Risk Management in

Islamic Financial Instruments

103

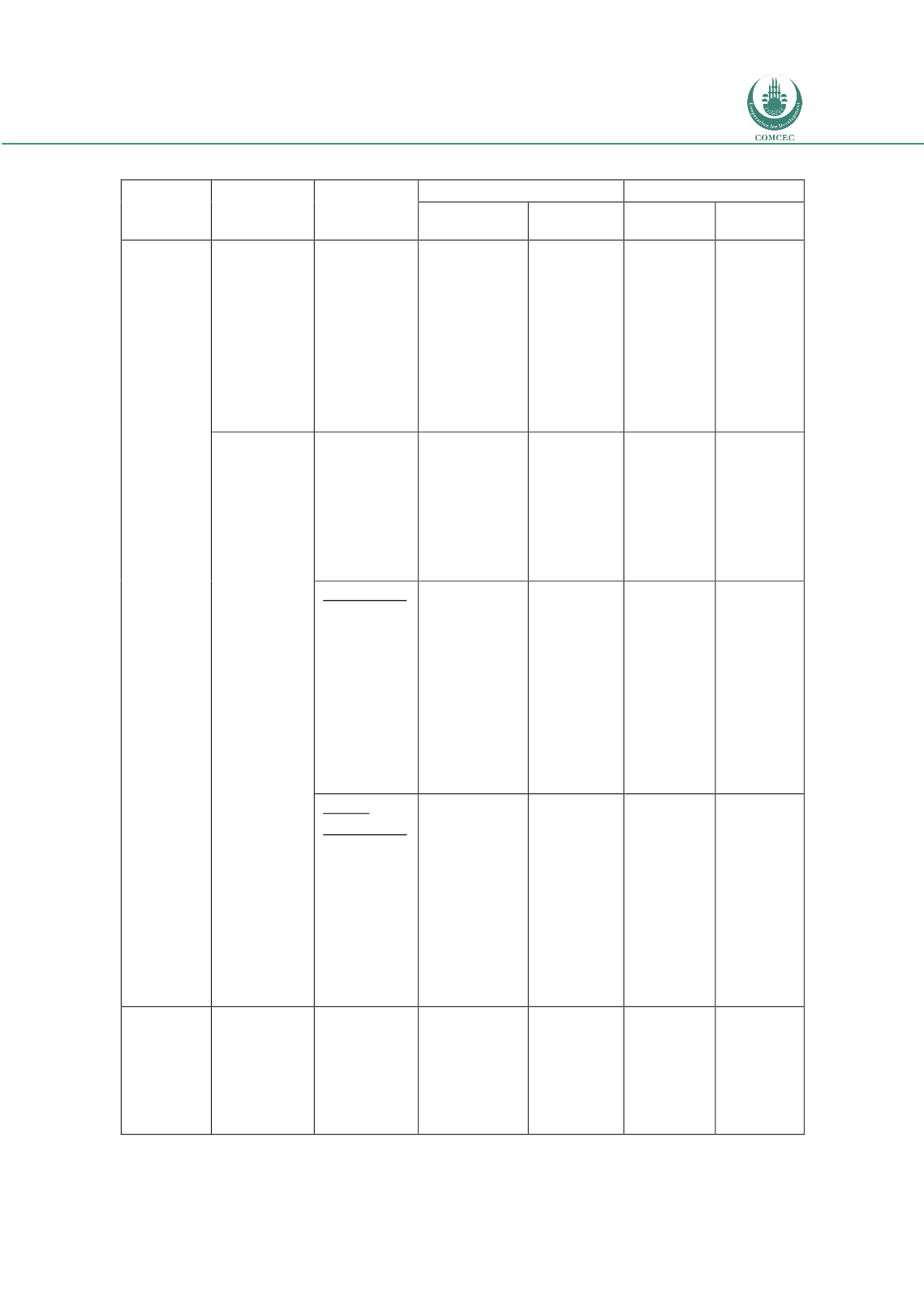

Table 5.1 Types of Risks – Description and Influence

Type of risk

Definition

Institution

Depositors

Bank

Shareholders

Demand

Investment

Transaction

Risks

Credit risk

Credit risk is

failure of

counter - party

to meet his or

her obligations

timely and on

the agreed

terms of the

contract

The bank faces

counter - party

risks in the

various forms of

contracts: such

as,

Bay mua’jal,

mudaraba,

musharaka

murabaha,

They face

the risk that

the bank

does not

honor

requests for

withdrawals

at face value

They face the risk

that the bank does

not honor requests

for withdrawals at

market

value

Market risk

Market risk is

the risk

associated

with change in

the market

value of held

assets

Mark– up risk

is risk of

divergence

between the

murabaha

contract mark

– up and the

market

benchmark

rate

The bank may

incur losses if

the benchmark

rate changes

adversely

Foreign

Exchange risk

is the risk of

the impact of

exchange rate

movements on

assets

denominated

in foreign

currency

This exposes the

bank to risks

associated with

their deferred –

trading

transactions

Business

Risk

Business risk

Business risk

results from

competitive

pressures from

existing

counter parts