National and Global Islamic Financial Architecture:

Prolems and Possible Solutions for the OIC Member Countries

217

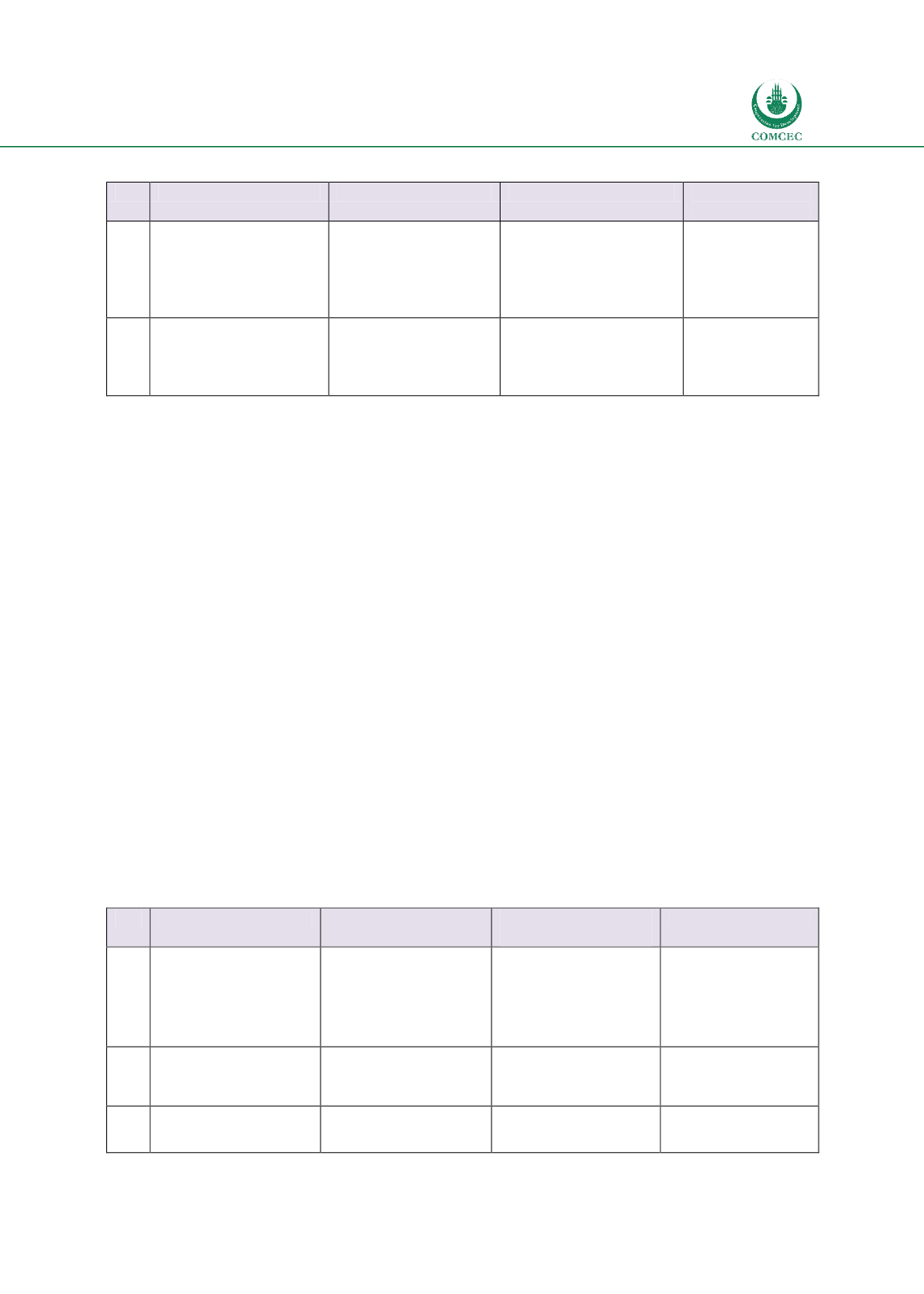

Table

7.10: Shari’ah Governance Framework

No. Recommendations

Existing Institutions Gaps Need to be filled

Implemented

by

3.1

Legal/Regulatory

Requirement

for

Shariah

Governance

(SG)

IFSB

AAOIFI

Role of national

Shariah board

IFSB

AAOIFI

3.3

Developing

Shariah

parameters/

standards

IsFA

AAOIFI

IIFM

Standards for a range

of new financial

products

IsFA

AAOIFI

IIFM

7.2.4. Liquidity Infrastructure

While IIFM has developed some templates of liquidity management instruments such as

Islamic repo, LMC and IILM have come up with specific instruments that Islamic financial

institutions can use for their liquidity needs. Note that while IILM has a global reach, LMC has

more regional scope. Given the huge demand for liquidity instruments relative to supply, there

is a need to develop and issue more Shariah complaint liquidity management products.

Furthermore, the introduction of Basel III liquidity requirements would require coming up

with Shariah compliant Hiqh Quality Liquid Assets (HQLA). In this regards, IIFM can come up

with templates and IILM can issue instruments that can satisfy the requirements of HQLA in

Islamic banks.

While IFSB has published a Technical Note on Islamic money markets, there are no specific

models that are suggested. IFSB and IIFM can play an important role in developing standards

and templates for Islamic money markets. Similarly, while IFSB has published a working paper

of Shariah complaint LOLR, no guidelines or standards on it exist. Thus, specific models and

clear guidelines for Islamic LOLR need to be developed.

There is also a need to develop sound deep secondary markets where international Islamic

financial securities and sukuk can be listed, traded and settled efficiently. This would require

building the necessary market infrastructures such as Electronic Trading Platforms and a Real-

time Electronic Transfer of Funds and Securities Systems (Karim 2015: 230).

Table

7.11: Liquidity Infrastructure

No. Recommendations

Existing Institutions Gaps Need to be

filled

Implemented by

4.1

Shariah

compliant

liquidity instruments

IIFM

LMC

IILM

Meeting the huge

demand

Shariah compliant

HQLA

IIFM

LMC

IILM

Other regional

entities

4.2

Islamic

money

market

IFSB

Models of Islamic

money market

structures

IFSB

IIFM

4.3

Lender of the last

resort (domestic)

IFSB

Models of Islamic

LOLR structures

IFSB