National and Global Islamic Financial Architecture:

Problems and Possible Solutions for the OIC Member Countries

218

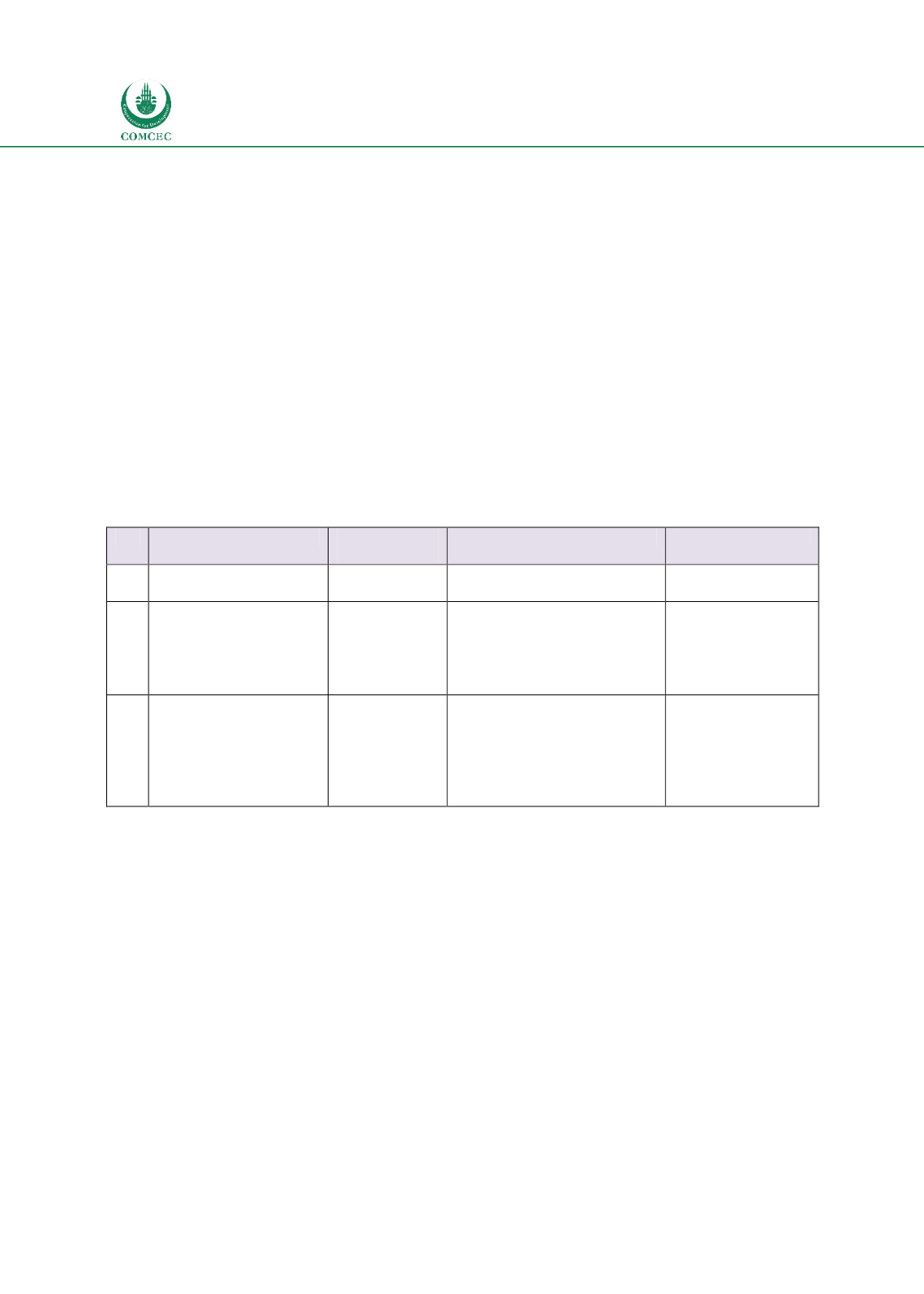

7.2.5. Information Infrastructure

AAOIFI has published 27 financial accounting standards, 2 codes of ethics and one guidance

note related to accounting and auditing for the Islamic financial sector. Similarly, AAOIFI and

IFSB have issued standards related to disclosure and transparency for Islamic financial

institutions. IFSB, IOSCO and the Securities Commission Malaysia (SCM) published a book

entitled

Disclosure Requirements for Islamic Capital Market Products

in 2013 (SCM 2103).

However, there are no specific disclosure guidelines issued by IFSB for takaful and Islamic

capital markets sectors. Furthermore, there is a need to have detailed standards related to

Shariah compliance disclosures.

IIRA is the only international rating agency providing ratings of Islamic financial institutions,

Islamic capital market products and

Shari’ah

Quality Rating (SQR) to assess the status of

Shariah compliance in different financial institutions. As the Islamic financial sector becomes

global, there is a need to come up with international ratings agencies to provide not only credit

ratings of Islamic financial institutions and instruments but also Shariah ratings.

Table

7.12: Information Infrastructure

No. Recommendations

Existing

Institutions

Gaps Need to be filled

Implemented by

5.1

Accounting and auditing

standards

AAOIFI

5.2

Disclosure

and

Transparency

AAOIFI

IFSB

Disclosure guidelines for

takaful and Islamic capital

markets

Shariah compliance of

products

AAOIFI

IFSB

5.3

Rating agencies

IIRA

Appropriate models and

structures for rating risks

in equity based instruments

Appropriate models and

structures for rating

Shariah compliance

IIRA

Other

international

rating agencies.

7.2.6. Consumer Protection & Financial Literacy

While consumer protection principles for the conventional financial sector have been

published by the OECD and G20 (2011) and the World Bank (2012), there are no specific

guiding principles for the Islamic financial sector. Although the IFSB has issued Guiding

Principles on Conduct of Business in 2009, there is a need to come up with specific guidelines

that deal with protecting consumers of Islamic financial institutions.

While recognizing that IFSB has published a working paper and IADI (2010) has published a

discussion paper on Shariah compliant deposit insurance, no specific models or standards of

Islamic deposit insurance have been published. IFSB along with the Islamic Deposit Insurance

Group of International Association of Deposit Insurers (IADI) can work together to develop a

framework for deposit insurance of the Islamic banking sector. Similarly, no international body

has developed any framework for enhancing financial literacy related issues of Islamic finance.

Being an association of Islamic financial institutions, CIBAFI can take the initiatives to develop