National and Global Islamic Financial Architecture:

Problems and Possible Solutions for the OIC Member Countries

192

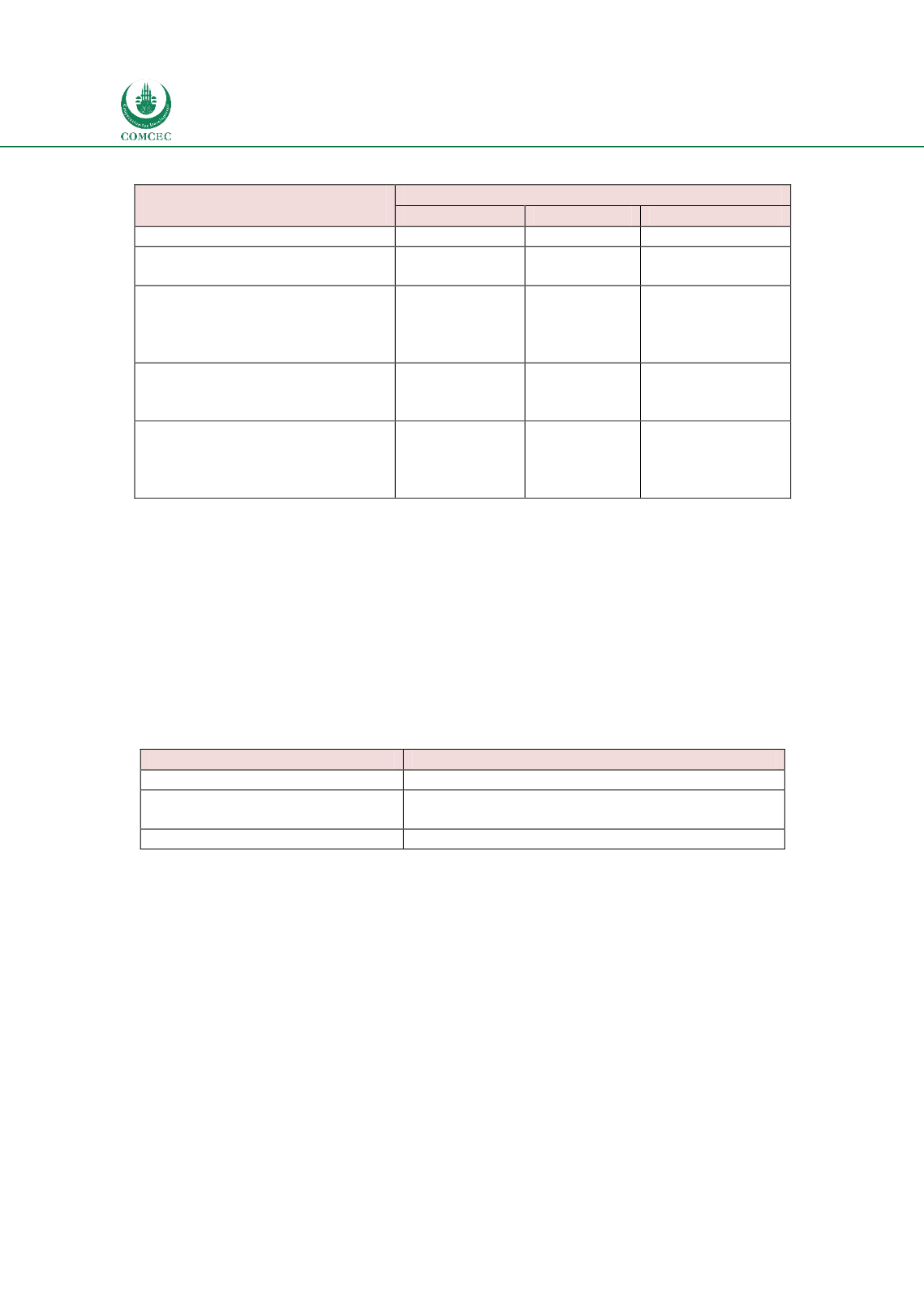

Table

6.1: Status of Islamic Financial Laws

Legal Infrastructure: Financial

Laws

Countries

Banking

Takaful

Capital Markets

1.

Islamic Legal System

Sudan

Sudan

Sudan

2.

Separate

Islamic

Financial

Laws

Malaysia,

Malaysia,

Oman

3.

Islamic Finance in Existing

Financial Laws

Bangladesh,

Indonesia,

Oman, Pakistan,

Turkey, UAE

Bangladesh,

Indonesia,

Pakistan

Bangladesh,

Indonesia,

Malaysia,

Oman,

Pakistan, Turkey

4.

Law Provides Authority to

Regulators to Issue Regulations

on Islamic Finance

Nigeria

Nigeria, UAE

Nigeria, UAE

5.

Single Finance Law

Egypt,

Saudi

Arabia, Senegal

Egypt, Saudi

Arabia,

Senegal,

Turkey

Egypt,

Saudi

Arabia, Senegal

Tax Laws

The key issue related to tax laws appear in countries with dual financial systems where taxes

make the Islamic financial products more expensive relative to their conventional

counterparts. Some facilitative countries proactively change the tax laws to level the playing

field between conventional and Islamic financial institutions. Accordingly, countries can be

grouped into three types when it comes to implications of tax laws. The first group is one in

which tax laws are not relevant in Islamic finance either because the conventional financial

sector does not exist (Sudan) or because there are no taxes that specifically affect the Islamic

financial sector (Saudi Arabia and UAE).

Table

6.2: Status of Tax Laws to Accommodate Islamic Finance

Legal Infrastructure: Tax Laws

Countries

Not Applicable

Saudi Arabia, Sudan, UAE

Tax

laws

changed/

accommodated

Bangladesh, Indonesia, Malaysia, Oman, Pakistan,

Turkey

No change in tax laws

Egypt, Nigeria, Senegal

Countries in which the governments have taken a facilitative role and change tax laws to level

the playing field for Islamic finance are Bangladesh, Indonesia, Malaysia, Oman, Pakistan and

Turkey. Countries where tax laws have not been changed are Egypt, Nigeria and Senegal. One

of the implications of not changing tax laws is that Islamic financial institutions tend to

structure their products very similar to their conventional counterparts to lower the costs of

their products.

Dispute Resolution

Other than countries in which the legal system is Islamic, civil courts use the laws of the

country. The case studies show different arrangements for resolving disputes arising in the

Islamic financial sector. In countries with Islamic legal systems, the courts will apply Islamic

law and there may not be any need for special courts. However, in Saudi Arabia there is a

special committee that deals with cases involving the financial sector. The second group of