Infrastructure Financing through Islamic

Finance in the Islamic Countries

128

execution.

63

The projects related to electricity and power have the largest share, with

investments valued at USD 274.8 billion followed by railway projects worth USD 90.9 billion

and airports and other infrastructure at USD 72.1 billion. The projects in the water and

sewerage sector are valued at USD 4.5 billion and investments for road projects amount to USD

4.4 billion.

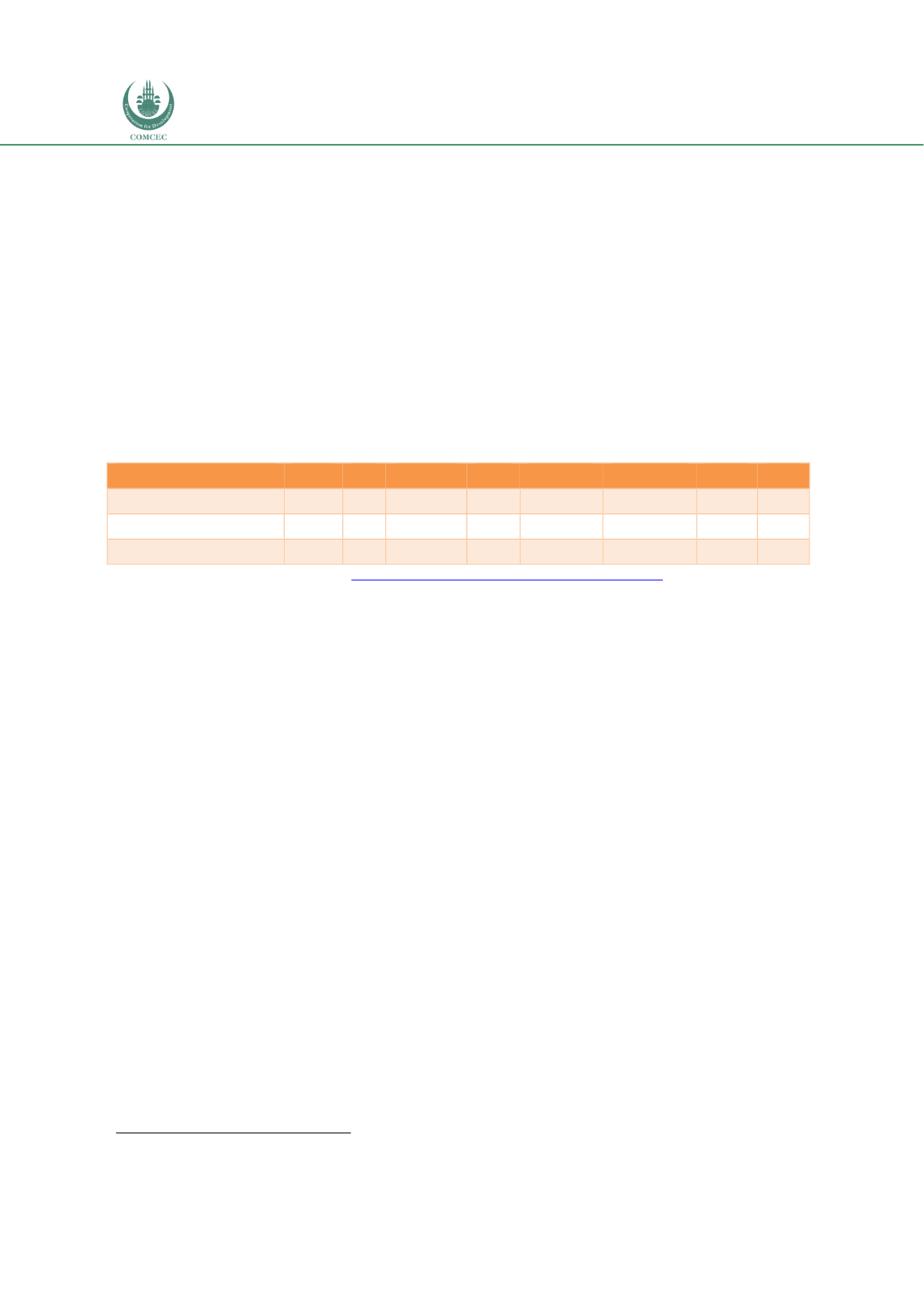

The projected investment needs in different infrastructure sectors in terms of current trends

and the projected investments needs during 2016-2040 are shown in Table 4.4.1. The total

investments according to current investment trends leading to 2040 are estimated at USD 499

billion while the actual investment needs would be USD 613 billion, showing a deficit of USD

215 billion. Most of the deficits will be in building roads (with projected deficits of USD 82

billion) followed by electricity (USD 14 billion) and telecoms (USD 10 billion).

Table 4.4. 1: Infrastructure Needs and Gaps Saudi Arabia 2016-2040

(Billion USD 2015 prices and exchange rates)

Road

Rail Airports

Ports Telecoms Electricity

Water Total

Current trends(CT)

151

10

12

21

34

208

62

499

Investment need (IN

233

11

12

21

44

222

69

613

Gap between IN and CT

82

2

0

0

10

14

8

115

Source: Global Infrastructure Outlook

, https://outlook.gihub.org/countries/SaudiArabia4.4.3.

National Level Policies and Framework of Infrastructure Development

Before the launching of Vision 2030 in 2016, various strategic decisions were undertaken for

the development of some specific infrastructure sectors. For example, the National

Transportation Strategy (NTS), under the Ministry of Transport, mandated in 2002 (1423H) by

a Royal Decree to coordinate the development of the NTS (NTS Transport KSA, 2011). It

started through an initial discussion with all concerned Ministries and agencies to identify

three development phases and a consensus was reached to address the needs for the transport

sector (Al Rajhi et al, 2012).

The current Saudi Arabian development agenda is driven by Vision 2030. Vision 2030 has 96

strategic objectives under the three pillars of

a vibrant society, a thriving economy

and

an

ambitious society

. Strategic goals under a thriving economy include growing and diversifying

the economy and investing in the long-term. Key aspects of Vision 2030 are to reduce the

dependence of oil and the role of the public sector in the economy.

Traditionally, infrastructure has been funded and managed by the government either through

direct procurements or indirectly by using state-owned enterprises to provide infrastructural

services. The role of the private sector was recognized in 2002 when the Supreme Economic

Council approved privatization procedures and transferred certain public services provided by

state-owned companies to the private sector. The state-owned companies listed for

privatization included infrastructure related to water supply and drainage, water desalination,

telecommunications, power, air transportation and related services, railways, some sectors of

roadways, postal services, seaport services, educational services, and health services.

As a

result of the privatization strategy, the Saudi Telecommunications Company (STC) floated

63

https://www.reportbuyer.com/product/5086601/infrastructure-insight-saudi-arabia.html