Risk Management in

Islamic Financial Instruments

111

The Rate of return, which is directly connected to mark-up risk, has severe influence on bank

deposits in IFIs. According to Figure 5.1, 39 percent of the respondents believed that lower

rates of return in IFIs, compared to conventional banks, would force a major portion of the

deposit-holders to withdraw their funds. This phenomenon is also connected to ‘displaced

commercial risk’. We conducted an extended analysis by decomposing these problems into

regional groups. Regulatory and lack of understanding problems are closely connected to

developing MENA countries and South Asian countries.

5.3 RISK REPORTING

Risk reporting is an essential component of efficient risk management. The IFIs are required to

report partially or in full content, the amount of risk taken in various financial activities. IFIs

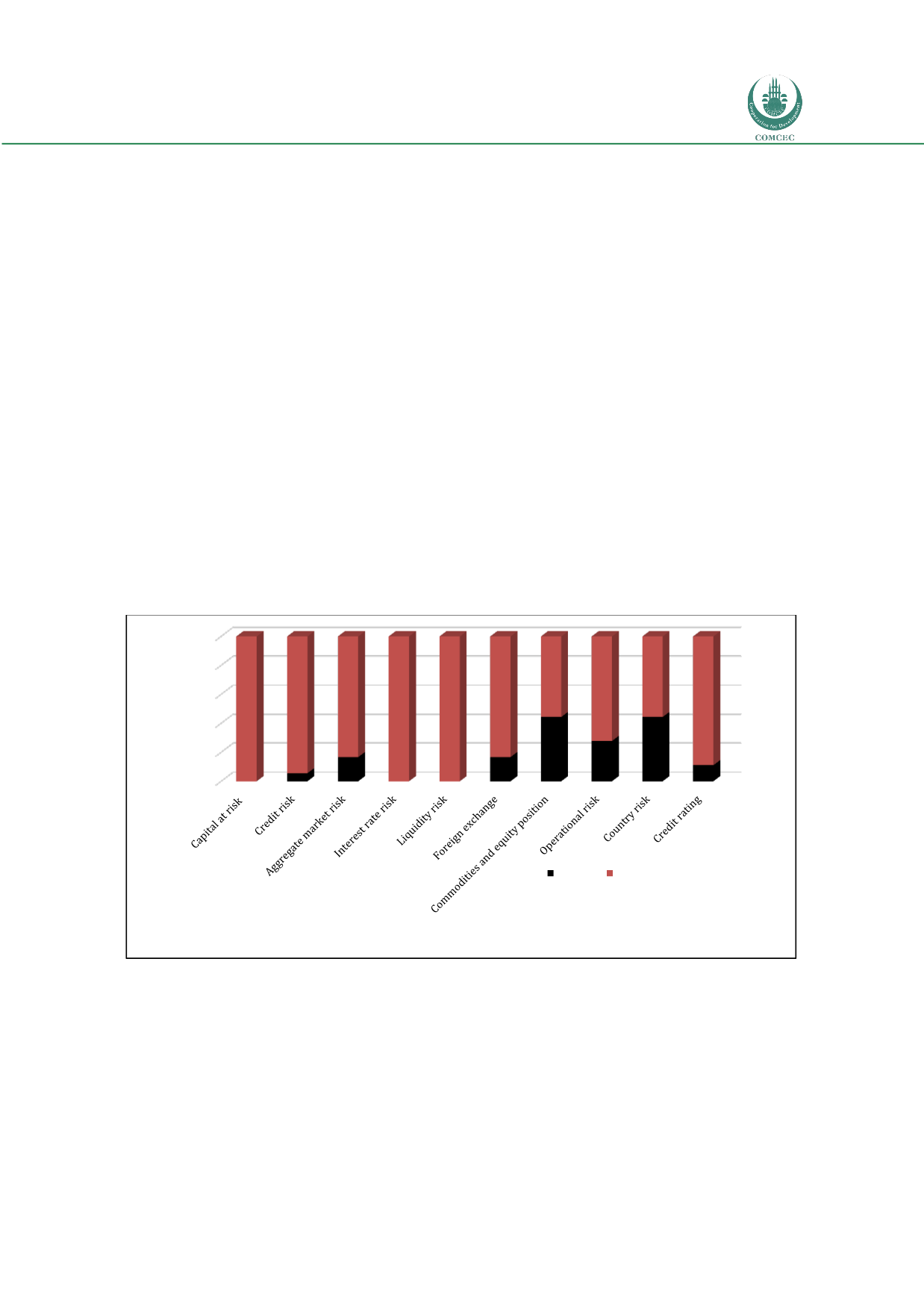

produce a number of risk reports. Figure 5.2 provides explanations of the presence of various

risk reports. Not all the reports were equally important, and, thus, were not prepared by all

IFIs. IFIs did not report changes in commodities prices, which might be of concern for the

Salam mode of financing. The country risk report was not needed, as the IFIs were not globally

diversified. However, we must consider the country risk report very important for cross-

border banking activities in the future. Operational risk was not reported fully as well. Hence,

operational risk remains an influential risk among IFIs.

Figure 5.2: Risk Reporting

It is clear why IFIs have operational, credit, liquidity and mark-up risks. In order to fully

understand the risk profile of the banks, the IFIs must report the types and propensity to such

risks in a formal manner. These reports should also be monitored at a periodic basis. While the

risk perceptions and reporting face limitations, IFIs are analyse the existing internal

environment. The start of this environmental scanning is to gather information on the ideal

risk management requirement and policies and procedures that are considered prerequisites

to efficient risk management.

0

20

40

60

80

100

100

94,4

83,3

100

100

83,3

55,6

72,2

55,6

88,9

No (%)

Yes (%)