Risk Management in

Islamic Financial Instruments

106

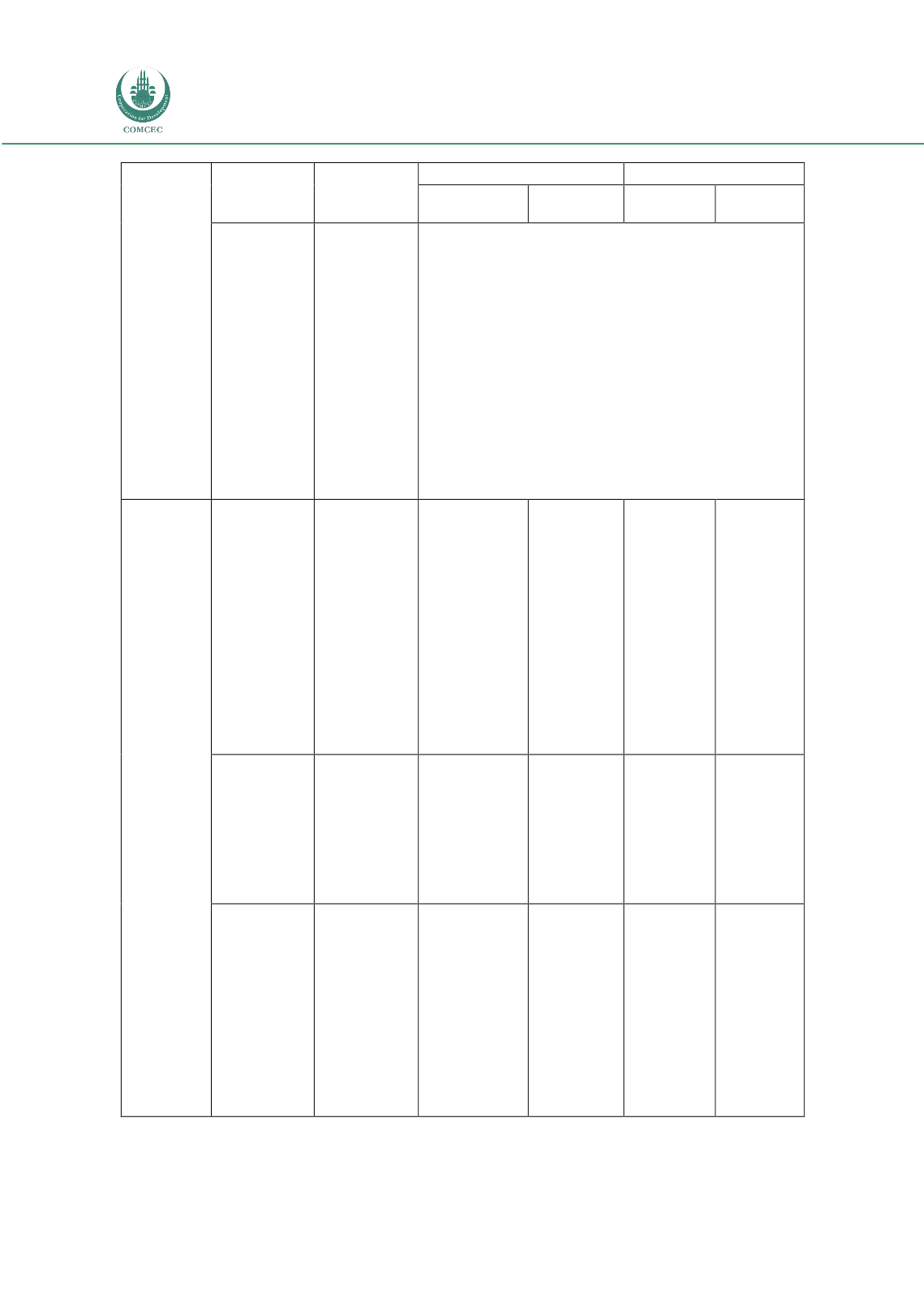

Type of risk

Definition

Institution

Depositors

Bank

Shareholders

Demand

Investment

Transparency

risk

Transparency

risk is the risk

of

consequences

of decisions

based on

inaccurate or

incomplete

information

which is the

outcome of

poor

disclosure

Losses may occur as a result of bad decisions based on inaccurate

or incomplete information

System

Risks

Business

environment

risk

Business

environment

risk is the risk

of poor broad

institutional

environment

including legal

risk whereby

banks are

unable to

enforce their

contracts.

Business

environment

risk increases

banks’ exposure

to counter -

party risk as

weak contracts

are not easily

enforceable

Institutional

risk

Institutional

risk is the risk

of divergence

between

product

definition and

practices

Institutional

risk exposes the

bank to counter

-party risks due

to the unsettled

nature of the

contract

Regulatory

risk

Regulatory risk

is the risk of

non -

compliance

with

regulations

due to

confusion, bad

management

or mistakes

Banks may be

penalized for

non-complying

with the rules or

regulations. It

could be an

issue with the

regulator or

supervisor

Source: Adopted from Haawari, Grais and Iqbal (2003)