Improving Public Debt Management

In the OIC Member Countries

41

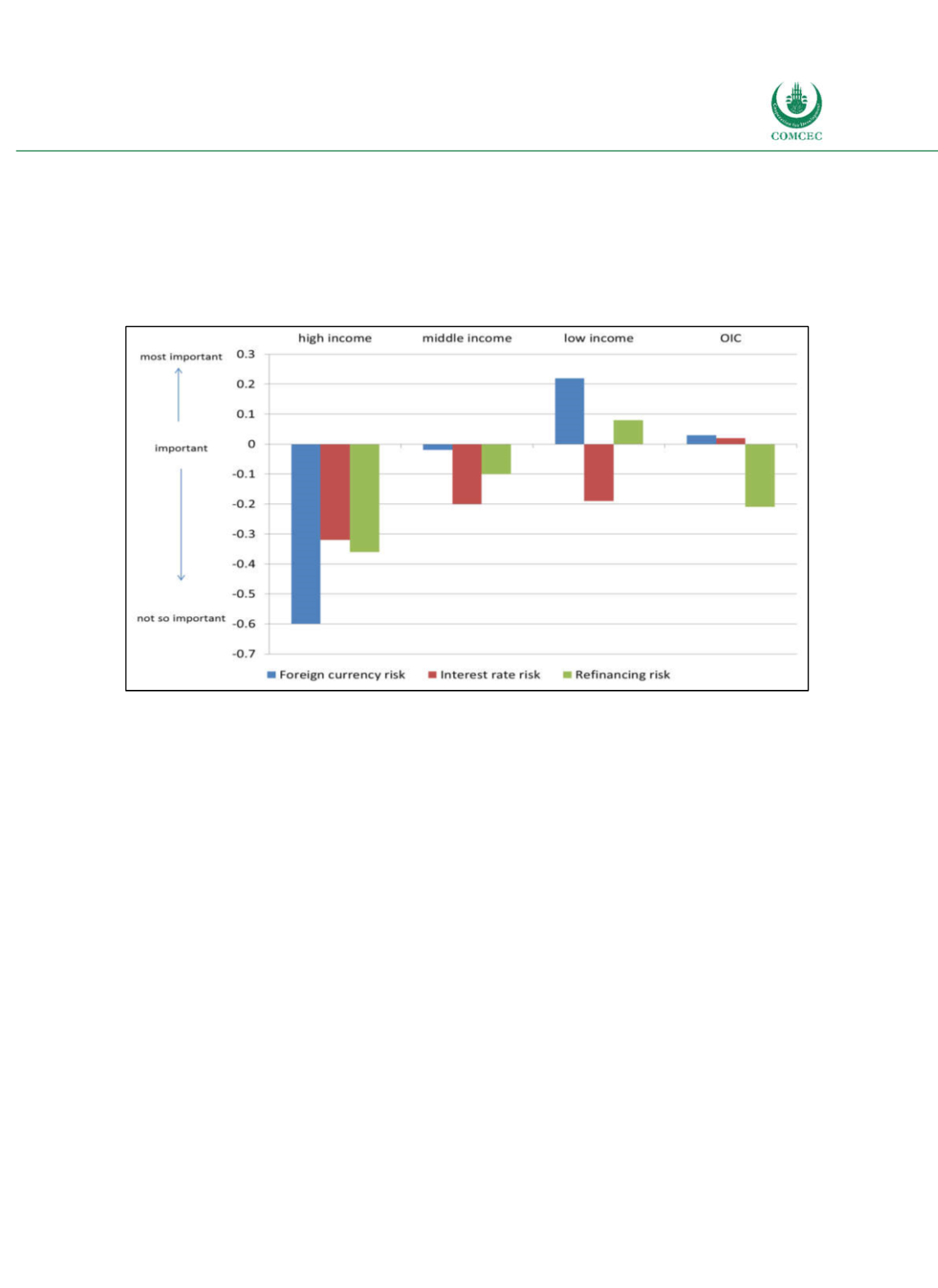

characterised by an environment where foreign currency risk and interest rate risk are

evaluated to be almost equally important. Noteworthy is the low relevance of refinancing risk

in the OIC sample. For all three types of risks individually holds that their importance is

considered to be negatively correlated with the level of income: All three types of risk are

attributed the highest importance in lowincome countries and the lowest in highincome

countries.

Figure 2-17: Importance of Risk Categories in Public Debt Management

Source: Ifo World Economic Survey (WES) IV/2016.

Domestic debt markets are an important source of financial resources for governments. A wellfunctioning domestic market for public debt helps to reduce risks linked to public debt

because it provides additional diversification opportunities. Data suggest that lowincome

countries might try to expand their base of domestic creditors: while in 2015 highincome

countries relied mostly on domestic creditors (59%), lowincome countries only sold 31% of

their liabilities to domestic agents. Moreover, given that in many emerging and developing

countries the government is the largest debtor, it dominates debt markets and may assume a

crucial role in developing a functioning domestic debt market, which has positive spillovers for

the private sector.

WES experts were asked the following question: “How do you assess the functioning of the

domestic public debt market?” Possible answers were “good”, “satisfactory” or “bad, which

were again attributed values from +1 to 1, respectively. In the entire sample, public debt

markets are assessed to work below satisfactory levels (0.12). Figure 218 depicts the

distribution of unweighted individual answers. Public debt markets in highincome countries

received the best assessment (+0.14), in lowincome countries the worst (0.43). Public debt

markets in the group of OIC countries perform relatively unsatisfactory in the international

comparison (0.35).

These results are an indication for a positive correlation between the functioning of the

domestic debt market and the quality of public debt management: lowincome countries

received the least favourable assessment of both their domestic public debt market