Risk Management in

Islamic Financial Instruments

113

5.5 RISK MEASURING AND MANAGEMENT TECHNIQUES

Banks must establish regular management information systems for measuring, monitoring,

controlling, and reporting different risk exposures. IFIs can use a number of techniques to

measure and manage risks. This study asked the respondents to identify whether they are

familiar with the techniques. Gap and duration analysis are similar in principle. Gap identifies

the dollar gap, while the duration gap analyses the gap in maturity for rate sensitive assets and

liabilities. These techniques are especially important for liquidity risk management. Both

earnings at risk and value at risk methods use confidence intervals, which is sometimes

difficult for managers to interpret. Simulation techniques and best-worse case analyses fall

largely under the scope of scenario analysis. Extensive mathematical and management skills

are required to perform and interpret the outcomes of these analyses.

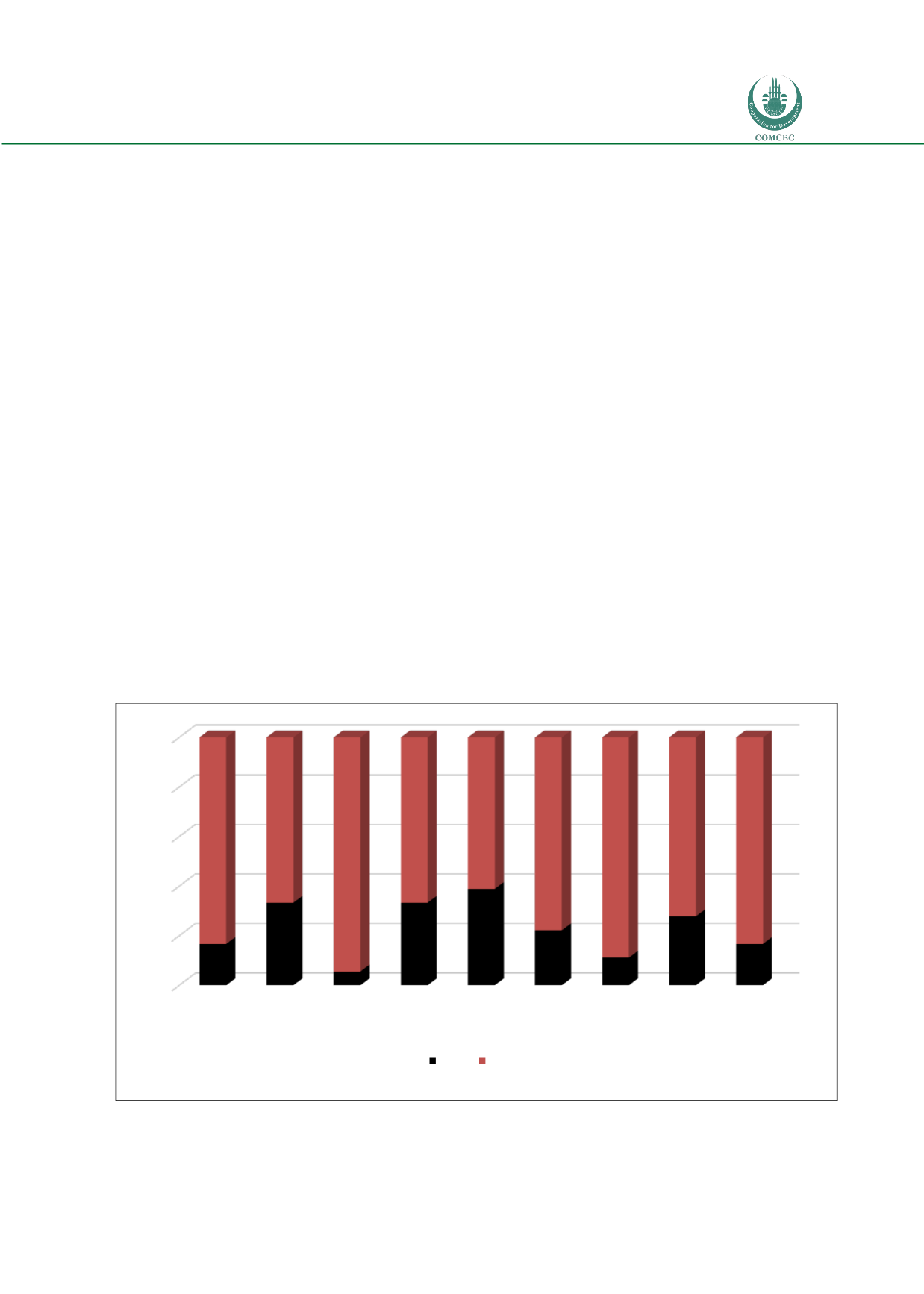

Figure 5.4 summarises the findings. Duration analysis, earnings at risk analysis, Value at risk

analysis, risk adjusted rate of return on capital analysis, and simulation techniques were not

utilized properly by the banks. One of the reasons could be the limited computerized

management of risk. The traditional method of maturity matching is quite popular among IFIs.

The results imply that IFIs do not use sophisticated techniques to measure and manage risks. It

is not a necessity that banks should be using these techniques. Perhaps a combination of some

of the techniques may enrich the experience of the managers by helping them in making

informed decision. It is important to note that IFIs have moved to the internal rating based

approach required by Basel III. This approach offers flexibility and freedom to IFIs, but

increases the level of commitment and responsibility towards the efficient management of the

banks.

Figure 5.4: Risk Measuring and Management Techniques

0

20

40

60

80

100

Gap analysis Duration

analysis

Maturity

matching

Earnings at

risk analysis

VAR analysis Simulation

techniques

Best vs.

Worse case

scenarios

Risk adjusted

rate of

return on

capital

Internal

rating

systems

83,3

66,7

94,4

66,7

61,1

77,8

88,9

72,2

83,3

No (%)

Yes (%)