Risk Management in

Islamic Financial Instruments

110

Table 5.5: Challenges in Risk Management

Problems

1

2

3

4

5

Lack of understanding

5.6

5.6

0.00

50.0

38.9

Rate of return of IFI

5.6

16.7

22.2

27.8

27.8

Islamic money market

0.00

5.6

16.7

50.0

27.8

Derivative

0.00

5.6

22.2

33.3

38.9

Legal system

0.00

11.1

16.7

33.3

38.9

Regulatory system

0.00

5.6

11.1

44.4

38.9

Notes: 1 = Critically Unimportant, 2 = Unimportant, 3 = Neutral, 4 = Important, 5 =

Critically Important. Values are in Percentage (%).

5.2.2 Major Challenges Facing IFIS

Among six different problems, Table 5.5 shows that a lack of understanding is the major

challenge facing IFIs. Lack of understanding is directly connected to availability of efficient

human capital for IFIs. One of the major components of operational risk is the unavailability of

efficient Islamic bankers. This is a true reflection of the most important type of risk, as

operational risk was seen as most important. The next problem is the absence of Islamic

money markets in many regions. In the absence of such markets, IFIs will face liquidity

shortages. Hence, this coincides with the third most important risk for IFIs, liquidity risk.

Finally, the absence of efficient regulatory frameworks to deal with problem borrowers and

guide other general banking activities is the third most important problem. This problem is

connected to credit risk, which is the most important risk.

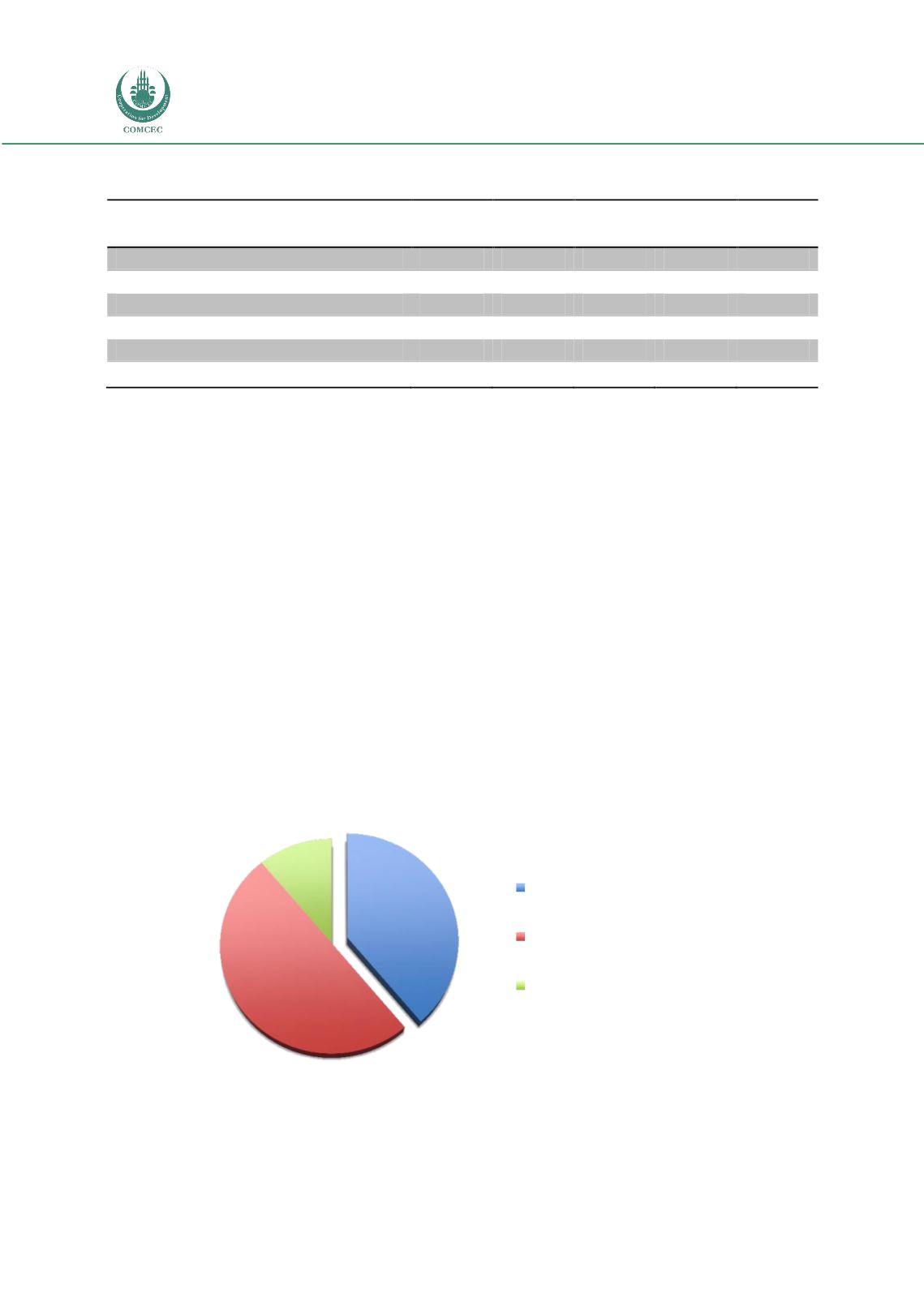

Figure 5.1: Influence of Low Return in IFI on Deposit

39%

50%

11%

Most of them will

withdraw

A fraction will withdraw

None or very few will

withdraw