National and Global Islamic Financial Architecture:

Prolems and Possible Solutions for the OIC Member Countries

219

specific material that can be used for educating the people on Islamic financial principles and

practices.

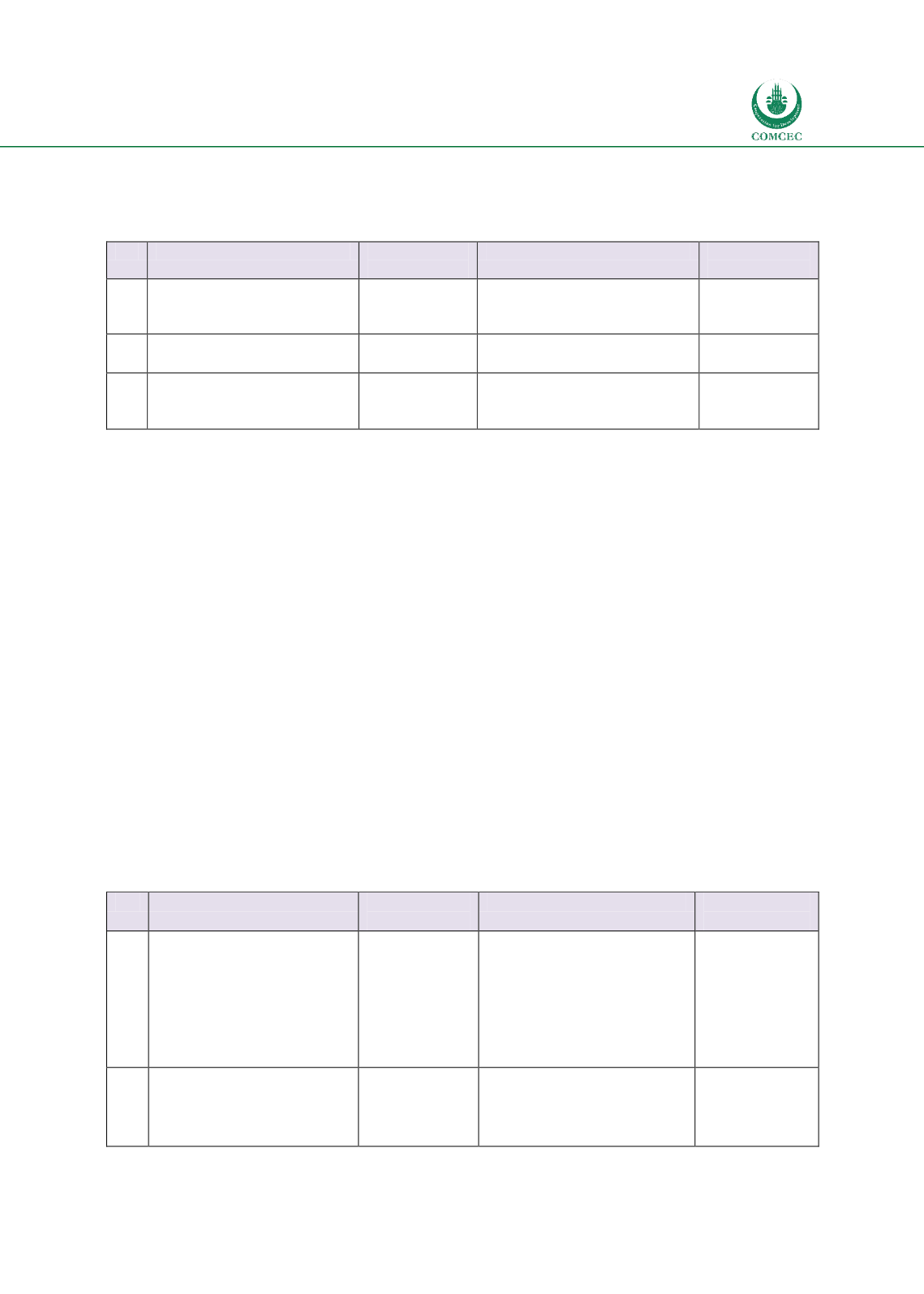

Table

7.13: Consumer Protection & Financial Literacy

No. Recommendations

Existing

Institutions

Gaps Need to be filled

Implemented

by

6.1 Consumer

protection

framework

for

Islamic

finance

IFSB

Guidelines and models of

consumer protection laws

IFSB

6.2 Deposit Insurance

IFSB

IADI

Models of Islamic deposit

insurance structures

IFSB

IADI

6.3 Financial literacy programs

Samples of potential

material used for Islamic

money market structures

CIBAFI

7.2.7. Human Capital and Knowledge Development

Although many universities are providing education and doing research on Islamic banking

and finance, some of the applied research and policy oriented papers needed for the

development of the industry can also be carried out by international multilateral organizations.

In this regards, IRTI, IDB and World Bank GIFDC can play an important role. Another key area

that needs attention is the production of relevant knowledge related to sound infrastructural

institutions. While IFSB provides some training on its published standards, there is a need to

conduct more research and provide training in other areas of Islamic financial infrastructure.

This can be done by IDB and WB through their technical assistance programs.

As the Islamic financial industry expands, there will also be a need to develop professional

development programs and certificates. Although there are different initiatives taken in the

private sector, there is a need to develop certification programs by international bodies to

enhance credibility and acceptance. For example, AAOIFI has professional certificates such as

the Certified Shari’a Adviser and Auditor (CSAA) and Certified Islamic Professional Accountant

(CIPA). There is a need to come up with different sector specific Islamic financial certification

programs such as the Islamic banking professional certificate, takaful professional certificate

and Islamic capital markets professional certificates. Being a trade association of Islamic

financial institutions, CIBAFI can take the initiative to implement these.

Table

7.14: Human Capital and Knowledge Development

No. Recommendations

Existing

Institutions

Gaps Need to be filled

Implemented

by

7.1 Research and Development

IRTI

GIFDC

Enhance investment in

research and

development of key

strategic areas

Research and training on

Islamic architectural

institutions

IDB

IFSB

IRTI

WB(GIFDC)

7.2 Professional development

programs and certificates

AAOFI

CIBAFI

Professional development

programs

Sector specific

professional certificates

AAOIFI

CIBAFI