Infrastructure Financing through Islamic

Finance in the Islamic Countries

123

opportunity, both the Islamic banking and the Islamic Capital Market sectors are being

challenged by some fundamental issues which limit their active participation in the financing

scheme. For the sectors to fully benefit, the regulatory authorities need to come up with some

suitable policy actions.

The Islamic banking sector is relatively new and small in the country. With assets of only

0.28% of the overall banking sector, Islamic banks are not able to contribute to infrastructure

projects which require large amounts of investments. The regulatory limits on exposures for

banks inhibit Islamic banks from investing in large infrastructure projects. Furthermore,

Nigeria does not have an active Islamic money and interbank market, and this also discourages

Islamic financial institutions from investing in assets with long-term maturities as it creates

liquidity risks.

While Nigeria has issued a number of sukuk to finance infrastructure projects, the issuance has

not been frequent. Furthermore, the NICMP Master Plan has identified additional challenges

that are militating against the development of the sukuk market which includes awareness and

knowledge gaps, limited legal and regulatory framework, dearth of market players, product

deficit and the lack of a secondary market. Although some states in Nigeria have enacted

enabling laws on waqf, its use for social infrastructure services has been insignificant. The

challenges facing the sector are dominance by informal activities and the size of the funds

being very small.

Although Islamic finance is relatively new in Nigeria, Table 4.3.5 outlines the issues and

recommendations that can further enhance its role in infrastructure development in the

country.

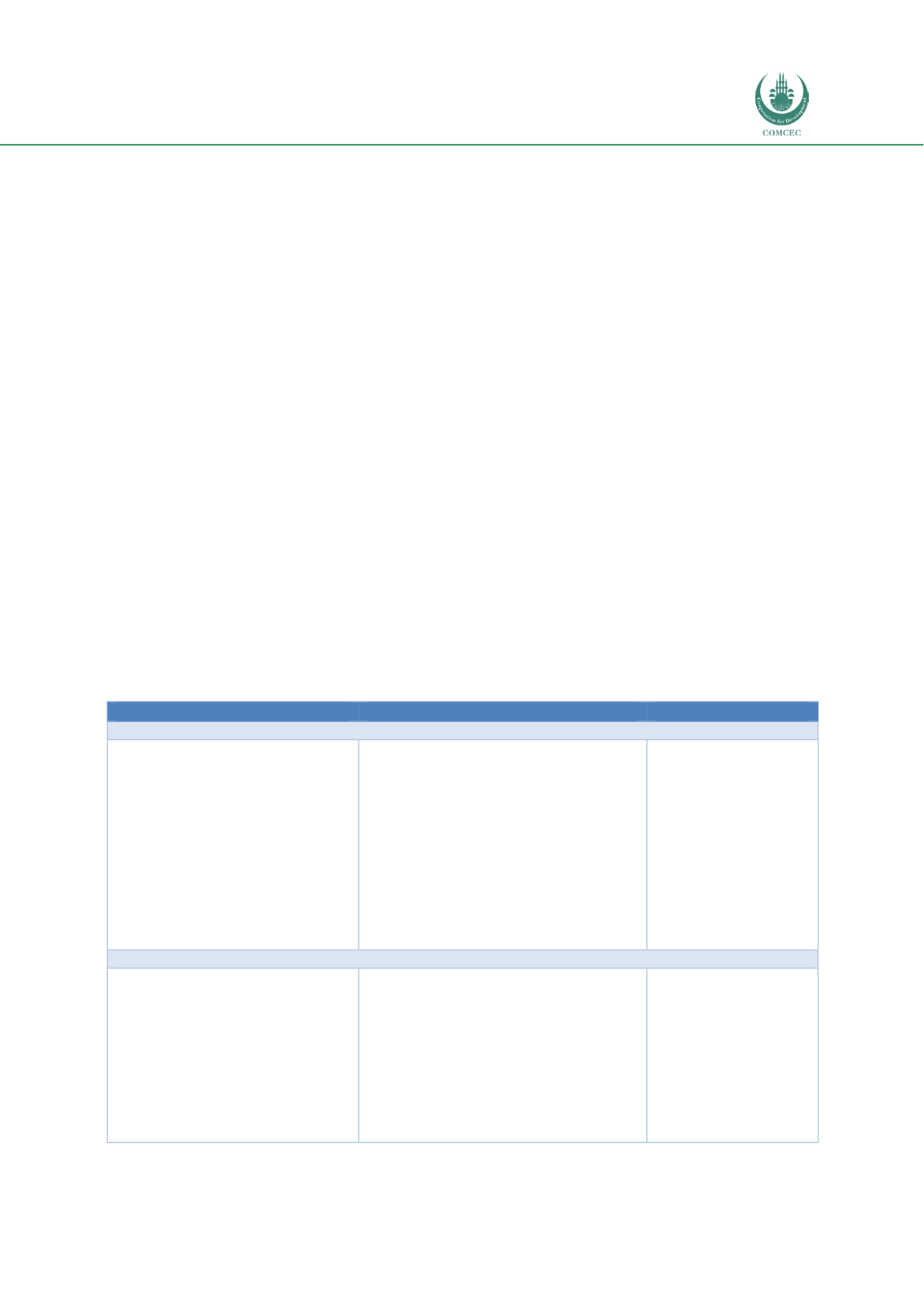

Table 4.3. 5: Issues and Policy Recommendations: Nigeria

Issues

Recommendations

Implemented by

Infrastructure Related Strategies and Policies

Islamic finance is relatively new in

Nigeria and PPP contracts are

novel and complex for most

stakeholders.

Islamic banks are small and

infrastructure investments are

deemed too risky for them.

Develop

Shariah-compliant

contract

templates that can be used for different

types of PPP projects

Expand the scope of guarantees and

insurances to cover risks such as political

risks and partial credit risks in a Shariah-

compliant manner to encourage Islamic

financial institutions to participate in

infrastructure projects.

Infrastructure

Concession

Regulatory

Commission (ICRC)

Islamic financial

industry stakeholders

Relevant public bodies

Private sector

insurance/takaful

companies

Legal and Regulatory Regimes

The laws for Islamic banking,

takaful and capital markets/sukuk

are incorporated in the existing

financial laws.

Islamic bank contribution to

infrastructure development can

also be enhanced by jointly funding

the projects with other banks

through syndicated financing.

Enact specific Islamic financial laws to

provide a sound legal and regulatory

basis for the development of the Islamic

financial industry in Nigeria.

Create a sound legal and contractual

framework for Islamic bank participation

in syndicated financing in infrastructure

projects with both Islamic and

conventional banks.

Relevant government

ministries.

Relevant government

ministries.