Risk Management in

Islamic Financial Instruments

108

addition of the responses given as ‘important’ and ‘critically important’, both credit and

operational risks are considered important in the

Murabahah

mode of financing. Mark-up risk

is the second largest risk in the

Murabahah

mode of financing.

The credit and the operational risks are the two most important risks for banks in all the

remaining five modes of financing as well. Except for the

Murabahah

, operating risk has been

considered as relatively more important than the credit risk in the remaining five modes of

financing. In other words, IFIs have to concentrate on investing in developing an efficient

system, technologies, and building efficient human capital in order to reduce operational risks.

Despite a diverse experience with liquidity and mark-up risks, the respondents chose liquidity

risk as the third important risk, followed by mark-up risk.

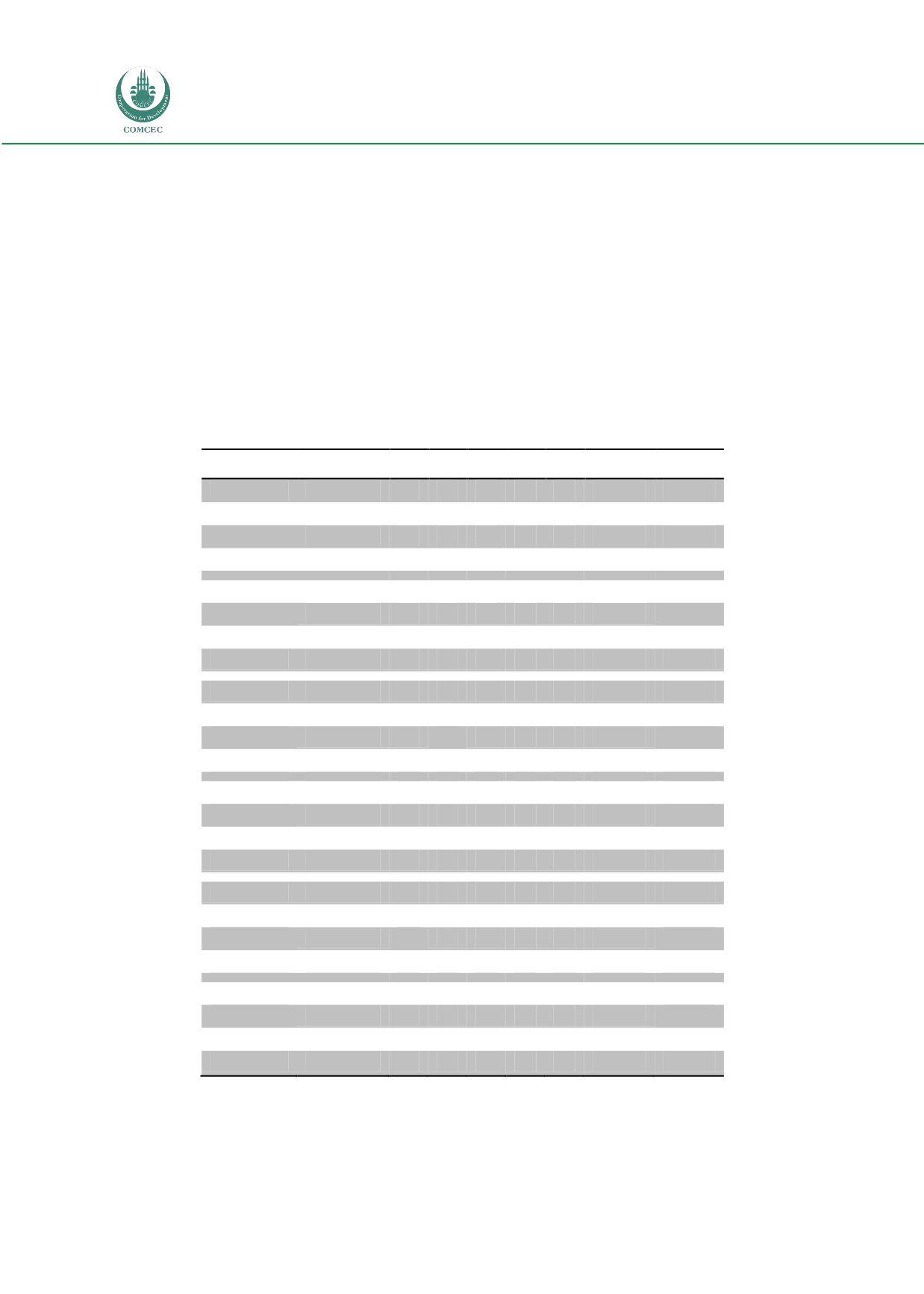

Table 5.2: Perception of Risks in Modes of Financing

Contracts

Risks

1

2

3

4

5

Total % Missing

Murabahah

Credit

5.6

11.1

11.1

38.9

27.8

94.4

5.6

Mark-up

5.6

22.2

16.7

22.2

27.8

94.4

5.6

Liquidity

5.6

11.1

33.3

16.7

27.8

94.4

5.6

Operational

0

0

27.8

44.4

22.2

94.4

5.6

Mudarabah

Credit

5.6

11.1

27.8

55.6

100.0

Mark-up

11.1

16.7

33.3

22.2

16.7

100.0

Liquidity

5.6

5.6

33.3

33.3

16.7

94.4

5.6

Operational

66.7

33.3

100.0

Musharakah Credit

5.6

11.1

22.2

61.1

100.0

Mark-up

11.1

16.7

27.8

27.8

16.7

100.0

Liquidity

5.6

33.3

38.9

22.2

100.0

Operational

11.1

50.0

38.9

100.0

Ijtisna

Credit

11.1

5.6

5.6

38.9

38.9

100.0

Mark-up

5.6

11.1

33.3

22.2

27.8

100.0

Liquidity

11.1

44.4

27.8

16.7

100.0

Operational

16.7

44.4

38.9

100.0

Ijarah

Credit

5.6

16.7

11.1

27.8

38.9

100.0

Mark-up

5.6

44.4

11.1

22.2

16.7

100.0

Liquidity

11.1

38.9

27.8

22.2

100.0

Operational

5.6

11.1

50.0

33.3

100.0

Salam

Credit

11.1

11.1

38.9

38.9

100.0

Mark-up

5.6

11.1

22.2

33.3

27.8

100.0

Liquidity

5.6

5.6

22.2

38.9

27.8

100.0

Operational

11.1

38.9

50.0

100.0

Notes: 1 = Critically Unimportant, 2 = Unimportant, 3 = Neutral, 4 = Important, 5 = Critically Important. Values are in

Percentage (%).