Risk Management in

Islamic Financial Instruments

112

5.4 RISK MANAGEMENT ENVIRONMENT

5.4.1 Establishing an Appropriate Risk Management Environment, Policies

and Procedures

The board of directors is responsible for the overall objectives, policies and strategy of the

bank towards risk and its management policies. The risk appetite should be communicated

throughout upper management. The board of directors should ensure management takes the

necessary actions to identify, measure, monitor, and control these risks. Senior management is

responsible for establishing policies and procedures that manage risk according to the board

of director’s appetite for risk. The policies and procedures include maintaining a review

process, limiting risk taking, establishing an adequate system of risk measurement, promoting

a comprehensive reporting system, and an ensuring an effective system of internal controls.

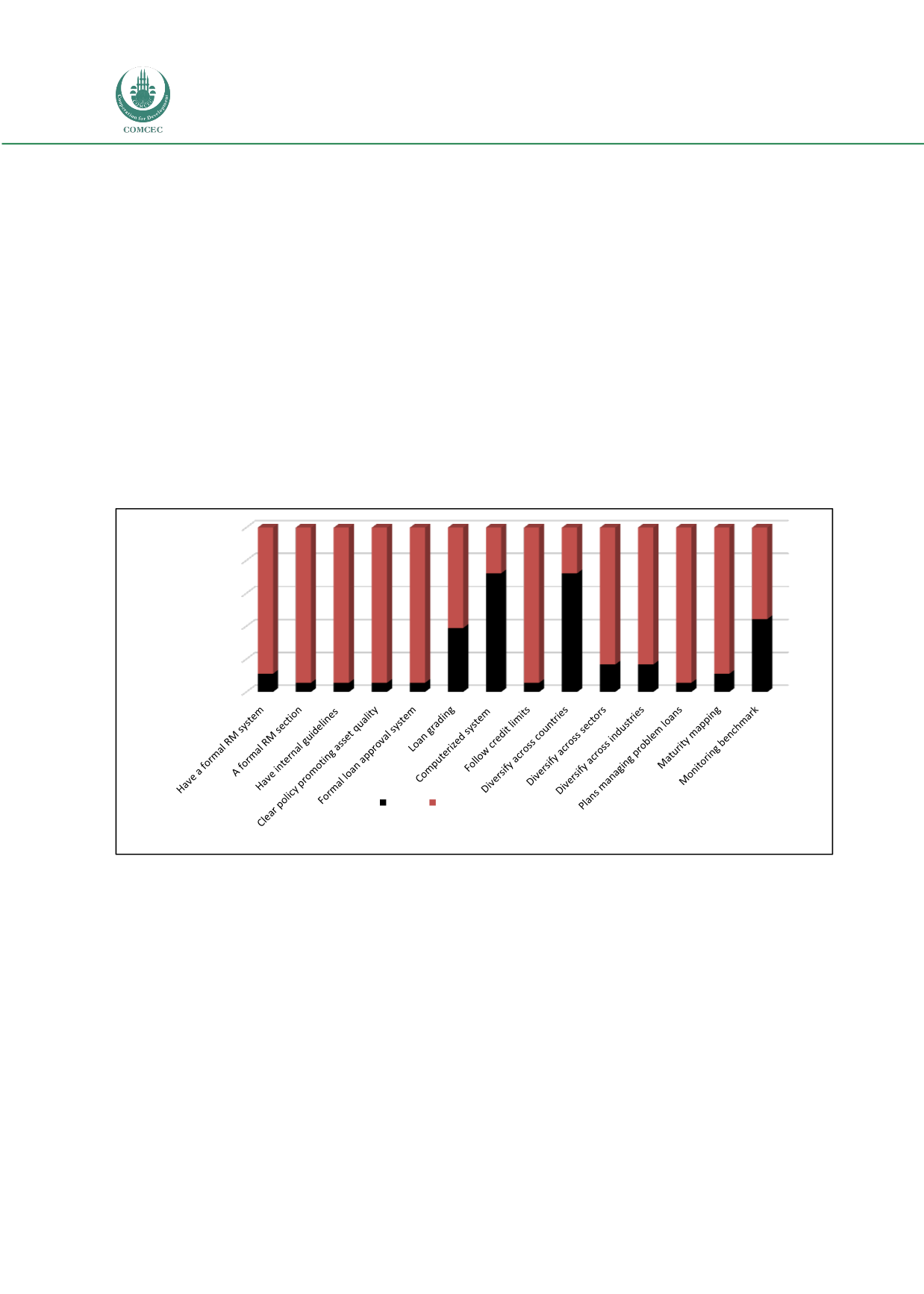

Figure 5.3: Establishing Strong Risk Management Environment

Figure 5.3 shows that most of the banks have already established a strong risk management

environment. Loan grading has been a problem for 39 percent of the banks. Loan grading helps

bank identify the riskiness of the borrowers. A problem with this grading system will lead to

more defaults, which can be translated into higher credit risk. A massive drawback of the poor

internal mechanism is that over 70 percent of the banks did not have computerized risk

management tools. Diversification across countries, sectors, and industries has been another

important problem area. The IFIs were not internally diversified. Also, the problem of

monitoring benchmark rates has contributed to mark-up risk. Since IFIs do not have efficient

human capital and the use of computers was very limited, the IFIs reported facing difficulties

with operational and mark-up risks.

0

20

40

60

80

100

88,9

94,4

94,4

94,4

94,4

61,1

27,8

94,4

27,8

83,3

83,3

94,4

88,9

55,6

No (%)

Yes (%)