Infrastructure Financing through Islamic

Finance in the Islamic Countries

125

4.4. Saudi Arabia

4.4.1.

Financial Sector and Islamic Finance Overview

The Saudi Arabian economy is currently guided by Vision 2030 which was launched in 2016.

The vision has three pillars (a vibrant society, a thriving economy and an ambitious nation)

and six strategic objectives that include strengthening the Islamic and national identity,

offering a fulfilling and healthy life, growing and diversifying the economy, increasing

employment, enhancing government effectiveness, and enabling social responsibility. The

document recognizes the role of establishing the necessary infrastructure to realize Vision

2030 and support its objectives. Several specific programs were initiated to accomplish

various aspects of the Vision, which include the National Transformation Program, Financial

Sector Development Program, Public Investment Program, Housing Program and National

Companies Promotion Program.

The financial sector of Saudi Arabia is well-developed compared to the averages of the OIC

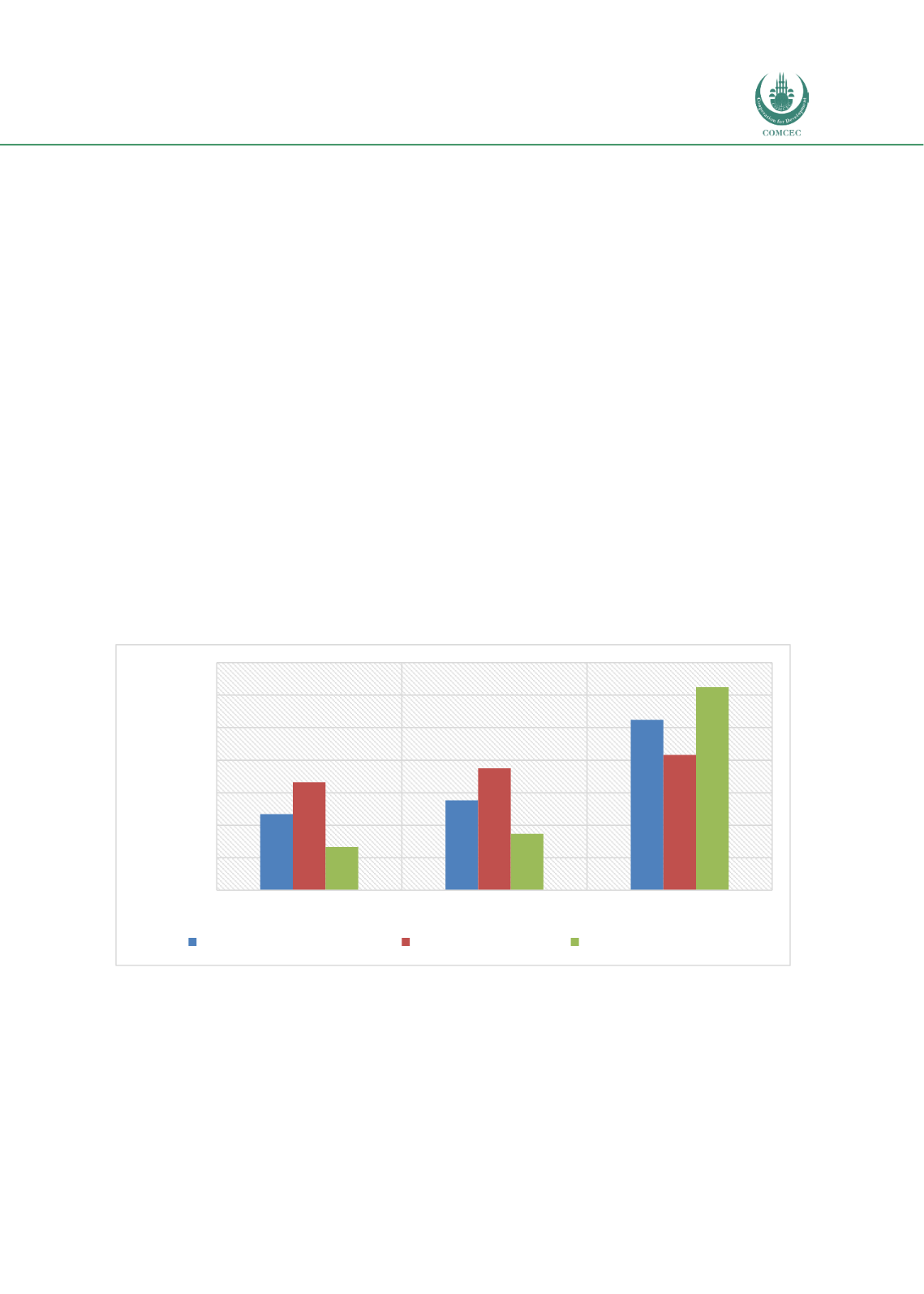

countries and the Middle East and Central Asian (MECA) region. Chart 4.4.1 shows that the

overall index of financial sector development stands at 0.52, which is significantly higher than

that of OIC (0.23) and MECA (0.28). While the financial institutions index and financial markets

index show similar trends, the latter appears to be significantly more developed in Saudi

Arabia (0.62) compared to the two country groupings with indices of 0.13 and 0.17 for OIC and

MECA countries respectively.

Chart 4.4. 1: Relative Financial Sector Development in Saudi Arabia (2016) (0-1 Highest)

Source: IMF Financial Sector Development Database,

http://data.imf.org/?sk=F8032E80-B36C-43B1-AC26-493C5B1CD33B&sId=1481126573525

The size of the financial sector and its breakdown into different sectors in Saudi Arabia are

shown in Charts 4.4.2 and 4.4.3. Chart 4.4.2 shows that the total financial assets are valued at

SAR 4.7 trillion (USD 1.25 trillion), which is 192% of the GDP. The financial institution assets

are worth SAR 2.8 trillion (USD 750 billion), constituting almost 60% of total financial assets.

Chart 4.3 shows the relative size of different financial institutions in Saudi Arabia. The banking

sector is dominant with 51% of the assets, followed by the pension fund (26%) and other

specialized financial credit institutions (19%). The Financial Sector Development Program

0.23

0.28

0.52

0.33

0.38

0.42

0.13

0.17

0.62

0.00

0.10

0.20

0.30

0.40

0.50

0.60

0.70

OIC Average

Middle East and Central Asia

Saudi Arabia

Index value (0-1Highest)

Financial Development Index

Fin. Institutions Index

Financial Markets Index