Risk Management in

Islamic Financial Instruments

104

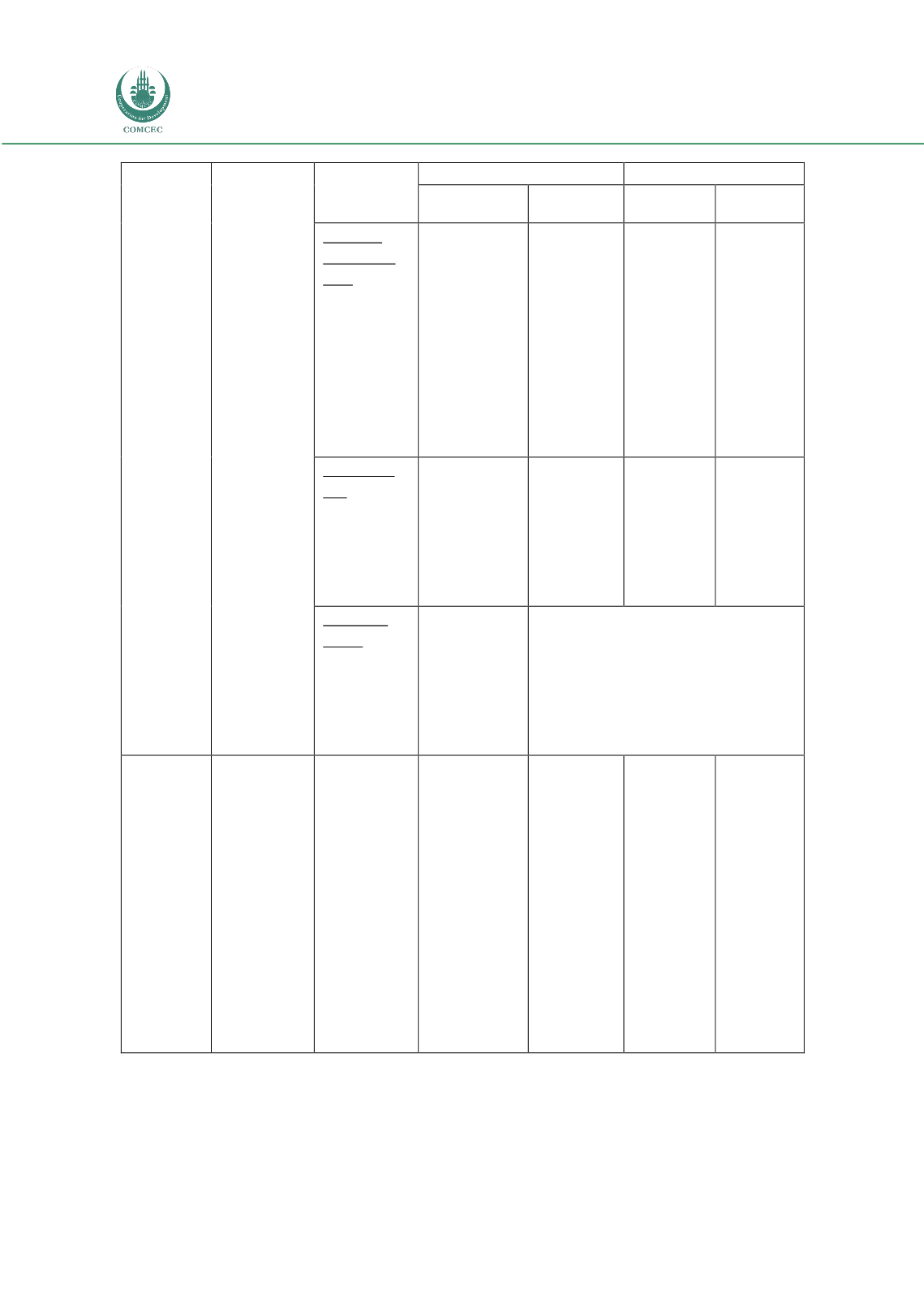

Type of risk

Definition

Institution

Depositors

Bank

Shareholders

Demand

Investment

Displaced

Commercial

risk

is the risk

of divergence

between

assets’

performance

and

expectations

for returns on

liabilities

Displaced

commercial risk

may adversely

affect the value

of the bank’s

capital. Return

on equity goes

down

Shareholders

are exposed

to the risk of

not receiving

their share of

the bank’s

profit

Investment

depositors

may have to

forgo

receiving

their

mudarib

share

Withdrawal

risk

where the

bank is

exposed to the

risk of

withdrawal of

deposits

Withdrawal risk

exposes the

bank to liquidity

problems and

erosion of its

franchise value

Insolvency

risk is

the risk

of bank’s

failure to meet

its obligations

when they fall

due

Insolvency risk

may expose the

bank to loss of

its reputation

Insolvency risk exposes the different

stakeholders to counter – party risks

Treasury

Risks

Asset &

Liability

Management

(ALM) risk

Asset &

Liability

Management

(ALM) risk is

a balance sheet

mismatch risk

resulting from

the difference

in terms and

conditions of a

bank’s

portfolio on its

asset & liability

sides

This may

adversely affect

the bank’s

capital