Infrastructure Financing through Islamic

Finance in the Islamic Countries

127

Chart 4.4. 4: Islamic Financial Sector Composition in Saudi Arabia (2016)

Source: ICD and TR (2017)

4.4.2.

Current Status and Projected Investments in Infrastructure Sectors

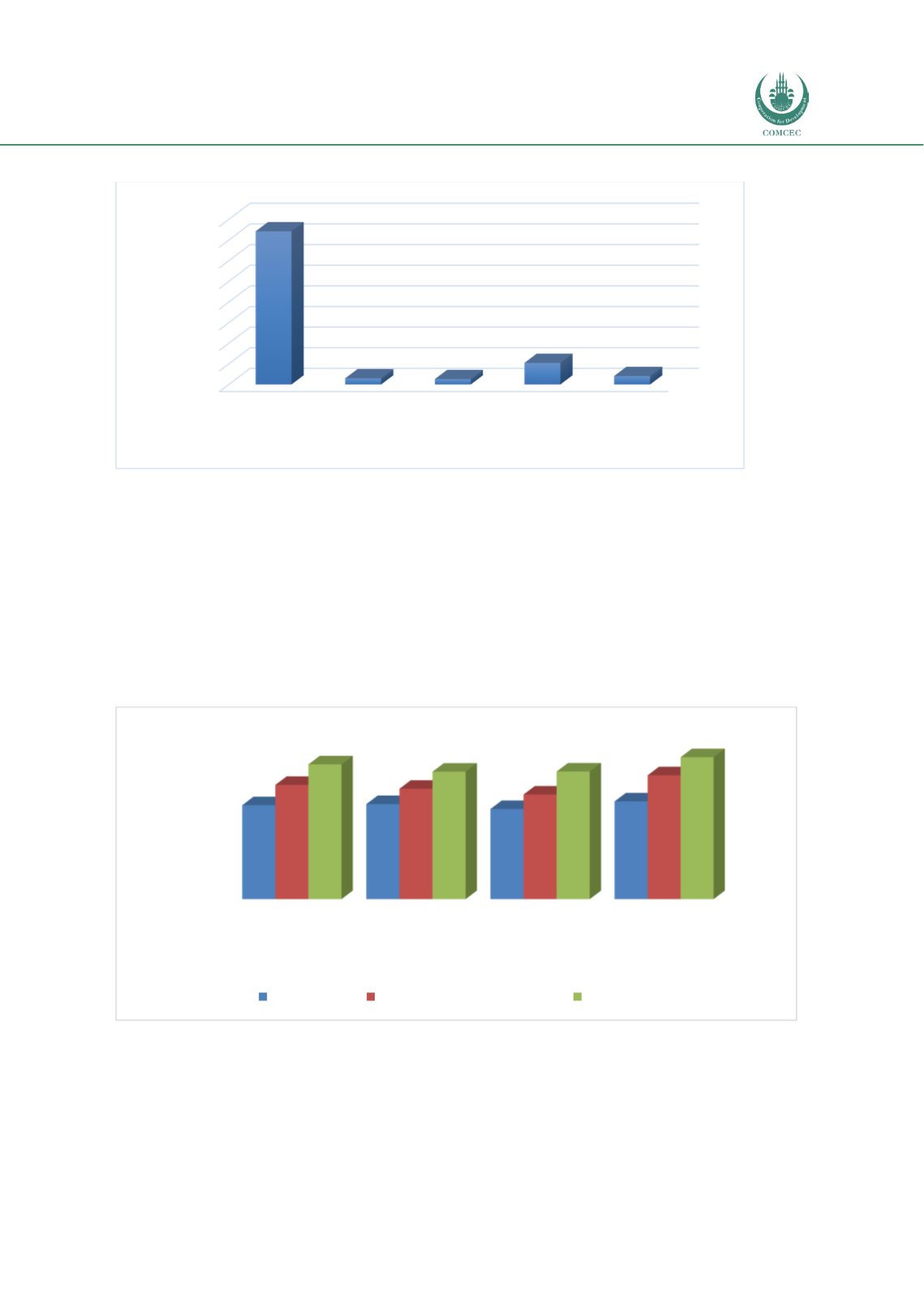

The status of infrastructure in Saudi Arabia relative to the averages of the MENA region and

OIC countries is shown in Chart 4.4.5. The status of both overall infrastructure and its quality

in Saudi Arabia (5.2 and 4.9 respectively) is better than the corresponding indices for both OIC

and MENA countries. The same trends are observed in the case of the transport and electricity

and telephony sectors with Saudi Arabia’s index scores (of 4.9 and 5.5 respectively) being

higher than those in the OIC and MENA region.

Chart 4.4. 5: Relative Status of Infrastructure in Saudi Arabia (2017) (1-7 Best)

Source: WEF (2018), The Global Competitiveness Index Historical Dataset

Timetric reports that currently there are 111 infrastructure projects in the pipeline valued at

USD 446.7 billion that are at different stages of development, ranging from announcement to

0

50

100

150

200

250

300

350

400

Islamic banks Takaful

Other Islamic

financial

institutions

Sukuk Islamic funds

371.23

15.12

13.16

52.55

20.60

UD$ Billions

0.0

1.0

2.0

3.0

4.0

5.0

6.0

Overall

Infrastucture

Quality of overall

infrastructure

Transport

infrastructure

Electricity and

telephony

infrastructure

3.6

3.7

3.5

3.8

4.4

4.3

4.0

4.8

5.2

4.9

4.9

5.5

Index Value (1-7 best)

OIC Average Middle East and North Africa Saudi Arabia