Infrastructure Financing through Islamic

Finance in the Islamic Countries

131

stated in the act. The hydrocarbon law enacted by Royal Decree No. 4703, p. 43 dated

03/04/1439 states that all hydrocarbon deposits, hydrocarbons and hydrocarbon resources

are the property of the State (KSA Regulation, 2018).

The Government Tenders and Procurement Law was enacted by Royal Decree No. M/58 dated

4

th

Ramadan 1427H/27/09/2006

(Bureau of Experts at the Council of Ministers)to achieve

four key goals. First, to regulate the procedures of tenders and procurements carried out by

the government authorities and ensure they are not influenced by personal interests in order

to protect public funds. Second, achieving the maximum degree of economic efficiency in

government procurements and carrying out government projects at fair and competitive

prices. Third, promoting honesty and competition and ensuring the fair treatment of suppliers

and contractors in accordance with the principles of equal opportunities. Finally, guaranteeing

transparency in all stages of government tender and procurement procedures.

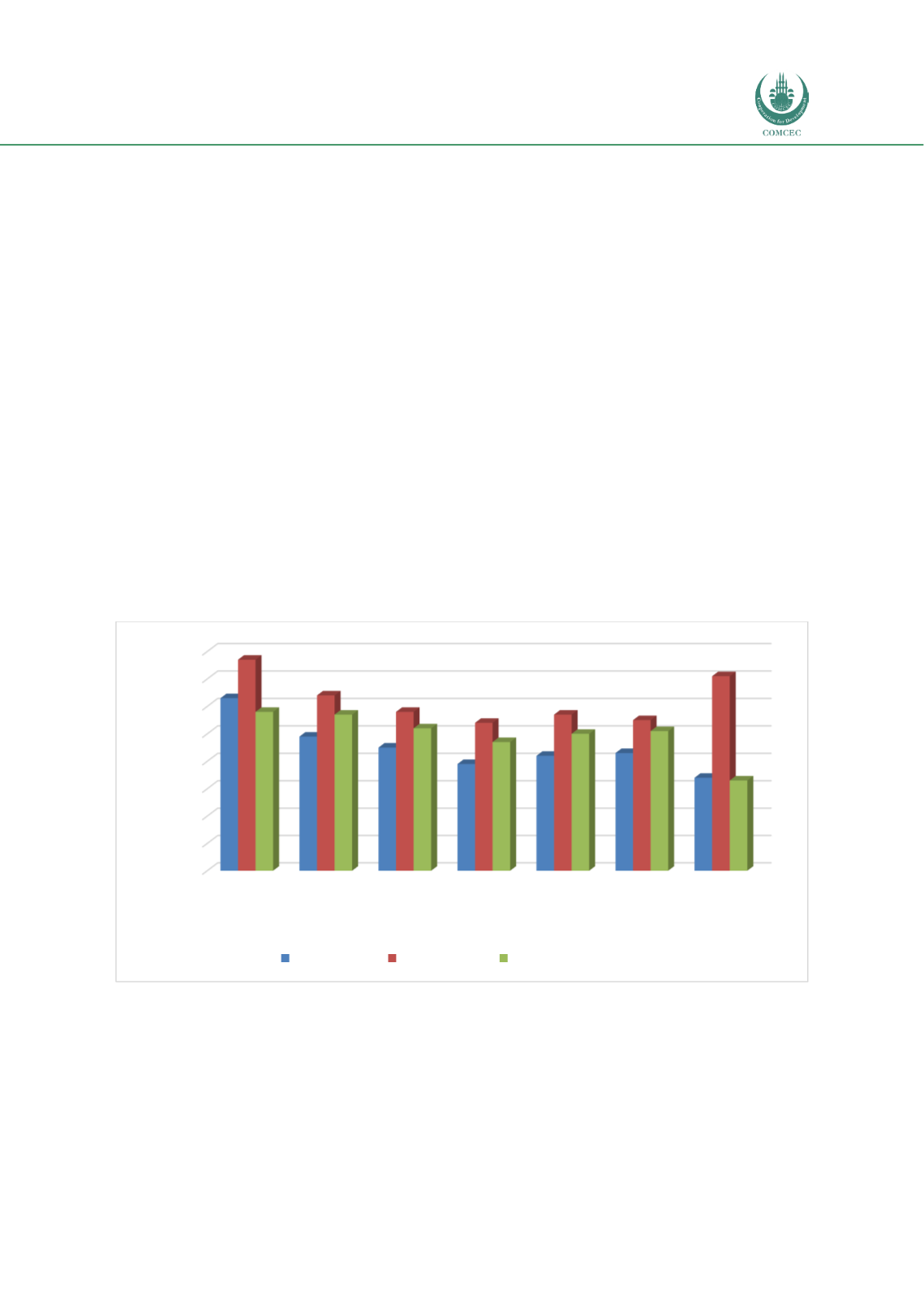

Chart 4.4.6 shows the status of the procurement regime discussed in Chapter 2 in Saudi Arabia

compared to different income groupings and the MENA region. While Saudi Arabia scores high

on procurement with a score of 71, which is the second best score after that of high-income

countries (77), the scores for preparation (34) and contract management (33) are the lowest

across all regions. Thus, there is a need to modify the law guiding the overall procurement

procedure in the Kingdom to attract more domestic and foreign investors in the infrastructure

sector.

Chart 4.4. 6: Procurement Regime of PPPs: Saudi Arabia (0-100 Highest)

Source: World Bank (2018f).

4.4.4.1.

Laws and Regulation Related to Islamic Finance

Article 2 of Royal decree No.23 Dated 15/12/1957

forms the charter of the Saudi Arabian

Monetary Agency (SAMA). Recognizing SAMA as the central bank, the article forbids it from

engaging in business based on interest. The banking law enacted by Royal Decree No. M/5

dated 22/02/1386H (11/06/1966) governs the banking sector in Saudi Arabia. Although the

0

10

20

30

40

50

60

70

80

High income Upper-middle

income

Lower-middle

income

Low income Middle East

and North

Africa

OIC Members

(40)

Saudi Arabia

63

49

45

39

42

43

34

77

64

58

54

57

55

71

58

57

52

47

50

51

33

Index (0-100 Highest)

Preparation Procurement

Contract management