk

(meant as a broad

category for Islamic finance bonds), $71 billion for Islamic fund’s assets and $23 billion for

takaful

(meant as a broad category for Islamic finance insurance). The relatively moderate

increase of Islamic finance assets in 2015 was caused by exchange rate depreciations in large

Islamic finance markets, the withdrawal of a major issuer of

sukuk

bonds, namely the Central

11

Besides the prohibition of any kind of interest, Islamic finance is bound to

shariah

approved activities. Investment in

certain areas, for example drugs or gambling, is forbidden. Social justice and the sanctity of contracts are important

principles, too (Song and Oosthuizen 2014). Ambiguous contracts, for example, are not allowed under Islamic principles

in order to prevent excessive uncertainty in contracts, to increase transparency and to prevent defraud (Mohieldin

2012).

0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100%

Currency risk

Refinancing risk

Interest rate risk

OIC Member Countries

Worldwide