Improving Public Debt Management

In the OIC Member Countries

59

Bank of Malaysia), and overall downward pressures in the global equity markets (IFSB 2016).

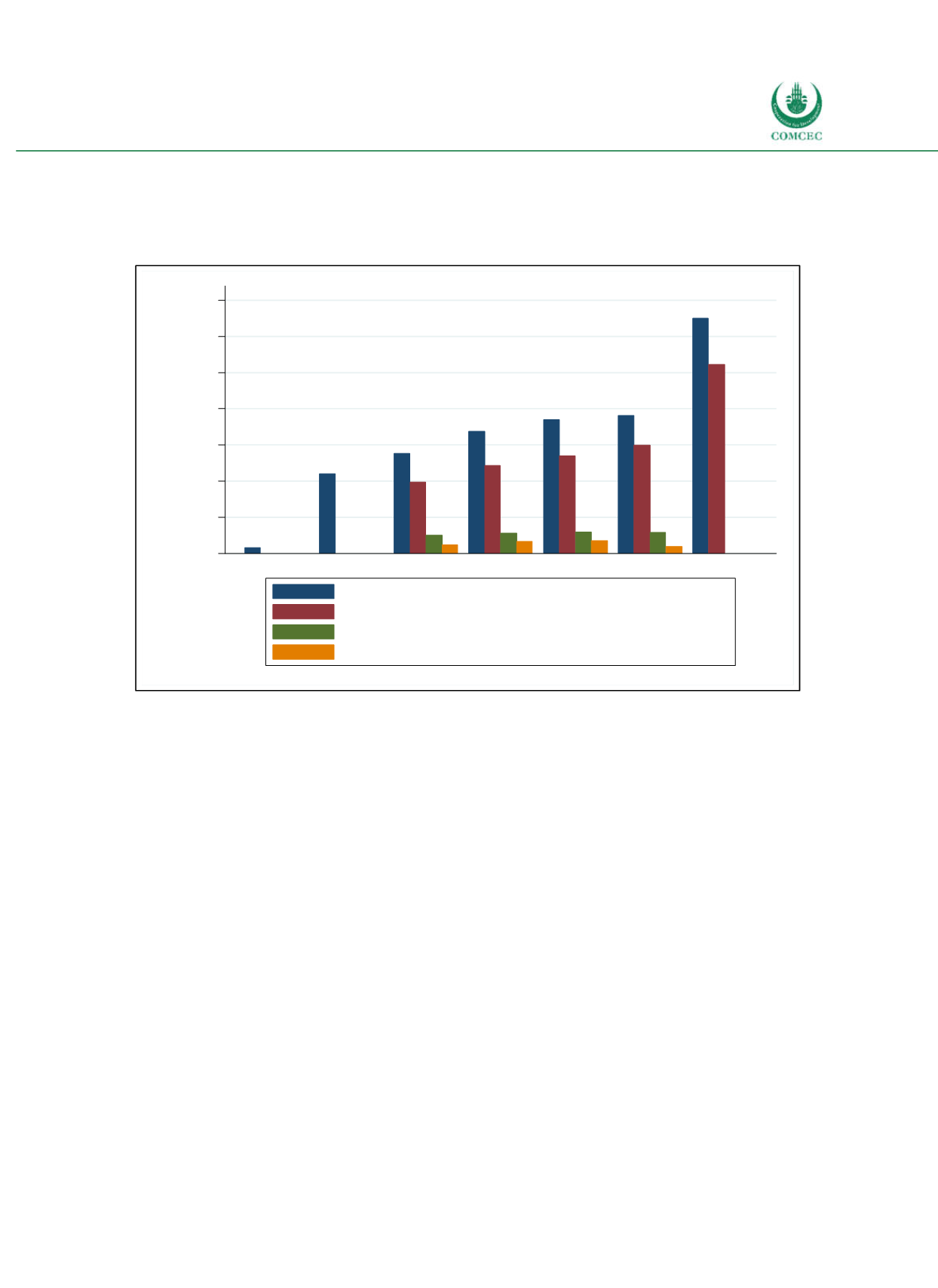

The Islamic finance sector is forecasted to continue growing strongly in the future: until 2020,

Islamic finance assets are projected to reach $3.25 trillion (Reuters 2015).

Figure 3-15: Global Assets of Islamic Finance

Note: Data for banking and takaful in 2015 refers to 2015H1, data for sukuk and Islamic funds refers to 2015M11.

Projections for sukuk, Islamic funds and takaful are not available for 2020. Sources: IFSB (2016), OIC (2012),

Reuters (2015), calculations by the Ifo Institute.

Islamic banks are supposed to focus on assetbased intermediation and risk sharing, whereas

conventional banks conduct debtbased intermediation and rather focus on risk transfers

(López et al. 2014). However, Islamic banks may sometimes mimic the characteristics of

conventional lending products while complying with sharia principles. A large share of the

liability side of Islamic banks is based on profit and loss sharing (Baele et al. 2014). In general,

Islamic banks invest mostly by engaging in trade and industrial activities. Investments are

based on partnerships or on shared profit agreements with depositors (Lewis and Algaoud

2001). Islamic banks tend to be better capitalized (Beck et al. 2010) and financially stronger

(Čihák and Hesse 2010) than conventional banks. Moreover, Islamic finance limits excessive

risktaking and leverage (Baele et al. 2014).

To illustrate the size and importance of the Islamic banking sector, Figure 316 shows the

Islamic banking share in total banking assets for individual countries. A banking share of 15%

or more indicates that the Islamic financial sector is systemically important in the respective

country. As the whole financial systems in Iran and Sudan rely on Islamic principles, the

Islamic banking share is 100% in both countries. Other countries have established mixed

systems consisting of conventional banks and

sharia

compliant banks (see also COMCEC

2016b). Figure 317 shows that Iran had the largest share of worldwide Islamic banking assets

in 2015 (37.3%), followed by Saudi Arabia (19%), Malaysia (9.3 %) and the United Arab

Emirates (8.1%).

0

500

1,000

1,500

2,000

2,500

3,000

3,500

Billion U.S. dollars

2000

2011

2012

2013

2014

2015

2020

Total assets

Banking assets

Sukuk (bonds)

Islamic funds, Takaful (insurance) and other assets