Improving Public Debt Management

In the OIC Member Countries

57

Governance and Strategy Development

Legal framework and managerial structure

In most OIC member countries, a specialized department at the Ministry of Finance is

responsible for public debt management. Alternatively or additionally, in a number of

countries a department at the central bank carries out debt management operations. However,

only a few countries have established fully independent debt management offices. In contrast,

in several countries not one single entity is responsible for public debt management, but

several departments in different institutions and committees, mostly located at the Ministry of

Finance and the central bank, share relevant tasks.

Debt management strategy

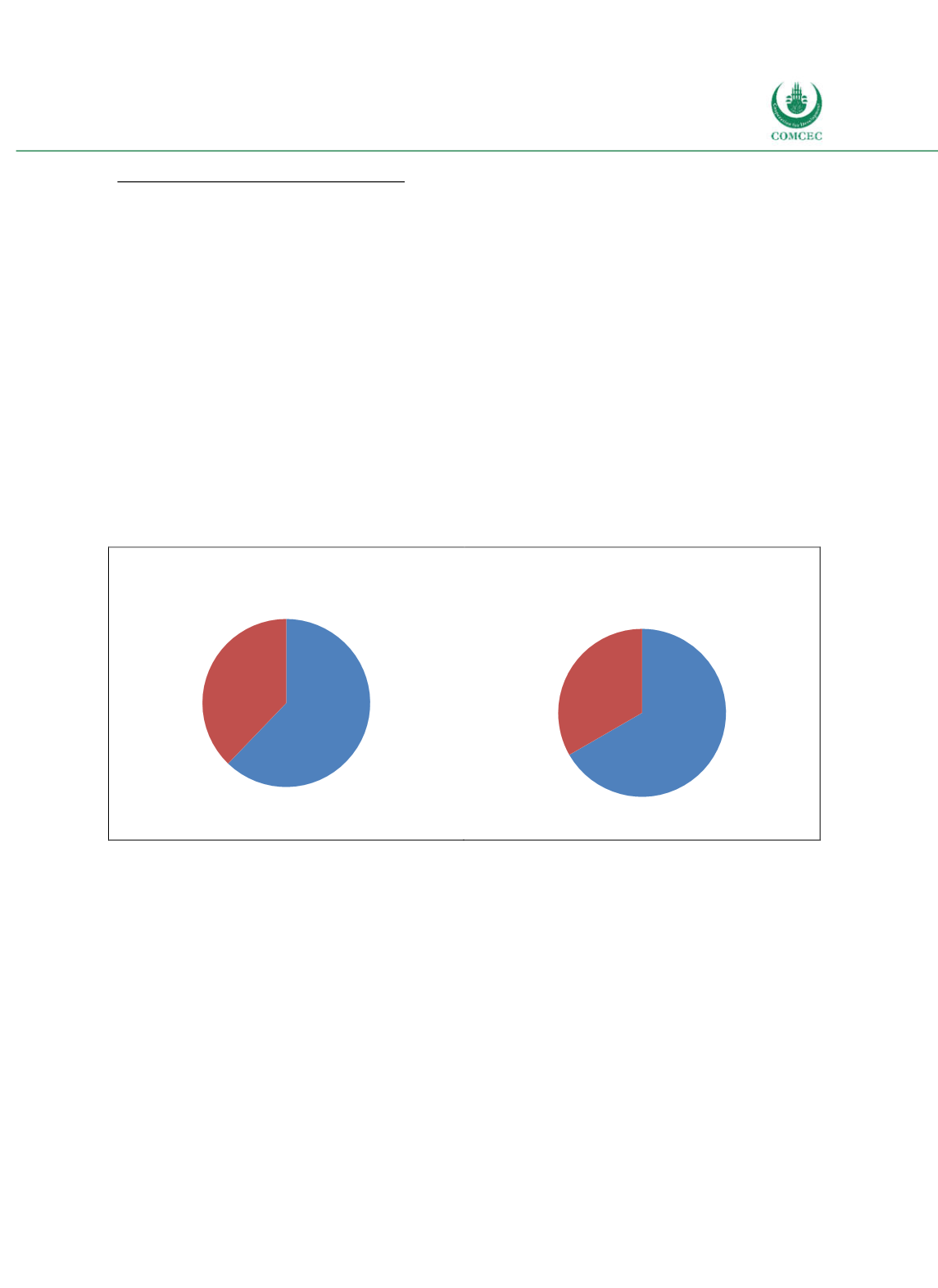

Among the OIC member countries, 62% have established a formal debt management strategy

(see Figure 313). This share is similar to the worldwide average of 60% (Cabral 2015). Among

the OIC member countries with a formal public debt management strategy, 78% have

published this document and 67% use strategic targets and benchmarks. The latter share is

lower than the worldwide average of 77% (Cabral 2015).

Figure 3-13: DeM Strategies in OIC Member Countries

Formal Debt Management Strategy

Use of Strategic Targets

Note: 37 observations. Sources: Ifo Public Debt Management Survey (2016), public debt management strategies,

Cabral (2015).

Among the OIC member countries with a formal public debt management strategy, 62% have

set targets for currency risk, 57% have set targets for refinancing risk, and 52% have set

targets for interest rate risk (see Figure 314). In contrast, the worldwide survey by Cabral

(2015) showed that it is most common to set strategic targets for refinancing risk (66%),

followed by interest rate risk (56%) and currency risk (50%). Targets used for currency risk

include the share of foreign currency debt in total debt, while targets used for interest rate risk

include the share of fixed interest debt in total debt and the average time to refixing. Finally,

targets used for refinancing risk include a ceiling on maturing debt within one year (in % of

total outstanding debt) and the average time to maturity.

Yes

62%

No

38%

Yes

67%

No

33%