Improving Public Debt Management

In the OIC Member Countries

60

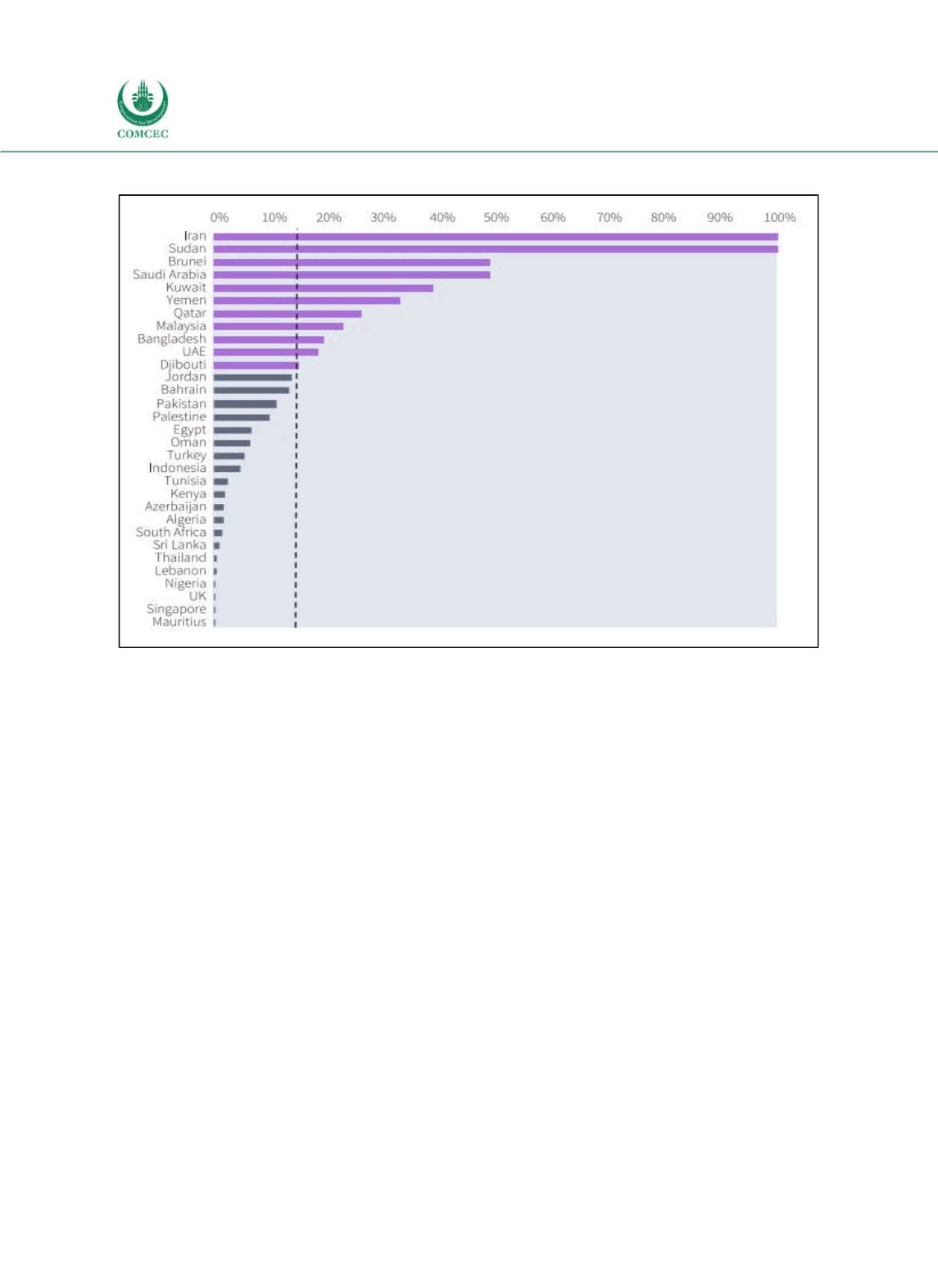

Figure 3-16: Islamic Banking Share in Total Banking Assets by Country (2015H1)

Source: IFSB (2016, p. 8).

Market shares of the Islamic banking sector are expected to grow by a considerable amount

over the next years in Saudi Arabia, Malaysia, the United Arab Emirates, Kuwait, Turkey, and

Indonesia, while stabilizing in Bahrain, Pakistan and Qatar. In general, worldwide growth rates

of the Islamic finance sector have exceeded growth rates of the conventional banking sector by

190% on average. The average annual growth rate of the Islamic banking sector is estimated to

equal 19% between 2014 and 2019 across Qatar, Indonesia, Saudi Arabia, Malaysia, the United

Arab Emirates and Turkey (Ernst & Young 2015). Islamic banks also operate in countries

where Muslims only account for a minority of the population, e.g., in Kenya, South Africa or the

United Kingdom. Islamic finance is often considered a promising innovation and addresses a

substantial minority in these countries (Lewis and Algaoud 2001, Song and Oosthuizen 2014).

In the Eurozone, an Islamic bank has opened in Germany, while plans for an Islamic bank in

Luxembourg are being developed (COMCEC 2016a).