Risk Management in

Islamic Financial Instruments

105

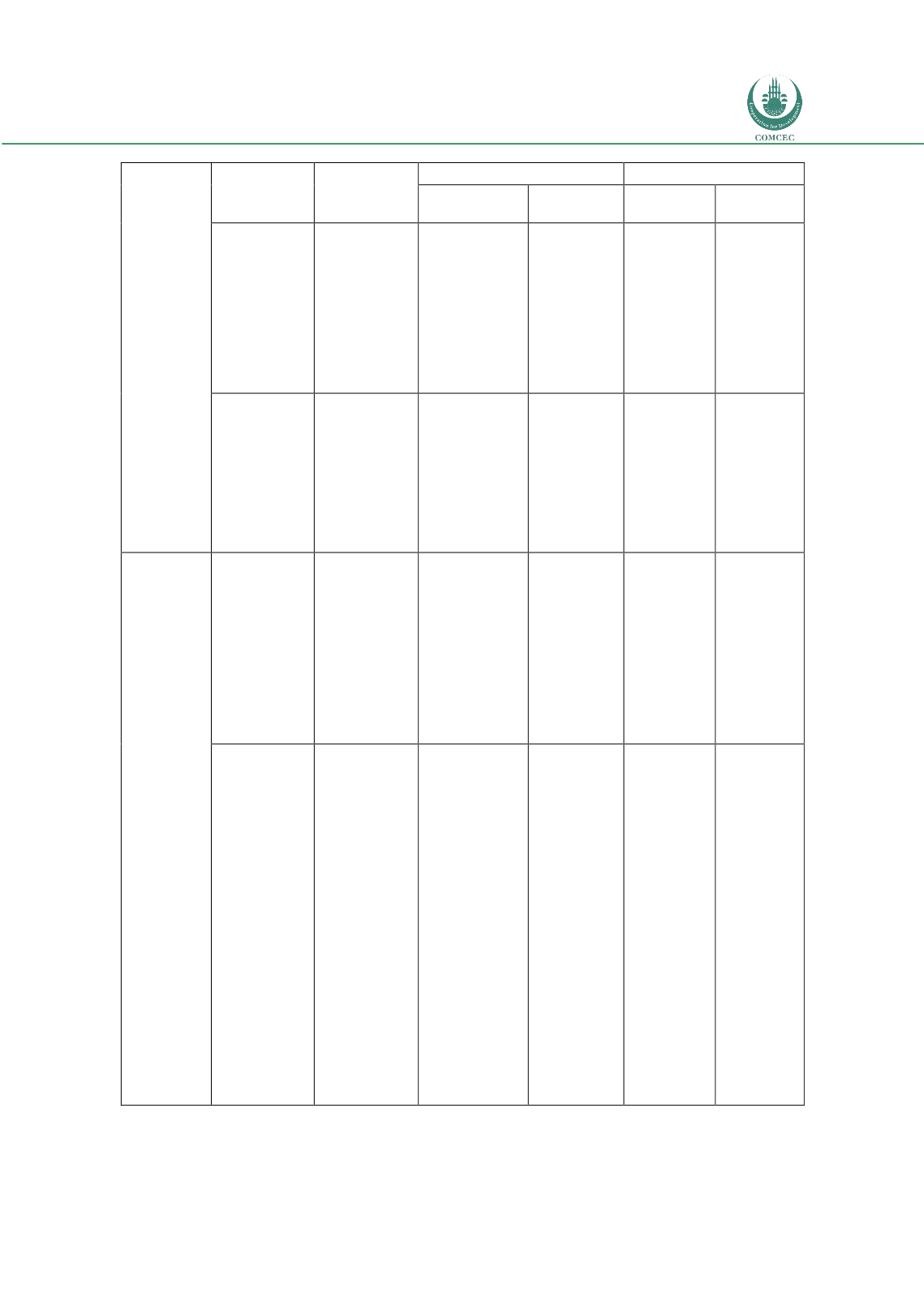

Type of risk

Definition

Institution

Depositors

Bank

Shareholders

Demand

Investment

Liquidity risk

Liquidity risk

is the risk of

bank’s inability

to access liquid

funds to meet

its obligations

The bank is

exposed to risk

of failure to

honor requests

for withdrawals

from its

depositors

They face

the risk of

not being

able to

access their

deposits

when they

need to

Hedging risk

Hedging risk is

the risk of

failure to

mitigate &

manage the

different types

of risks

This increases

the bank’ s

overall risk

exposure

Governance

Risk

Operational risk

Operational

risk is the risk

of failure of

internal

processes as

related to

people or

systems

The bank incurs

losses due to

occurrence of

that risk hence

may fail to meet

its obligations

towards the

different

stakeholders

This risk

adversely

affects return

on equity

This risk

adversely

affects

return on

assets

Fiduciary

risk

- Fiduciary risk

is the risk of

facing legal

recourse action

in case the

bank breaches

its fiduciary

responsibility

towards

depositors and

shareholders.

- Risk of loss of

reputation

Legal recourse

may lead to

charging the

bank a penalty

or

compensation.

This may lead to

withdrawal of

deposits, sale of

shares, bad

access to

liquidity or

decline in the

market price of

shares if listed

on the stock

exchange